The stock market in Ghana closed 2016 with a negative 15.33% resulting in three straight years

of underperformance and two straight years of negative return. This is making a lot of equity investors uneasy, whilst some have even abandoned the whole idea of investing in equities. Developed capital markets have talked about a lost decade for equities given a decade long underperformance of equities compared to other asset classes. Is the Ghanaian equity market fast approaching that state given the three straight years of underperformance?

The capital market has seen very interesting times in the past few years and performance of fixed income and equity securities have test both the greed and the resolve of most investors who favor these asset classes. Aside the two asset classes, real estate properties as an asset class have proven to be an important addition to an investment portfolio given the high inflation environment in Ghana and the sub-region.

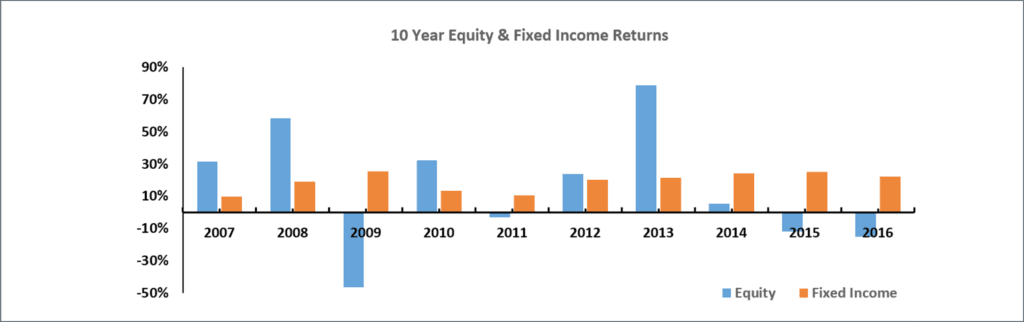

The Ghanaian equity market has underperformed the fixed income market, represented here by Government Treasuries to make comparison easy and straight forward, in three straight years. This has led to even the most diehard of equity investors to take a second look at their forecasting and valuation models. Some investors have been burnt so bad that it will take a while for them to return to investing in equities again. Finance and investment professionals are accused of driving into the future looking through their rear view mirror. All the same I will look five and ten years respectively into the rear view mirror of the performance of the various asset classes to see if we should be concerned about the recent past performance of equities.

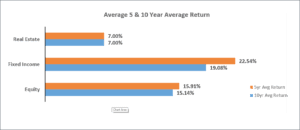

A look at the performance of the three main asset classes namely equity, fixed income and real estate; puts their returns into perspective. Looking at a 5 year average return puts fixed income in the lead with an average return of 22.54%. Equity was second with an average return of 15.91% whilst real estate assets returned a paltry 7% over the same period. A caveat for the real estate return is that the return figure represents only gross rental yield and did not include returns from the price appreciation of these real estate properties. The story doesn’t change much when we extend the assessment period to ten years, with the equity return dropping slightly to 15.14% whilst the fixed income return goes down to 19.08%. The real estate asset return remained fixed at 7%.

The real estate asset class presents a very interesting story in Ghana given the fact that real estate has not truly evolved into an asset class but is rather combined with other investment options mainly due to very little aggregated data on such asset and a lack of investment avenues for the average investor. Real estate investing is not for the faint hearted or those with a shallow pocket. It requires very huge initial investment and historical returns have mostly been sub-ten percent and are mainly attributed to rental income. Price appreciation in real estate properties provides additional gains but it’s very difficult to generalize because of the difficulty in obtaining historical house prices. The real estate sector has performed poorly compared to the other asset classes but it continues to be a very important component in an investor’s arsenal because it provides other benefits to an investment portfolio including providing a hedge against unexpected inflation. Given the high inflation environment in Ghana and the sub-region, this benefit becomes even more critical to the portfolio.

The real estate asset class presents a very interesting story in Ghana given the fact that real estate has not truly evolved into an asset class but is rather combined with other investment options mainly due to very little aggregated data on such asset and a lack of investment avenues for the average investor. Real estate investing is not for the faint hearted or those with a shallow pocket. It requires very huge initial investment and historical returns have mostly been sub-ten percent and are mainly attributed to rental income. Price appreciation in real estate properties provides additional gains but it’s very difficult to generalize because of the difficulty in obtaining historical house prices. The real estate sector has performed poorly compared to the other asset classes but it continues to be a very important component in an investor’s arsenal because it provides other benefits to an investment portfolio including providing a hedge against unexpected inflation. Given the high inflation environment in Ghana and the sub-region, this benefit becomes even more critical to the portfolio.

This leaves us with the two other asset classes and especially equity asset class which has seen very bad days in the past three years. Before 2014, equities were putting up better performance on average than the fixed income market and this was mainly attributed to relatively strong GDP growth after 2008 and a low interest rate environment because the inflationary pressures had eased considerably. There were a lot of incentives for business to invest and expand their operations because of the general increase in demand for goods and services. Companies listed on the stock exchange shared in the overall performance in the economy in that period and equity investors were rewarded accordingly.

The honeymoon for equities ended in 2013 when the Ghanaian cedi depreciated significantly and setting off a cascade of events that resulted in a noticeable increase in inflation and general interest rate on the market. These negative effects on the economy was exacerbated by a power crises that affected both businesses and households. In all of this, businesses were negatively affected because it became increasingly more expensive to import raw materials because of the weaker cedi, the increase in interest rate also raised borrowing cost whilst the energy crises led to an increase in the operating cost for these businesses. Weaknesses started showing in the fundamentals of listed companies on the Ghana Stock Exchange (GSE) leading investors to have a more negative outlook for the stock market. The challenges in the economy persisted from 2014 to the end of 2015 with most market participants having the view that we were out of the woods. Unfortunately the recovery expected in 2016 was very slow and the gains made were easily reversed by the beginning of the second half of the year due to an increase in the level of nonperforming loans of the various financial institutions.

Three straight years of underperformance by equities will definitely test the resolve of any equity investor, especially ones that are required to report on their performance on a regular basis. The most important question to ask is whether we should give up on equities or to lower our return expectations from equities. Most equity investors expected equities to put up a very strong performance in 2016 because the previous two years gave unimpressive return and also because the stock market mostly does well in election years. To say equities will do well after two successive years of underperformance is equivalent to saying that the probability of a tail showing up in a coin flip after having ten heads in a row will be different from the 50-50 probability for a head or a tail. Most election years have been favorable for the equity market but conventional wisdom has it that no two years are the same and it is even truer for the stock market where predicting performance still remains extremely difficult.

There is also the temptation for equity investors to switch completely to fixed income because even the safest of fixed income investments, government of Ghana Treasuries, have been putting up returns above 20% since 2012. That is five straight years of earning an average of 22.54% on Treasury securities. I am tempted to use the 72 rule, which tells you how long it will take to double your money given a specified interest rate. Guess what, it takes a little over three years to double your money when you use the average return earned by fixed income investments over the past five years. This means that investors will be able to double their money two fold by 2017 if interest rates on Treasuries stay the same. I don’t think anyone can argue against this point and win, so I rest my case. Let me however add that, it doesn’t rain every day and interest rates will not stay the same forever.

There is also the temptation for equity investors to switch completely to fixed income because even the safest of fixed income investments, government of Ghana Treasuries, have been putting up returns above 20% since 2012. That is five straight years of earning an average of 22.54% on Treasury securities. I am tempted to use the 72 rule, which tells you how long it will take to double your money given a specified interest rate. Guess what, it takes a little over three years to double your money when you use the average return earned by fixed income investments over the past five years. This means that investors will be able to double their money two fold by 2017 if interest rates on Treasuries stay the same. I don’t think anyone can argue against this point and win, so I rest my case. Let me however add that, it doesn’t rain every day and interest rates will not stay the same forever.

The interest rate regime will likely change in future and it appears we are beginning to see that change gradually coming up when we look at the current 91 day treasury rate (16.86%). Outlook for equities remains marginally optimistic (I am choosing my words carefully) given that we have seen some positive movement in some of the economic indicators especially inflation and Ghana cedi continues to be stable. The fundamentals of companies listed on the Ghana Stock Exchange are also beginning to pick up and we have seen significant recovery in the manufacturing sector. The banking sector, which remains the main driver of all the listed companies, is however lagging the other sectors in the recovery process due to the fact that some of them are still grappling with high non- performing loans in their loan portfolio. The silver lining for the abysmal performance by equities is that most of them are trading at all-time lows and others are even priced below their book value. This provides an opportunity for bargain hunters and very astute equity investors who live by the adage of buy low and sell high.

We cannot just give up on equities because of a string of underperformance and it still remains a fact that equities are a very important component of most investment portfolios including even the very conservative ones because they provide the growth a portfolio needs to at least maintain its inflation adjusted value.