As Ghana’s real estate sector continues to witness remarkable growth, Accra stands at the forefront of this transformative wave, poised to become Africa’s elite city. The city’s skyline is rapidly evolving, adorned with contemporary architectural masterpieces that symbolize its progressive spirit and economic vitality.

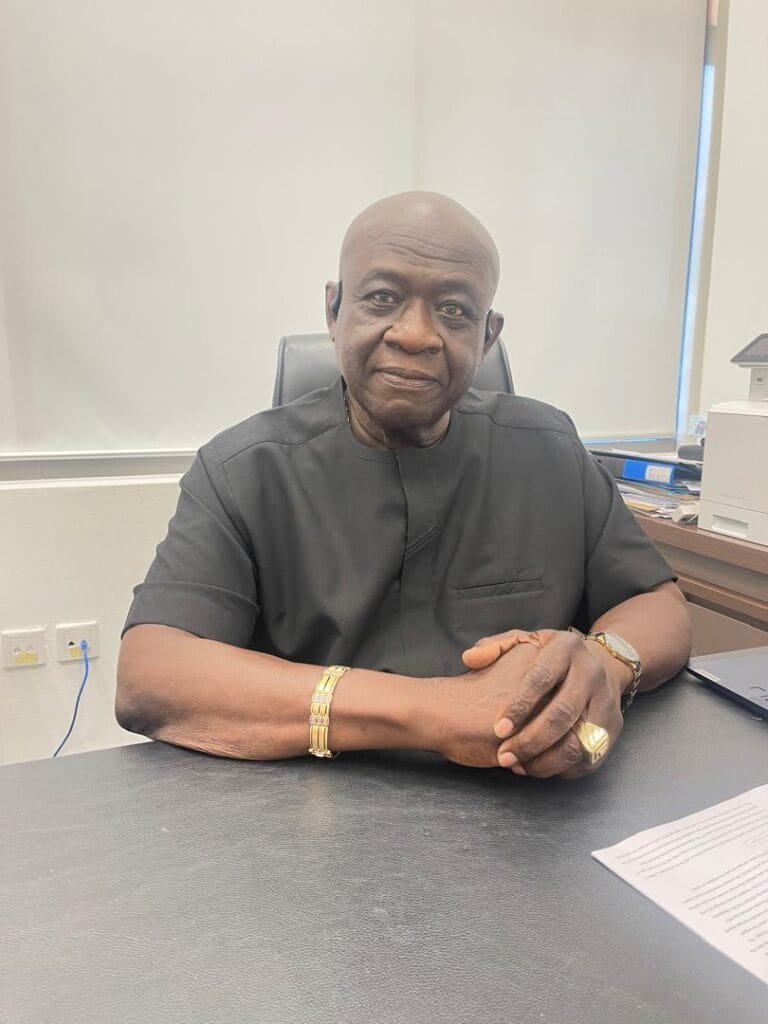

This surge in real estate development is fuelled by a convergence of factors including urbanization, population growth, economic stability, and increased foreign investment, all contributing to Accra’s status as a burgeoning metropolis on the African continent. Guiding this remarkable transformation is the Ghana Real Estate Developers Association (GREDA), led by its President, Mr Patrick Ebo Bonful.

GREDA has emerged as a catalyst for change, spearheading strategic initiatives and advocacy efforts to propel the industry towards sustainable growth and innovation. Through collaborative efforts with developers, investors, and policymakers, GREDA has created a conducive environment for real estate development, laying the groundwork for Accra’s future as a centre of commerce, culture, and innovation.

In an exclusive interview, Mr Patrick Ebo Bonful, the President of GREDA, shared his insights into the current state of the real estate industry in Ghana and outlined GREDA’s strategic initiatives aimed at driving positive change and transformation. His perspective on real estate development in Ghana is not merely about erecting structures but about building communities, fostering economic growth, and shaping the trajectory of the nation.

Acceding to the transformative wave in the capital city, the President of GREDA disclosed “It is true that the industry, if you look at the landscape of Accra, you’ll see a lot of high rise buildings. If I can put it clearly, these are luxury properties’ developments across the face of Accra. It’s a trend and like every growing city, it’s a trend that would necessarily come as redevelopments begin to take place within the inner city space. So, what we are seeing here in Accra is just as a result of human development. So, it’s good news for all of us.”

Lack of Governmental Support, Primary Cause of Housing Deficit

Amidst Accra’s burgeoning skyline, lies a persistent housing deficit, underscoring the urgent need for comprehensive solutions. Despite the proliferation of real estate firms in Ghana, this deficit persists due to a myriad of challenges including rapid urbanization, inadequate infrastructure, and regulatory bottlenecks. GREDA, cognizant of these challenges, has endeavored to address the affordability concerns by championing initiatives that promote sustainable development and advocate for policies aimed at ensuring equitable access to housing for the middle class.

Addressing the exorbitant costs of housing currently witnessed in the country, Mr Patrick Ebo Bonful highlighted GREDA’s role in providing affordable housing. He indicated that ever since he came into office, he has been working tirelessly with his team to try and push the agenda of GREDA, that is, developing houses at regular interval and at particular end to develop Ghana, and its particular concern has been for affordable housing.

One of the key focal points of his Presidency is the promotion of affordable housing initiatives that cater to the middle and lower-middle-income segments of the population. With Ghana facing a significant housing deficit, estimated at 1.9 million units, according to the Minister of Housing and Construction, Mr Bonful emphasized the urgency of addressing this gap through strategic partnerships and innovative approaches.

Under the GREDA President’s leadership, the Association has been actively engaged in advocating for policy reforms and incentives that support the development of affordable housing projects. From lobbying for tax incentives to streamline the development process to advocating for legal reforms to address land disputes, GREDA is committed to creating an enabling environment for real estate developers to thrive.

“The issue of housing deficit is a decades-old problem, primarily stemming from a lack of governmental support, particularly in terms of policy. Most of us in the real estate industry are businessmen seeking the right environment to thrive. We aim to develop products that cater to specific market segments. For instance, consider two developers building identical three-bedroom houses— one on Spintex Road and the other at Community 25. There will likely be a price difference, with the latter targeting the middle-income bracket, which constitutes a significant portion of Ghana’s workforce.

“However, for developers to choose to invest in affordable housing, they require incentives. If both developers are subjected to the same corporate tax rate of 25%, it becomes financially advantageous to focus on higher-end projects. This is illustrated by the fact that a $300,000 house yields the same tax amount as a $150,000 one. Hence, there’s a disparity that needs to be addressed to encourage investment in affordable housing.”

Meanwhile, GREDA undertook strategic initiatives to bolster housing supply. Between 2018 and 2019, an agreement was signed with then Minister of Works and Housing, Hon. Atta Akyeah, outlining plans for over 200,000 housing units. However, unforeseen challenges such as the COVID-19 pandemic disrupted progress.

GREDA’S Contribution to the Economy

Mr. Bonful explained that GREDA’s mission goes beyond constructing buildings; as it is about creating sustainable solutions that cater to the diverse needs of the people. He asserted that housing is not just a basic requirement but a fundamental pillar of economic development and social progress. According to him, it’s essential to recognize the current developments in the real estate sector as a proof of human advancement and societal evolution.

“GREDA, over the years, that’s thirty-five (35) years of our existence, have played pivotal roles in developing Housing to the Ghanaian population. We have helped, especially in the area of not luxury; mostly our houses are for the middle income market… and lower middle income markets. So we have done a lot of that and we have delivered a lot.”

Moreover, Mr Bonful highlighted the proactive efforts of GREDA members in providing affordable housing solutions, who offer two to three-bedroom homes priced between $40,000 and $60,000, showcasing the association’s commitment to addressing market needs.

“We have contributed a lot to this economy. If you put the construction sector together, as of 2020, our contribution to GDP was in the region of 20% on the average. Given all the challenges and everything, for us to contribute 20% to GDP, that’s significant. So, that’s for the real estate and construction sector…”

Mr Patrick Ebo Bonful, however, emphasized that over the years, the government has not recognized the real estate sector’s significance as it should. He opined that successive administrations, dating back to the 1990s, have failed to sufficiently prioritize the sector. He argued, with compelling statistics, that if the true contribution of the construction sector to the economy were understood, governments over the years would have approached it differently.

He cited examples from the United States and Europe, where the construction sector accounts for over 70% of GDP, indicating its crucial role in driving economic growth. As such, Mr Bonful underscored the need for government’s intervention to bolster both the demand and supply sides of the real estate market, to create a seamless value chain that will support developers, banks, mortgage companies, and buyers.

Addressing Mortgage Financing Inadequacies

Drawing parallels with Europe, Mr Bonful advocated for the implementation of strong legal regimes to protect the integrity of the real estate market. He highlighted the need for amendments to the mortgage law to ensure that defaults are swiftly addressed, thereby safeguarding the interests of financial institutions and promoting financial stability.

The GREDA President proposed specific changes to the mortgage law, including clear procedures for addressing defaults and streamlining the legal procedures for property repossession. He emphasized the importance of preventing legal loopholes that could be exploited to the detriment of banks and the wider economy.

“We need very good and a strong legal regimes akin to what is happening in Europe. In Europe, if someone defaults in mortgages, then the whole nation sees you [the person] as enemy of the state. So the policy for the banks to recover property from you is merciless.”

He highlighted the detrimental impact of mortgage defaults on the performance of mortgage portfolios, leading to the shrinking of the sector and stunting economic growth. Therefore, he emphasized the self-destructive nature of such actions, as they undermine the very foundation of the economy.

As such, he advocated for amendments to ensure that the mortgage law is ONLY subject to the Constitution of the Republic, thereby providing a stable legal framework for the real estate sector to thrive. The GREDA Boss also revealed the transformative potential of the real estate sector in driving economic growth, citing the multiplier effect it has on employment and local businesses.

“We have proposed the law must be amended; make the law only subject to the Constitution of the Republic. This is an area of the economy that can change this economy. Consider this: If you are building one house, how many people don’t you engage? Even the woman selling ‘Kofi brokeman’ gets business to do, because workers working on your property will buy, and as soon as you start, they themselves will come and create such economy there; that’s an economy that has been created. It’s a value chain that builds up. So just multiply that and see the effect of that on the economy. It’s not rocket science!”

Besides, Mr. Bonful proposed the establishment of a secondary market for the real estate industry, akin to systems in Europe and the United States. In such markets, banks can offload mortgage assets to institutional investors like Fannie Mae, freeing up capital for further lending and stimulating liquidity in the real estate market. This, he believes, would encourage banks to expand their mortgage financing activities and contribute to the sector’s growth.

Consequently, GREDA has established the GREDA Investment Limited and is in the process of instituting GREDA Real Estate Investment Trust( GREIT). Through this approach, GREDA aims to significantly contribute to addressing the housing deficit.

GREDA Investments Limited (GRIT) and the GREDA Real Estate Investment Trust (GREIT) Operationalization

According to the GREDA President, GREDA Investments Limited and the GREDA Real Estate Investment Trust (REIT) are integral components of GREDA’s strategy to address the evolving needs of the real estate market in Ghana.

He explained that in the past, GREDA collaborated with the Social Security and National Insurance Trust (SSNIT), where SSNIT provided land and basic infrastructure, and GREDA developed the vertical structures. However, SSNIT withdrew from these collaborations due to challenges faced in previous investments.

In filling the void left by SSNIT, the Association established GREDA Investments Limited. The primary objective of GREDA Investments Ltd., according to the President, is to acquire lands, develop infrastructure, and create satellite communities across the country. These communities aim to provide housing solutions while fostering economic growth in various regions.

To finance these endeavours as well as the financing of the demand side of the value chain, GREDA Real Estate Investment Trust (GREDA REIT) plans to raise funds on the open market. The GREDA REIT will attract both local and international investors interested in long-term investments backed by physical assets. This initiative seeks to address the low mortgage penetration rate in Ghana, which stands at less than 1% of GDP compared to rates of 70% to 80% in Europe and America. This will provide alternative financing options such as sales, rentals, rent-to-own, and mortgages, providing medium to long-term finance solutions for real estate development.

Moreover, GREDA envisions expanding its influence beyond real estate development. The President revealed the Association aims to establish its own bank in the medium to long term, following the successful models observed in South Africa, Canada, and the United States. By owning a bank, GREDA can further support its members and drive economic growth within the real estate sector.

Challenges Confronting the Real Estate Industry

Mr. Bonful highlighted the pervasive challenges faced by the real estate industry, particularly concerning land acquisition and litigation. He disclosed that more than 33% of members’ court cases are related to land disputes, indicating a systemic issue that adversely affects developers. “Some of our members are in court for land litigation cases and an individual member’s cases can be numbering to more than 10 depending on the size of the company and then how wide you are spread.”

Meanwhile, he shared a harrowing experience of a smaller company in the Association grappling with 19 ongoing land litigation cases, illustrating the significant burden placed on developers. “He had to sell his salon car that takes his children to school just to be able to pay some lawyers.”

Tackling these challenges, Mr Bonful advocated for deliberate policy interventions to streamline the resolution of land disputes. GREDA, according to him, has actively engaged with the government, proposing measures that would enable real estate developers to proceed with their projects even amidst land disputes. Specifically, he suggested that developers should be allowed to continue development while the courts adjudicate ownership disputes. Then, any payments made to contesting parties could be held in escrow until a resolution is reached, providing a level of assurance to investors and developers alike.

By implementing such policies, he believes confidence in the real estate market would increase, attracting both local and international investors. This, in turn, would contribute to the reduction of the housing deficit, as projects would proceed unimpeded by protracted legal battles.

The GREDA President, therefore, elaborated on the Association’s proactive approach in addressing land disputes affecting its members. He indicated that when a member encounters such challenges, GREDA intervenes by assisting in establishing a prima facie evidence of legal title or ownership. If the evidence favors the GREDA member, the association takes further steps by engaging relevant authorities, including law enforcement agencies such as the police, to help resolve the dispute.

“In some cases, we even fall on the military, depending on the height of the land guard activity in the area… So, we, the association, come in and back our members; the association tries its best. We can only do so much to try and help our members to secure their investments.

“But then, if we can get some legislative backing also, I think it will go a very long way in the first place to avoid such stresses, needless expenditures, [and] wastages. Because if you are engaging the security services, as a private person, you must pay; it’s not free. Meanwhile, developing your business plan, that budget was not included in them and if you go to court, you don’t even know how long it’s going to stay in courts. So, GREDA is doing what it can do to help.”

Luxury Properties Overpriced, Stalls Investors Returns

While lauding the rising spate of luxury properties dotted across the capital city, Mr. Bonful offered insights into the dynamics of the property market in Ghana, likening it to a pyramid with luxury properties at the narrow top and middle-income and lower-income segments forming the broader base.

Acknowledging the high rate of unoccupancy, he highlighted a concerning trend where the market’s supply, particularly in luxury properties, exceeding demand, leading to an oversaturated market. This oversupply has resulted in stagnation, as luxury properties remain unoccupied due to their high prices.

He expressed bewilderment at the pricing of luxury properties, noting that some are priced exorbitantly compared to similar properties in the US or UK. He cited statistics indicating that nearly 13% of luxury buildings in Ghana are vacant, underscoring the financial risks associated with investing in this segment.

The GREDA President, thus, emphasized the importance of thorough market analysis and research to forestall such challenges, noting that some investors have suffered financial losses, particularly those who have relied on bank loans to finance luxury developments. He recounted advising against entering the luxury market to some partners due to the uncertainties and risks involved.

In contrast, he highlighted the growing demand in the middle-income market, which underscores the mismatch between supply and demand in the property sector. This oversupply of luxury properties and undersupply of middle-income housing further exacerbates the challenges faced by developers and investors.

Curbing Overpricing in the Luxury Properties Market

Acknowledging the challenge of exorbitant pricing in the luxury properties market, Mr Bonful outlined GREDA’s efforts to address it. He regretfully noted that many companies operating in the luxury market are not members of the Association, as such, limiting the Association’s direct influence over their pricing strategies.

Additionally, he highlighted GREDA’s lack of legal authority to compel all real estate developers to become members of the association. Without this legal backing, GREDA’s ability to influence pricing behaviours among non-member developers is restricted.

However, the GREDA President emphasized that the Association maintains a proactive approach to engage with its members. The Association conducts regular visits to members’ companies, engaging in discussions and offering advice where necessary. This dialogue allows GREDA to listen to its members’ concerns and provide guidance on pricing strategies.

Moreover, GREDA collaborates closely with various government institutions, including law enforcement agencies and anti-money laundering bodies such as EOCO & FIC, to address issues within the real estate sector. Despite these efforts, the Association’s impact is limited by its lack of legal mandate to enforce membership among all real estate developers.

Lack of Regulatory Authority, Limiting the Association’s Capacity

In spite of concerns regarding GREDA’s perceived lack of regulatory authority, Mr Bonful revealed the association’s efforts to uphold industry standards and protect consumers.

He acknowledged that GREDA, as a voluntary association, lacks the legal mandate to regulate all real estate developers in Ghana. However, within its membership, GREDA maintains strict adherence to industry standards and ethics. The Association has a dedicated welfare committee tasked with addressing complaints and ensuring members comply with established guidelines. When necessary, GREDA takes disciplinary actions against erring members to maintain integrity within the association.

Despite its limitations, GREDA’s reputation has grown over the years, with more developers seeking membership with the Association. Financial institutions, according to the President, increasingly inquire about GREDA membership status when real estate firms try accessing loans, reflecting the Association’s credibility and influence within the industry.

The GREDA Boss recounted instances where non-members faced challenges due to their non-membership of the Association, leading to prospective clients from overseas expressing hesitancy in engaging with such companies, citing concerns about credibility and accountability.

To further safeguard the industry’s reputation and protect consumers, GREDA conducts site visits to verify the legitimacy of developers and their projects. These efforts ensure transparency and accountability, mitigating risks associated with unscrupulous developers.

“We need a law and the law that must be passed must have to go through Parliament. We tried to push this through when they were passing the Real Estate Agency Act. We tried to push it in to make it mandatory that anybody that calls himself real estate developer must be a member, but it didn’t work out. Because, without the legal backing, you cannot compel anybody. We have freedom of association, so you cannot compel anybody to be part of it.

“So, it’s our hope that one of these days, we’ll get to the point where they will see eye to eye with us and then make it a law that before you call yourself a real estate developer, you must necessarily be part of GREDA. We will do the basic checks. If you come and say you want to register, we don’t just say pay and go. You submit your details and everything will be verified before you become a member.”

Meanwhile, Mr Bonful highlighted GREDA’s proactive approach to address the proliferation of unscrupulous players in the real estate market, who tarnish the Association’s reputation. Despite GREDA’s lack of regulatory authority, it collaborates closely with law enforcement agencies such as the Economic and Organized Crime Office (EOCO) and the Financial Intelligence Centre (FIC) to combat money laundering and fraudulent activities within the industry.

Through seminars, public awareness campaigns, and collaboration with regulatory bodies, GREDA seeks to educate the public about the importance of verifying the credentials of real estate developers before engaging them. As such, the Association encourages individuals to inquire about membership status and conduct background checks on developers to mitigate risks associated with fraudulent activities.

GREDA Seeks Government’s Collaboration to Address Industry Challenges

Addressing the industry challenges, Mr. Ebo Bonful disclosed that GREDA has presented several proposals to the government aimed at resolving various challenges within the real estate sector. One notable proposal is the creation of land banks without the government having to pay compensation for land acquisition.

In this proposal, GREDA suggests that the government engages Allodial owners of land across the country. He revealed that many families in Ghana own vast tracts of land without proper land title, some of which are subject to land litigation, leading to delays in development projects. GREDA’s President emphasized that the economy suffers as a result of these legal disputes, hindering progress and economic growth.

“So they [investors] are bedeviled with a lot of land litigations. Some of them are needless. Land litigations proliferating in the industry. The ultimate loser is the government, because while we should be developing and churning out houses, making profit and paying more taxes, engaging more workers who can also then pay taxes, we are locked up in litigation. So, the ultimate loser is the economy.”

To mitigate this issue, GREDA’s President proposed that the government conducts thorough investigations and select suitable parcels of land controlled by Allodial owners. Then government offers to provide services such as land valuation, legal assistance, and land registration free of charge to these landowners. In return, the government retains a portion of the land, typically around 25%, as compensation for the services rendered by Government.

By implementing this proposal, the government would effectively create land banks. These land banks could then be utilized for various government projects, including infrastructure development, industrial expansion, and affordable housing initiatives. Additionally, the availability of government-owned land banks would attract investors and developers interested in undertaking projects in Ghana.

Mr Bonful, therefore, explained that the proposal offers significant benefits to both the government and landowners. “…this not only saves government expenditure but also generates new revenue through the sale of retained land at current market value”.

Moreover, the GREDA President added that the government stands to gain substantial income from the sale of such land banks, which can exceed 300% of the initial investment in providing prior services. This additional revenue stream contributes to fiscal economy and boosts economic growth. Additionally, the credibility of government-backed land titles enhances the market value of the land, benefiting both landowners and government.

Furthermore, the proposal fosters capital accumulation for landowners, who can leverage their newly acquired land titles to generate income through property sales or development projects. This, in turn, stimulates economic activity and tax revenue generation from land valuation fees, land title registration processing fees, etc., for would-be purchasers of these lands.

GREDA President Calls for Unity Among Members

Mr. Patrick Ebo Bonful, the President of GREDA, in conclusion, extended his heartfelt gratitude to members, stakeholders, and all participants within the Association. “Your dedication, collaboration, and unwavering commitment to advancing the real estate sector in Ghana are truly commendable.”

He further emphasized the importance of unity and active participation among GREDA members to drive the Association’s vision forward. He highlighted the need for members to work together with the Executive Council, under his leadership, to address common challenges and improve the overall welfare of the membership.

The GREDA President also encouraged members to engage in the Association’s activities, including seminars and events organized by the Secretariat. These initiatives, according to him, aim to provide valuable insights and knowledge, particularly regarding the legal framework governing the real estate industry. By understanding these regulations, members can protect their businesses from potential legal challenges and ensure their long-term success.

Furthermore, he stressed the significance of paying dues, as they are essential for the functioning of the Association. He also emphasized the need for members to stay informed and actively participate in the Association’s initiatives, as they are designed for the benefit of the membership.