Ghana’s banking industry has evolved tremendously since the country gained independence in 1957. The advent of banking in the country was in the then Gold Coast with the launch of the BANK of BRITISH WEST AFRICA (BBWA) in 1896. This later transitioned to Standard Chartered Bank in 1985. Other banks started trooping in on the back of the success of the then BBWA.

Bank of British West Africa was a British Overseas bank that was critical in introducing modern banking into the

British West African colonies.

In the early years the banking sector then was largely dominated by foreign banks such as BBWA and the Colonial Bank which started operations in 1918. This later merged with a number of banks to become Barclays Bank.

In the 1950’s, the country saw the establishment of the first Ghanaian Bank– Bank of the Gold Coast, which split later into Bank of Ghana and the Ghana Commercial Bank now known as GCB Bank. These two banks contributed to the activities of the economy alongside the two expatriate banks that were in operation till the mid-1960s when the country started witnessing establishments of other banks. The 1970s saw the establishment of state-owned Development Financial Institutions such as National Investment Bank (NIB), National Savings and Credit Bank (NSCB) and Social Security Bank (SSB).

PNDC Law 225 was enacted in 1989 to enable suitable locally incorporated bodies to operate as banking institutions. Post this development, the country experienced an uptake in the number of locally incorporated banks and an influx of foreign-owned banks especially Nigerian banks, bringing about intense competition within the industry.

PNDC Law 225 was enacted in 1989 to enable suitable locally incorporated bodies to operate as banking institutions. Post this development, the country experienced an uptake in the number of locally incorporated banks and an influx of foreign-owned banks especially Nigerian banks, bringing about intense competition within the industry.

According to data from the BOG, there were 33 Commercial banks in Ghana as at December 2016 and counting. Products and services in the industry have also gone through a series of transformational phases on the back of competition, technology and an improved regulatory framework.

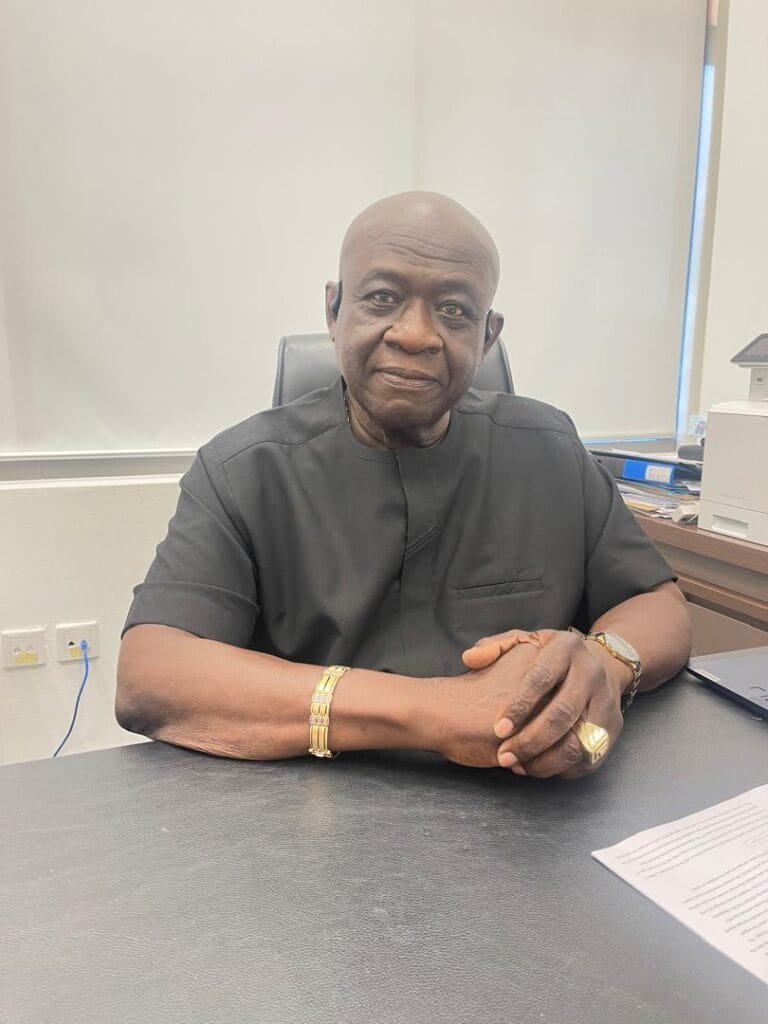

After 60 years of independence, the banking industry tells its story of evolution through one of its most experienced and astute professionals, Mr Alhassan Andani, the Chief Executive of Stanbic Bank Ghana Limited.

Ghana banking industry 60 years on

Considering the journey of the banking industry since the independence of Ghana, it is important to acknowledge the tremendous strides the industry has made. According to Mr. Andani, huge progress has been made to deliver “value to customers and the economy” as a whole. “Product evolution based on insight and service improvements” to the benefit of the customer has been impressive. Additionally, “penetration of the banking industry across the sectors of the economy and across the expanse of the country” has been progressive. Recognizing the banking sector’s total support of the economy, he revealed that the banking sector played and continues to play a vital role in the wellbeing of the economy. However, he was quick to add that there was still “more room for improvement”.

Financial Inclusion

According to the World Bank Group, Financial Inclusion simply means that “individuals and businesses have access to useful and affordable financial products and services that meet their needs. These include transactions, payments, savings, credit and insurance solutions delivered in aresponsible and sustainable way”. On the back of this, the question then begs asking: how much of the populace of Ghana is financially included?

Currently in Ghana, according to a Financial Inclusion Survey in 2015, 48% of adult Ghanaians have financial accounts. (Source: Financial Inclusion Insights: Ghana Summary Report National Survey Dec. 2015 pdf. Pg. 6).

This survey further reveals 34% of the people have bank accounts while 20% have registered mobile money accounts of which 17% are active. Mobile money is by far the largest tool for roping in the unbanked for example. Also, microfinance institutions can be leveraged if they efficiently execute their core mandate that stipulates them to focus on the low income and poorer sections of the economy.

From the report above, it simply shows that after sixty years of independence the country has more to do to achieve an effective financial inclusion using all the means available to propagate this agenda. Narrowing down to the banking populace in the country, it is evident that majority of Ghanaians are unbanked. Ghana’s ‘unbanked’ population currently stands at about 60% and its worrying effect poses a lot of concern to both the industry and the economy. But with the recent developments in ICT, it shows that industry players can target the unbanked in a very cost efficient manner.

Through the use of smart devices in every home, banking is sure of penetrating the ‘unbanked’ gradually. “We will see a greater acceleration of this process. Technology has been a critical piece of our evolution in the last couple of years. It has been a great drive of communication and transaction and plays a big part in driving adaption and banking inclusion.” One will notice that the surge in technology and innovation has improved the ease of on-boarding banking customers. Ghana is currently going through a period where banks are introducing simple ways of signing up customers. The recent spread of short codes banking and apps to kick-start the processes have been great. As the Telcos base keeps growing, the industry should be seeing more banking customer signups.

Impact of Telcos and Fintechs on Banking

Ghana’s Telcos industry comprises 6 companies: Vodafone, Glo Mobile, Expresso, Milicom(Tigo),Airtel,Scancom(MTN).Fintech, the abbreviation for financial technology, is a broad category that refers to the innovative use of technology in the design and delivery of financial services and products. These technologies are also being used and applied in the financial services sector, chiefly used by financial institutions themselves on the back end of their businesses. But more and more, FinTech is coming to represent technologies that are disrupting traditional financial services, including mobile payments, money transfers, loans, fundraising, and asset management.

Mobile money transactions are consistently growing in the country and the total number of transactions keeps increasing. In 2015, the total number of mobile money transactions was around 266 million with a transaction value of GHC 35 Billion. With lots of monies moving from one wallet to the other, one may ask: are banks threatened in anyway by the operations of Telcos or Fintechs?

Rather than seeing these institutions as a threat, Mr Andani, the M.D of Stanbic Bank, sees them more as a ‘complement’ to the operations of the banks. “Banks are not threatened by them but are rather supported by them. There is more of collaboration between banks and these institutions. They rather enhance banking operations. “I don’t see a threat! Our banking services are better facilitated and enhanced by these operators. Banks are not just customer based, we are product based and our industry is regulated to deliver a lot of essentials which these institutions cannot perform. Telcos and/ or Fintechs have a space within which they can operate. Some of their transactions are peripheral. For instance, transfers were predominantly done by banks and that is the space these institutions are playing within. But banks do more than just transfers!”

Mobile Money Impact on Banking Operations

With the advent of Mobile Money on the Ghanaian market in 2009, it has played a key role in the push for financial inclusion.

Mobile Money is an electronic wallet service, available in many countries, that lets users store, send and receive money as well as make payments using their mobile phone. Its safe and easy electronic payments model makes Mobile Money a popular alternative to bank accounts. It can be used on both smartphones and basic feature phones. Mobile money is disrupting and revolutionizing the banking industry in Ghana. Mainstream banks saw this as a threat initially but collaboration has deepened over the period between network operators and financial institutions. This effect is deepening the financial inclusion of the economy and complements each other to deliver value to customers.

According to a PWC 2016 Ghana Banking Survey: “How to win in an era of mobile money”, it was concluded that the introduction of mobile money technology in Ghana presents both opportunities and threats to banks. But bank executives believe that the opportunities presented by mobile money outweigh its threats and banks that win in this era of mobile money will do so by identifying actions that have to be taken to benefit from the opportunities present in this new era, while mitigating the risks.

The autonomy of the Central Bank

The autonomy of the Central Bank

The debate around the Central Bank’s Independence has raged on for a while with different schools of thoughts. Some proponents of independence argue that

subjecting it to political pressures will impact negatively on its role in reining in inflation or ensuring price stability. Proponents against independence argue it would be unjust to subject the entire economy to the whims or caprices of an elite group of learned individuals.

In Ghana, the Bank of Ghana Act as amended cloaks it with the power to oversee the industry. The Central Bank is known to manage the monetary policies of the economy while the government manages the fiscal policies. These parties have definite roles to ensure the growth and stability of the economy. To achieve a better economic management framework, they must work hand-in-hand.

Recent developments have shown that there is no absolute autonomy in the operation of the Bank of Ghana as selection of the governor of the Central Bank of Ghana is made by political appointment and this influences their decision making skewed towards the government that appointed them. Inquiring its worry on the industry, Mr. Alhassan Andani mentioned that the “President has the prerogative to appoint a governor, however, the tenure of office of the governor must allow for a period of relative stability and continuity”. He was quick to add that “it is not so much the person who occupies the position” but the focus should rather be on the policies which are pursued to the extent that these changes do not take away from the needed stability required for the financial services sector.

Touching on the new BoG’s push on corporate governance, he acceded to the 15- year tenure directive of the BoG as a step in the right direction. “An institution needs fresh minds to take it to the next level. The 15-year term for CEOs is appropriate to drive change. It’s a step in the right direction. After a while there are people who can take over from you guided with smarter ideas for acceleration.”

He buttressed his point with owner-managed institutions, that this measure would even be more pressing to drive freshness of ideas and business sustainability while private limited liability companies like Stanbic Bank Ltd. Ghana, he stated had systems in place to keep the structure and process running beyond the current leadership.

INFLUX OF BANKS AND BANK CAPITALIZATION

Ghana’s population currently stands at about 27million with just about 40% of this populace banked. This figure presents opportunities for any person(s) or institution(s) that wants to venture into the business of banking to capitalize on the percentage of the unbanked populace. But should the governor of the Central Bank continue to issue license to such individuals or institutions?

The country is inundated with about 34 licensed banks serving a populace of about 28 million. Comparing this to the larger and buoyant economies in Africa such as South Africa (with about 30 banks and about 55million people) and Nigeria (with about 27 banks and over 180 million people), it can be said the Ghanaian banking industry is ‘over- saturated’.

Addressing this issue of over-saturation of the industry, recapitalization has become one of the medium the Central Bank is considering to curb the situation. Currently, to commence operations as a Universal Bank, one needs approximately GHC 120 Million (approximately US$27 Million at an exchange rate of about GHc4.5 to the dollar). The Bank of Ghana is pushing to raise the capital requirements of the industry to strengthen banks which can undertake significant risks to propel the economy. This call has brought about various analysts and industry players to caution the regulator not to make a rush decision as this may not augur well for indigenous banks vis-à-vis international banks. Some have also called on the regulator to pursue a tiered capital/ economic risk capital rather than a blanket capital for the banks. Capitalization level in this industry is still very small as compared to countries like Nigeria. “Put all banks together and total capitalization is still smaller compared to some single banks in Nigeria. Ghana in terms of owner’s capital today does not match up to Nigeria’s 4th largest bank”.

The regulator has what it takes to ensure that there are no systemic risks from a fall out in recapitalization. The right level of capitalization is important to secure the sector against any systemic risk and also to guarantee stability within the sector.

On the other hand, another school of thought suggests that this recapitalization will also

lead to consolidation. “Big banks are good, but consolidation should not be pursued for consolidation sake,” suggests Mr. Andani. Consolidation should be done strategically to drive and support synergistic business objectives that make the new bank bigger than the arithmetic sum of the merging entities. This strengthens the balance sheet of banks to take on large exposures and serve a wider and more diversified client base. Consolidation might reduce the spread of banks in terms of geography or in terms of “areas of focus”. But the question still lingers; assuming all banks refuse to consolidate and are able to raise the minimum capital required by the Bank of Ghana, how does it address the over-saturation in the economy?

Is a Financial Ombudsman Necessary?

Customer Service is a very necessary ingredient in the operations of the banking industry. Banking is essentially acceptance of deposits and lending out these deposits to make a return. In carrying out this business it is possible certain human-induced problems may come up. How the institutions respond and react to certain issues is very important particularly on the human interaction front. To resolve such issues Bank of Ghana has instituted the Investigation and Consumer Reporting Office (ICRO) as the watchdog of the industry with responsibility for protecting consumers of financial products/services and educating them on their rights and responsibilities.

Recently, a call was made to parliament to set up a financial ombudsman with the legal powers to mediate between financial institutions and customers and that seems to portray duplicity of tasks. From the maws of the experienced banker, he was convinced that an Ombudsman will not be the reason why banks will provide excellent customer service and that it was ingrained in their sleeves. “Market forces and customer demand will compel you to match up to customer service standards. Ombudsman is good but may work in price regulations (where for example you may have an opaque pricing regime). Service is our business. Customers have choices and a single feedback powered by technology can be disruptive to your business. You must get customer service right. It is called “brilliant basics” and there is no compromise for that.”

Rise in Cybercrime in the Industry

With the rise in cyber-attack in the global arena, many industries are struck by these developments. Moreover, in the wake of this attack, is the harm it causes to such institutions. Cyber-attack is more predominant with banks as banking is conducted through computer-generated systems (algorithms). A recent report published by Serianu Limited, revealed that Ghana lost about US$50 million tocybercrime in 2016. Achieving Cyber Security Resilience report showed that five African countries lost a total of US$895million in this regard. Of the 5 countries, Nigeria suffered the biggest loss of US$550 million. Ghana recorded a loss of US$50 million. This shows the growing spate of such menace in the industry. Acknowledging the rise in the cybercrime in the industry, Mr. Andani revealed that most banks are investing massively to combat the menace. “We are aware of that and are taking several gateway security measures. No investment is spared to keep us ahead of the game. Cyber or ICT is a means of accelerating banking. Yet, the same algorithm needed to accelerate is being exploited by some to break the system.” Noting that the primary thing about banks is confidentiality, it is important to avoid any one from accessing that space illegally and once that is breached, privacy is threatened and therefore such massive investments in several gateways of security to protect customer data and the banks must be put in place.

Non-Performing Loans Impact on Banks

Non-Performing Loans have been the greatest hurdle banks face in their operations over the years. According to the Central Bank’s latest Banking Sector Stability Report, the Non-Performing Loans (NPLs) recorded on the shelves of banks increased by 36.17

% in February 2017. This represents an increase from 4.7 billion to 6.4 billion Cedis within the twelve months’ period. Most banks’ financials are crippled as a result of this loans and advances that were disbursed to businesses and individuals that defaulted. A nonperforming loan is either in default or close to being in default.

It is expected to hear that majority of the non- performing loans are from the private sector but a new data suggests otherwise. “Though the data suggests that public sector has more Non-Performing Loans, it’s a function of time for all such amounts to be paid”, Mr. Andani emphasized. He stressed that despite the delay in payment from government, no bank can claim non-receipt of payment for a transaction at all as a result of change in government unlike the private sector where he said that their NPLs mean the business model may not be working; pricing of products may not be right or some other factor may be at play. As such the private sector loans have a greater tendency to go to losses compared to Public Sector loans. Nonperforming Government loan does not mean losses but Private sector NPL may lead to a complete loss.

Performance of the Economy on the Banking industry

Various reports suggest that the performance of the Ghanaian economy has had a detrimental impact on the performance of the banking sector in the last couple of years. This undoubting statement is as a result of the economy being the bigger pie on which every other activity suspends. The economy comes first and then this defines the type of financial services the economy requires. The structure of economy drives the nature and structure of the financial services industry. They are built around the exchange of goods and services.

Beyond Banking as a Profession

Beyond banking as a profession, Mr. Andani reveals “I have a big passion for the youth, entrepreneurship and doing some philanthropy works. I like young people and I spend a lot of time engaging and empowering them to achieve more”.

Mr. Alhassan Andani, Managing Director of Stanbic Bank Ghana Ltd., served as an Executive Director of Barclays Bank of Ghana until 2005. He is a director of SOS Villages Ghana. He has been an Independent Non- Executive Director at Gold Fields Limited since August 1, 2016. He holds a B.Sc. in Agriculture from the University of Ghana and a Master’s Degree in Banking and Finance from the Finafrica Institute in Italy.

The autonomy of the Central Bank

The autonomy of the Central Bank