Ghana now finds itself grappling with an escalating debt crisis that threatens its financial future. Despite the government’s vigorous efforts to address the situation through a comprehensive debt restructuring program initiated in 2023, the country’s debt challenges persist, raising critical questions about the efficacy of these measures.

The International Monetary Fund’s (IMF) Debt Sustainability Analysis (DSA) casts a sobering light on Ghana’s financial predicament. The analysis reveals that the country continues to exhibit significant and prolonged breaches of standard debt thresholds, underscoring an unsustainable debt position. This grim assessment comes at a time when the Ghanaian government is striving to bring its debt levels to more manageable and sustainable levels through a detailed restructuring strategy.

The DSA’s findings are particularly concerning because they indicate that, despite ongoing restructuring efforts, Ghana’s debt remains on an unsustainable trajectory. The persistent breaches in debt thresholds highlight the enormity of the challenge at hand and the urgent need for effective solutions.

Despite these strategic interventions, the reality on the ground remains stark. The debt restructuring efforts, though well-intentioned and strategically sound, have yet to translate into tangible improvements in Ghana’s debt sustainability. The ongoing breaches in standard debt thresholds serve as a stark reminder of the challenges that lie ahead.

The effectiveness of the restructuring program is now under intense scrutiny. Stakeholders, including international financial institutions, investors, and the Ghanaian public, are keenly observing the developments, hoping for a turnaround.

Understanding Ghana’s Debt Sustainability Analysis

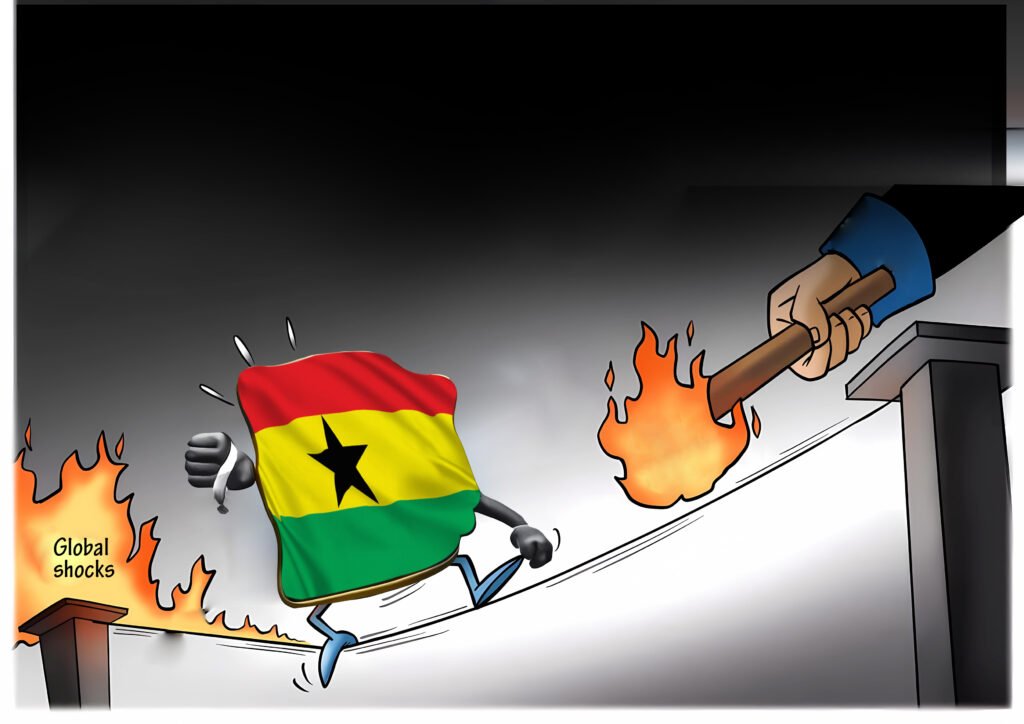

Ghana has experienced a substantial deterioration in its fiscal and external positions as a result of the global repercussions of the Covid-19 pandemic and the geopolitical tensions in Ukraine. These external shocks, coupled with pre-existing vulnerabilities in the fiscal and debt sectors, have led to a surge in both public and external debt. The repercussions were profound, with Ghana losing international market access in late 2021 and faced even more challenging macroeconomic conditions in 2022.

The aftermath of the pandemic and the economic slowdown resulted in large fiscal deficits, causing public debt to escalate from 63.0% of Gross Domestic Product (GDP) in 2019 to a concerning 93.3% of GDP by the end of 2022. As such, domestic debt reached 50% of GDP in 2022, with 16.0% of GDP held by the Bank of Ghana. Concurrently, public external debt stood at 43.3% of GDP, painting a worrisome picture of Ghana’s fiscal health.

In a detailed analysis by Dr. Richmond Atuahene, Isaac Kofi Agyei, and K.B. Frimpong, the depth and ramifications of Ghana’s ongoing economic and financial crisis are brought to light. The crisis reached a critical point in December 2022, when the Ghanaian government defaulted on both domestic and external debt payments.

“This unprecedented default led to a call for debt sustainability measures, primarily through debt restructuring, as advocated by both the government and the International Monetary Fund (IMF). The analysis underscores that the economic and financial crisis of the past three years has been the most severe in Ghana’s modern history. The crisis has inflicted considerable damage on both output and employment, making it unparalleled in its intensity and duration for a developing economy.”

Meanwhile, Ghana’s public debt increased by GH₵47.4 billion in the first two months of 2024, reaching GH₵658.6 billion, which represents 62.7% of the GDP as of February 2024. External debt amounts to GH₵380 billion, or 36.1% of the GDP. These figures were reported by the Bank of Ghana in its May 2024 Summary of Economic and Financial Data.

The report indicates that Ghana’s debt rose from GH₵611.2 billion at the end of 2023 to GH₵626 billion in January 2024, and further to GH₵658.6 billion in February 2024. This increase is partly due to the depreciation of the cedi against major currencies.

Historical Context of Ghana’s Debt

To fully grasp the severity of the current crisis, it is essential to understand its historical context. According to the Ministry of Finance, Ghana’s total public debt escalated from GH₵35.9 billion (47.8% of GDP) in 2012 to GH₵122.2 billion (72.5% of GDP) by the end of 2016. This upward trajectory continued, with the public debt reaching GH₵146.6 billion (69.8% of GDP) in 2017, although the debt-to-GDP ratio saw a slight decline. By December 2018, the public debt stood at GH₵173.1 billion, representing 57.9% of the rebased GDP.

“The surge in public debt was partly due to a banking sector bailout in 2018, which added GH₵11.1 billion to the debt stock. By June 2019, the public debt had risen to GH₵204 billion (59.2% of GDP), reflecting increases in both external and domestic debt. The accumulation of debt was driven by unplanned expenditures, revenue shortfalls, and persistent currency depreciation. External debt rose from GH₵86.2 billion in December 2018 to GH₵115 billion by June 2019, while domestic debt increased from GH₵86.9 billion to GH₵94.8 billion over the same period.”

The public debt stock continued its upward trend, reaching GH₵218.2 billion in 2019 and further increasing to GH₵291.6 billion in 2020, representing 76.1% of GDP. This increase was primarily due to higher fiscal deficits, exchange rate depreciation, and new loan disbursements. By the end of December 2021, Ghana’s public debt had risen to GH₵351.7 billion (US$58.6 billion), with external debt comprising GH₵170 billion and domestic debt at GH₵181.8 billion. The higher increase in domestic debt was largely due to costs incurred from contingent liabilities in the energy sector and the financial sector bailout.

The escalation did not stop there. By 2022, Ghana’s nominal debt had skyrocketed to GH₵546 billion, representing 88.1% of GDP. Despite the implementation of a comprehensive and painful domestic debt exchange program in September 2023, the debt continued to rise, reaching GH₵610 billion, though the debt-to-GDP ratio slightly improved to 72.5%.

According to Dr Atuahene et al, Ghana’s public sector deficit was financed through four primary methods: printing money, reducing foreign exchange reserves, borrowing from abroad, and borrowing domestically. Each of these financing strategies led to significant macroeconomic imbalances in 2022. The Bank of Ghana also intervened by purchasing GH₵10 billion of the government’s Covid-19 bonds, which, while helping to close the financing gap, contributed to higher inflation.

In 2022, sovereign spreads on Ghana bonds widened, and credit rating agencies downgraded Ghana’s sovereign debt rating, blocking access to international capital markets.

Ghana’s Current Public Debt Crisis and Its Causes

According to Dr Atuahene et al, Ghana’s public debt crisis is a multifaceted issue stemming from various underlying causes. Key factors include continued reliance on commodity exports, political expediency, corruption, persistent fiscal deficits, and irresponsible borrowing and lending practices that fail to generate sufficient revenue for repayment. These issues have culminated in Ghana’s severe debt situation.

A crucial factor in Ghana’s public debt crisis is the country’s inability to generate sufficient foreign exchange through export earnings. The heavy reliance on a few export commodities, such as cocoa and gold, whose prices are highly volatile, has exacerbated the current account deficit, destabilizing the balance of payments.

“A major contributor to the debt crisis is the unproductive use of borrowed funds, often financing consumption rather than economically viable projects. Funds have frequently been invested in ventures with low returns, failing to generate the necessary foreign exchange earnings to meet debt service requirements. In contrast, investments in infrastructure projects like roads, railways, and power stations would better support economic growth and debt repayment.

“Continuous high fiscal deficits, driven by unproductive public spending and political promises, have further fuelled the debt crisis. Public sector spending surged during the 2007-2008 global food and fuel price increases and the 2008 elections, significantly raising the fiscal deficit. Increased subsidies, infrastructure investments, wages, and social spending strained the budget.”

Over the past decade, primary deficits have grown, increasing the debt burden as the government struggled to service interest on public debt. Declining export revenues and increased social spending have worsened fiscal deficits. From 2017 to 2022, interest payments on public debt escalated, reflecting higher borrowing costs and the adverse impact of currency depreciation.

Corruption has also critically contributed to Ghana’s debt crisis. Public sector irregularities, amounting to GH¢17.5 billion in 2021, and significant COVID-19 expenditure infractions, led to substantial fiscal revenue losses.

Since 2014, energy sector debt has significantly contributed to the crisis. By the end of 2022, energy sector arrears stood at US$1.6 billion. Low recoveries, tight financing conditions, and pending negotiations with independent power producers have added to this debt.

The Debt Restructuring Program

In a bid to avert a full-blown financial crisis, the Ghanaian government launched a debt restructuring program in 2023. This program was a cornerstone of the country’s commitment to achieving sustainable debt levels, a crucial condition for securing support from the IMF. The overarching goal was to reduce Ghana’s risk of debt distress to a “moderate” level, as outlined in the IMF-World Bank Debt Sustainability Framework for low-income countries (LIC-DSF).

Launched in early December 2023, the voluntary program sought to swap outstanding medium- and long-term domestic bonds for lower-coupon, longer-maturity bonds. Covering about 65% of total outstanding domestic bonds, and excluding those held by pension funds, the program achieved an 85% participation rate.

This initiative is aimed to reduce the government’s debt burden from a staggering 105 percent of GDP, which includes contingent liabilities, to a more manageable 55 percent by 2028. The DDE program’s immediate focus was on the domestic debt exchange, marking the first step in a broader strategy to stabilize the country’s finances.

Following the severe impact of the COVID-19 pandemic, Ghana secured a $3 billion bailout from the International Monetary Fund (IMF) to stabilize the economy. The IMF projects a gradual decline in Ghana’s debt-to-GDP ratio over the next six years. According to its April 2024 Fiscal Monitor, the debt-to-GDP ratio is expected to fall to 69.7% by 2029. The projections are 83.6% for 2024, 80.9% for 2025, 77.9% for 2026, 74.9% for 2027, and 72.0% for 2028.

The restructuring strategy is both ambitious and multifaceted, targeting both external and domestic debts. Key measures include external debt service relief, designed to alleviate the country’s external financing pressures from 2023 to 2026. This relief is critical, providing the government with the necessary fiscal space to manage its financial obligations more effectively. On the domestic front, the program aims to ease the pressures on domestic financing, thereby stabilizing the internal financial landscape.

The restructuring plan aims to reduce the present value of total debt-to-GDP and external debt service-to-revenue ratios to 55% and 18% respectively, by 2028. These targets align with the IMF-World Bank Debt Sustainability Framework for low-income countries (LIC-DSF), with the overarching goal of achieving a moderate risk of debt distress.

Impact on Investor Confidence and Economic Repercussions

The excessive public debt had significantly eroded local investors’ confidence in government bonds. This lack of confidence was exacerbated by the restructuring of external debt, which further tarnished Ghana’s economic reputation on the global stage.

The immediate consequences included a sharp decline in foreign direct investment (FDI) and other forms of foreign capital inflow. This downturn also affected international cocoa syndicated loans for the 2023/2024 season, a crucial source of revenue for the country.

The prolonged debt distress has not only strained the country’s financial resources but has also had broader socio-economic implications, affecting public services, infrastructure development, and overall economic growth.

Ghana stands at a critical juncture. The success of the debt restructuring program is pivotal to the country’s economic future. As the government continues to negotiate and implement the necessary measures, the stakes could not be higher. Achieving a sustainable debt level is not just about financial metrics; it is about ensuring economic stability, fostering growth, and improving the quality of life for the millions of Ghanaians.