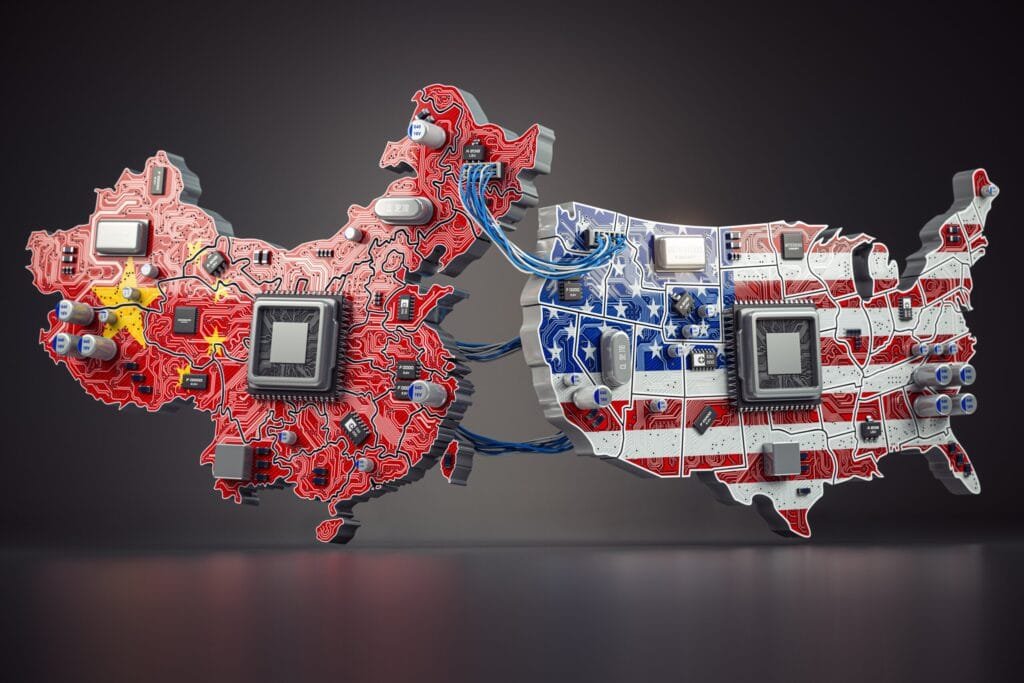

China and the United States are increasingly jostling for dominance in semiconductor intellectual property and manufacturing, with the US aiming to revitalize its chip production while imposing sanctions to curb China’s push for self-sufficiency in this pivotal industry.

The unfolding battle for supremacy in semiconductor manufacturing between the two nations highlights the importance of the chip industry. The semiconductor sector serves as a catalyst for technological breakthroughs like artificial intelligence, electric vehicles, and factory automation, playing a vital role in bolstering economic prosperity and national security.

Despite constituting a quarter of global semiconductor demand, the US’s semiconductor manufacturing capacity stands at a mere 12%, a stark decline from 37% in the 1990s. This has raised concerns about national security risks, especially in light of China’s ambitious endeavours to establish a significant foothold in this indispensable industry.

A central focus of the fight is on the CHIPS and Science Act, enacted into US law in 2022. The Act aims to stimulate domestic chip production by allocating $52.7 billion over five years to foster domestic manufacturing, research and development, and workforce enhancement programs.

Under the CHIPS Act, semiconductor firms are eligible for a 25% investment tax credit for investments in semiconductor manufacturing or specialized equipment. However, there are challenges in translating the Act’s objectives into tangible outcomes.

In March, 2024, the Commerce Department introduced stringent conditions for companies seeking funding of $150 million or more, including constraints on stock buybacks, profit-sharing, and a preference for Union labor. Meanwhile, such conditions could hinder the return of leading-edge semiconductor manufacturing to the US, as companies strive to remain below the $150 million threshold.

A Major Stumbling Block in the Way of US

The former chair and CEO of Taiwan Semiconductor Manufacturing Company (TSMC), a major player producing 90% of the world’s most advanced processor chips, estimates that manufacturing leading-edge chips in the US could cost up to 50% more than in Taiwan, citing higher labor costs and different labor norms.

Moreover, the majority of semiconductor companies do not require additional funding, as the industry ranks among the world’s most profitable. Consequently, the authors suggest that only less profitable chip companies may be inclined to participate in the CHIPS Act in its current form, thereby limiting its impact on the industry.

Semiconductor companies that opt to manufacture chips in-house are referred to as Integrated Device Manufacturers (IDMs), with their manufacturing facilities termed fabs. Alternatively, companies may adopt a “fabless” model, outsourcing the manufacturing process to foundries. Some firms have embraced a hybrid approach, combining elements of both models.

The Semiconductor Industry Association projects that the cost of constructing a state-of-the-art fab over a decade ranges from $10 billion to $40 billion, a stark increase from less than $1 billion in 1997. However, only four Integrated Device Manufacturers (IDMs)—Samsung, Intel, Hynix, and Micron—possess the necessary scale to support the construction of leading-edge fabs. On the other hand, semiconductor companies like Nvidia, AMD, Qualcomm, and Marvel have opted to outsource some or all of their manufacturing to Taiwan Semiconductor Manufacturing Company (TSMC), the dominant leader among the five major foundry companies with a commanding 58% share of the global market.

In 2021, Intel announced its intention to refocus on the foundry business with the aim of surpassing Samsung as the second-largest foundry by 2025. However, the authors of the report highlight various obstacles hindering Intel’s ambitions, including stringent design rules, talent turnover, and the divergent business model governing Intel’s CPU business compared to the foundry sector.

Simultaneously, TSMC is actively expanding its footprint beyond Taiwan to mitigate supply chain disruptions stemming from geopolitical tensions in the region. While this strategic move is expected to bolster TSMC’s dominance in the foundry business, the company has encountered challenges in establishing leading-edge foundries in the United States. Conversely, Samsung’s foundry business stands to benefit from the CHIPS Act, leveraging its 27 years of foundry experience in the United States.

In addition to the CHIPS Act, the United States and its allies have resorted to sanctions against China in the ongoing chips rivalry. These sanctions, which trace back to actions against ZTE in 2017, have been further tightened by the US Commerce Department’s Bureau of Industry and Security, imposing export controls on advanced semiconductor production equipment and high-performance computing chips.

Such restrictions have curtailed China’s access to advanced chip technology, particularly in areas crucial for supercomputing and AI training. The repercussions extend beyond US vendors, prompting Japan and the Netherlands to restrict their semiconductor-making technologies. Despite these limitations, China’s advanced semiconductor fabs remain capable of producing chips in limited volumes, raising the spectre of additional sanctions.

Meanwhile, Japan has embarked on its semiconductor production initiative, as outlined in the 2022 Economic Security Promotion Act, which seeks to mobilize combined public and private financing of ¥10 trillion over a decade. With Japan accounting for 12% of global semiconductor consumption but possessing a disproportionately low production capacity, semiconductor industry activity is on the rise.

US Revokes Licenses for Sales of Chips to Huawei

The ongoing trade tensions between the United States and China reached a new height when the US government recently announced the revocation of certain licenses that permitted US chip makers to export goods to Chinese technology giant Huawei. This move underscores the continued escalation of restrictions on technology exports to Huawei, a company that has been at the center of geopolitical tensions between the two superpowers.

However, the decision follows Huawei’s recent release of an AI-enabled computer powered by a chip manufactured by US-based chip maker Intel. While Intel declined to comment on the matter, the action signals a significant development in the ongoing saga surrounding Huawei’s access to critical semiconductor technology.

Since 2019, the US has imposed stringent restrictions on technology exports, particularly computer chips, to Huawei, citing concerns over alleged ties to the Chinese military. The latest move to revoke certain licenses reflects the Biden administration’s continued commitment to curbing Huawei’s access to advanced technology, a policy stance inherited from the previous administration.

The lack of transparency surrounding the revoked licenses has raised questions about the specific motivations behind the decision. Some US lawmakers, particularly from the Republican Party, have criticized the Biden administration, suggesting that the action was prompted by pressure from Congress.

Huawei, a prominent player in the global technology industry, has faced significant challenges due to US trade restrictions. However, the company has shown resilience and has recently experienced a resurgence, notably with the successful launch of its Mate 60 Pro smartphone in August 2023. Despite these setbacks, Huawei remains determined to navigate the complex geopolitical terrain and maintain its market presence.

The revocation of licenses for chip sales to Huawei is not an isolated incident but part of a broader pattern of US efforts to restrict Chinese technology firms’ access to critical components. In 2019, during the Trump administration, Huawei was added to the so-called “entity list,” requiring US companies to obtain government licenses for technology exports to the company. While some licenses have been granted in the past, particularly for non-5G related technologies, the recent move signals a tightening of restrictions.

The Difficult Price of Making Semiconductors

Manufacturing semiconductors represents one of the most complex endeavours undertaken by humankind. Cutting-edge chips, found in smartphones and data centers, boast billions of components, each measured in nanometers, a scale equivalent to billionths of a meter. Furthermore, the semiconductor landscape encompasses various chip types, each characterized by its unique and intricate design and manufacturing processes. Consequently, only a select few firms possess the expertise to efficiently design and manufacture these chips.

Currently, the bulk of global chip design occurs in the United States, while the majority of manufacturing takes place in East Asia. In particular, when it comes to processor chips— integral components of phones, PCs, and data centres- the most advanced chips are exclusively produced in Taiwan or South Korea. Notably, the Taiwan Semiconductor Manufacturing Company (TSMC) stands as the primary manufacturer, producing 90% of the world’s most advanced processor chips. Its pivotal role in supplying critical chips to tech giants such as Apple, Nvidia, and AMD underscores its significance in the semiconductor industry.

Conversely, China is endeavouring to bridge the gap in chipmaking capabilities, albeit trailing approximately five years behind Taiwan in processor chip technology for the past decade. Despite this pursuit, the semiconductor supply chain remains vulnerable, particularly at its intersection with geopolitical tensions. Both Taiwan and China contribute significantly to chip production, with China predominantly manufacturing lagging-edge chips and Taiwan producing a mix of cutting-edge and lagging-edge chips.

Furthermore, China plays a pivotal role in providing assembly services, receiving chips from Taiwan for assembly into various electronic devices such as phones and computers. Additionally, China serves as a primary supplier of refined materials essential for chipmaking and electronics assembly, including gallium, germanium, cobalt, and rare earths. While this supply chain has facilitated remarkable efficiencies and cost reductions, it also exposes vulnerabilities, particularly as China’s relations with neighbouring countries deteriorate.

As the semiconductor industry continues to evolve, managing geopolitical complexities will remain a paramount challenge. Balancing efficiency with resilience, companies must remain vigilant in assessing and mitigating risks to their supply chains to ensure continuity amid geopolitical uncertainties.