All too soon, Ghana has been ‘forced into retirement’! At its birth, Ghana, the hope of Africa was seen a beckon for good things to happen to Africa. The birth spurred the struggles and liberation of other countries on the landmass of Africa from the shackles of colonial governance systems. It was a call to the people of Africa to champion their own God given purposes.

More so, the continent Africa is blessed with enormous natural resources of all kinds. These resources signaled to most African governments and citizens including Ghana the hope of making good the resources to better the living conditions of their citizens and economy at large.

Though, Ghana is gone on retirement yet the prospects after retirement looks brighter and more feasible than at the time Ghana was birthed and had no old ropes. In fact, the historical economic records captured two enviable scenarios of Malaysia and Singapore. Both countries were believed to be at par with Ghana at independence but sixty years down the lane; the economic prosperity has changes as they moved from third world countries to first world countries attracting enormous foreign direct investment.

The Dream Perspectives

At independence, the first president of Ghana, Osagyefo Dr Kwame Nkrumah acclaimed and paraphrase here …the black man is capable of steering his own affairs. In other words skills and talents differentials are same for white men and black men. Related to this statement is a philosophical view that says that all men were born equal. On 6 March 1957, Ghana became an independent country. At the time the dreams and expectations of the country were big and bright. Each individual as a citizen was very expectant and danced and cheered on the leaders who led the struggles to attain the enviable feat of the first country within Sub-Saharan to attain independence.

This feat was admired by other sister African countries who later became zealous and fought their struggles as well and attained independence later. Indeed, Ghana was a beckon of hope! However, these aspirations and expectations changed as time rolled on. There was great despondency among the citizens. This led to different forms of disruptors – political instability; ineffective economic policies; infrastructural deficits; high interest rates; technology deficits; market access difficulties; and inadequate quality human capital etc. have sucked the oxygen from economic aspirations of the country. These disruptors have affec ed the country’s economic trajectory and symptoms are obvious to notice.

Economic Instability Triggers

In recent times, a significant global concern has been youth unemployment. Various global reports such as the International Labour Organization (ILO), the World Bank (WB), the International Monetary Fund (IMF) etc. report that youth unemployment is likely to see a surge unless various countries take the steps to create the environment and opportunities for young people to gain meaningful employment. Meaningful employment here means jobs that are legitimate according to international and domestic laws and does not dehumanized the one offered the job.

The reports also highlights that most developing countries will be largely affected and this may lead to various instabilities (i.e. political and economic instabilities). For instance, a report on Ghana by the World Bank dubbed “Landscape of Jobs in Ghana” indicated that almost half (48 percent) of Ghana’s youth aged between 15 and 24 are without jobs. Same report also alluded that young women in the country were particularly disadvantaged and had much higher job inactivity rates than their male counterparts. The Ghana Living Standards Survey (GLSS) for 2012/2013, stated unemployment was marginally higher for females (2.0 percent) than males (1.6 percent) and higher in urban areas (3.5 percent) than in rural areas (0.8 percent).

The GLSS again estimated that about 250,000 young men and women enter the Ghanaian labor market every year with only two percent absorbed in the formal sector while 98 percent seek employment in the informal sector or remain unemployed.

“Politico-economic” instability led to Ghana adopting different forms of economic management policies since independence. The repercussions of which the country is dealing with include high Debt-to-GDP ratio, high interest rates and inflation, unstable and depreciative currency, high infrastructural deficit, inadequate quality human capital, international market access difficulties etc. These could be attributed to the types and forms of economic policies the country adopted and implemented since independence till date.

As history has put it, post-independence Ghana saw strong state control and investment. The state, just like other socialist countries perceived capitalism and free market economy to be inefficient in distribution of wealth and social needs. Government socio- economic development policy map hinged on Import Substitution (IS). Political instabilities and incoherent developmental policies marred the socio-economic growth and development of Ghana. This led to Ghana adopting the Structure Adjustment Program (SAP) and Economic Recovery Program (ERP) to improve on state efficiency and effectiveness and improve on the macro-economic stability of the country. Implementation of these policies resulted in improvement of socio-economic indicators such as reduction in maternal mortality, increase in formal education enrolment, increase in adult literacy etc.

In the 2000s, Ghana vigorously implemented series of pro-poor programs. And also, the country enjoyed the benefits of half its debts cancelled by the “Club of Paris” when Ghana opted for the Heavily Indebted Poor Countries (HIPC) facility. Therefore at the turn of the millennium and poor performance in the major export earnings– Gold and Cocoa which deepened the woes of the country – high acceleration in Debt-to-GDP, weaken country’s currency again major trading currencies, high interest rates led to the country opting for the HIPIC program. The country reached completion point in 2006. Within these periods the country was able to accumulate funds and channeled them to its pro-poor policies. The Ghana’s Poverty Reduction Strategy (GPRS) I was initiated in 2003. The objective of this national important strategy was to attain anti-poverty objectives of the UN’s Millennium Development Goals (MDGs). In 2006, the Growth and Poverty Reduction Strategy (GPRS) II was launched and implemented up to 2009. The central goal of the new policy was to accelerate the growth of the economy so that Ghana could achieve middle- income status within a measurable planning period.

The decrease in the country’s debt to GDP ratio improved on the country’s credits rating by international rating agencies (i.e. Standard &Poor, Moody’s Investors Service, and Fitch Ratings) leading to strong investor confidence in the economy. This became a pointer for the government to source commercial loans from the international market. It has become another source of finance for fiscal budget. And this seems to be the trend as many developing and emerging economies are increasingly showing up on the international capital markets for additional sources of finance to support their developments. Ghana’s first attempt was in 2007. She issued the first Eurobond and successfully raised

$750 million and in 2013 and 2014 raised $2 billion. Parliament of Ghana approved a request by government to issue US$ 1.5 billion from international capital market to support the 2015 budget and refinanced domestic and external debts. All these sovereign bonds despite its advantages of funding infrastructure, benchmarking and restructuring debt adds up to Ghana’s public debt. Public debt in Ghana has reached unsustainable limits; about GHC 94.5 billion.

One significant monetary policy decision made by the government is the redenomination of the currency. In July, 2007, the Central Bank championed the redenomination of the Cedi. The cedi redenomination became necessary as a result of years of decline in the currency’s value. In 1982, for example, the US dollar exchanged for 2.78 cedis. Now the dollar exchanges for about GHc 4.50 cedis. The redenomination was carried out because it was part of the government’s efforts to convince citizens and markets that hyper- inflation was a thing of the past. Inflation was as high as 116% in 1977, 117% in 1981 and 123% in 1983. In 2007 inflation was t 12% and swings averagely over the period between 2007 and 2016 at 14%.

However, due to government uncontrollable appetite for borrowing– domestic and international, in order to fulfil its fiscal responsibilities including: provision of public infrastructure, statutory payments (i.e. wages and salaries), huge transfer payments as result of its pro-poor programs (i.e. Livelihood Empowerment Against Poverty Program (LEAP), Youth Employment Program coordinated by the Youth Employment Agency, Local Enterprise Skills Development Program(LESDEP) etc.) saddled the country with high Debt-to GDP ratio, high interests, over reliance on traditional export earners – gold and cocoa and currently the oil find.

Economic Trend Analysis

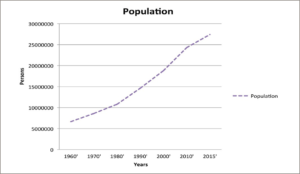

Various forecasts on the economic performance revealed that Ghana’s economic prospects are bright; despite the fact that the economy is saddled with huge debts. The population index of the economy revealed rapid growth in the population of the country. A closer look at the population shows highly youth based structure. This could be both positive and negative factor for the economy. Where government policies are aligned properly to create conducive environment for these young people gain meaningful employment or turn their ideas into enterprises in order to employ other peers, then the economy is set to achieve most of the projections made by the World Bank and OECD.

On the other hand, the growth in population index would serve as negative catalysts to the economy when government policies and programs failed to harness the potentials of these youth. The ability of the government the potentials of this young population will result into increase in domestic revenue, high productivity and economic growth. The final outcome is the economy will see improvement in economic welfare of its citizens, close in the gaps income inequalities, and decreased in poverty. Figure 1 shows population growth of Ghana from 1960 to 2015.

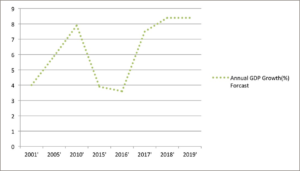

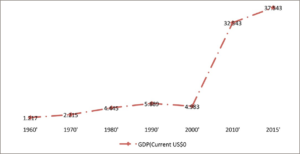

Figure 2 and 3 below show Gross Domestic Product at current market prices in dollar terms and in percentage. A close look at the trend from 1960 shows that GDP at current market prices began to grow slowly till 1990. The figure recorded in 2000 was lower than the average figure recorded in the 1990s. Around 1999 and 2000 the price performances of export earners on the international market was less favourable to the economy.

The economy saw depreciation in the national currency, high inflation rates, and interest rates. As a result, government undertook massive domestic borrowing which stifled other sectors of the economy to have access to cheap capital. Capital cost became high and the private shrunk. However, the economic fortunes turn around after the implementation of the HIPIC program, Eurobond, rebasing of the economy, and the oil find which saw Ghana become the fastest growing economy in 2011. After that the Gross Domestic Product grew below as expected till date.

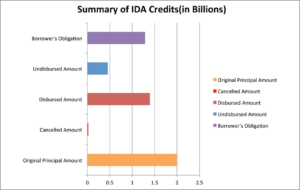

Figure 4 shows the International Development Agency’s credit disbursement as at December 31, 2016. One thing that is obvious is the alarming rate the borrower’s obligation is growing. It has been forecasted that the economy obligation to service loan interest will grow at an alarming rate unless the government instituted consistent fiscal discipline. Without that, the economic prospects of the country will be stifled and eventually will lead to total economic collapse. And when the economy collapses that may lead to greater despondency among the citizens

In conclusion, we have journeyed through the history of Ghana with respect to economic performance from independence till date. Various economic policies and programs implemented by the country saw mixed results in outcomes. This has resulted in high Debt-to-GDP ratio, a hike in interest rates, inflation, high cost of capital, high unemployment, etc. However, the aggressive infrastructure investments and other economic programs the government is pursuing to curb reckless public expenditures give a glimmer of hope that the prospect of the economy looks bright. The World Bank and OECD have predicted that Ghana will grow at 7.5%, 8.4%, and 8.4% in 2017, 2018, and 2019 respectively. When this happens there will be opportunities.