When John Dramani Mahama returned to the helm of Ghana government’s scene, he presented himself not just as a leader, but as a ‘savior’—ready to rescue the country from the dire economic strain characterized by soaring debt levels, a fast-depreciating cedi, and unrelenting inflation. With bold pronouncements and decisive policy proposals, he laid out a plan to reset the economy, triggering the coining of the term ‘Mahamanomics’—a catchphrase that encapsulates the John Mahama’s economic philosophy and policy direction. It symbolizes a radical shift from business-as-usual to a bold recovery plan anchored in stability, inclusiveness, and growth.

Now, with just a little over five months in office, many Ghanaians are beginning to see what some describe as an unfolding economic transformation. Inflation continues to trend downward, the local currency has appreciated significantly against major international currencies—including over 40% year to date against the US dollar—and the nation’s debt levels gradually declining. These developments have sparked renewed optimism, with many citizens warming up to Mahama’s ‘reset agenda’.

In an exclusive conversation with The Vaultz Africa, Professor Peter Quartey, a renowned economist and Director of the Institute of Statistical, Social and Economic Research (ISSER) at the University of Ghana, shared his expert analysis and weighed in on the Mahamanomics phenomenon that is now dominating Ghana’s economic discourse.

Ghana’s Surprising Post-Election Stability

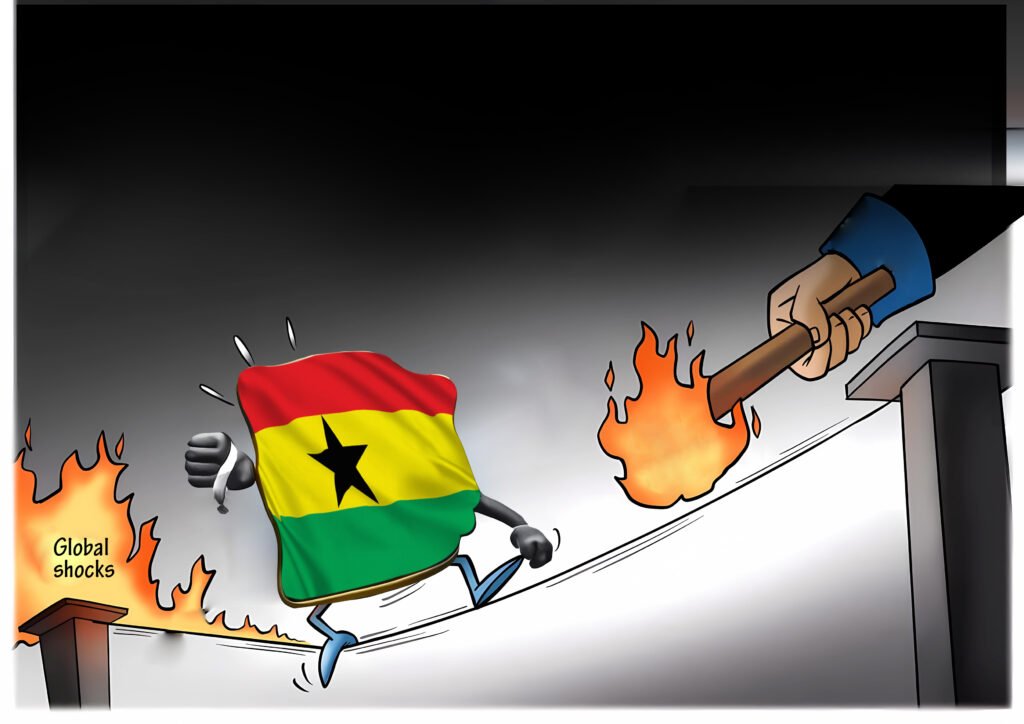

Giving a general overview of the economy, Prof. Quartey observed, “I think the economy has been relatively stable lately, because oftentimes the first quarter after each election year tends to be quite turbulent, but this year is different. It’s different for several reasons: external factors as well as internal factors that led to this relative stability.

Globally, we see that the dollar is struggling because of the geopolitics of the global economy. When you compare the dollar against the major currencies, you would observe that it has depreciated quite rapidly against the major currencies and that is what is translated into what we are seeing in the domestic front as well.”

However, Prof. Quartey stressed that global factors alone are not enough to achieve such stability. As such, he argued that effective domestic policies and public confidence are equally crucial. “…having said that, you could face favourable external factors but if your domestic policies are not right, and there is no confidence in your economy, in your leadership, or if the posture of your leaders doesn’t resonate well with the people, investors would start speculating with the currency. Consequently, you might not reap all the gains that is happening globally.”

According to him, recent signs of prudent spending, improved communication from leadership, and continuity in key initiatives like the gold-for-reserves program have helped reinforce economic confidence.

Furthermore, Prof. Quartey elaborated on the internal efforts that are sustaining this progress.

We’ve seen the posture of the president in assuring Ghanaians that they need to correct some of the wrongs of the past. We’ve seen a lot of steps being taken to ensure that the monetary sector is also kept well in shape. This gold for reserves programme that was started by the previous government, is being sustained. We even have a GoldBod. So, we have upped our reserves through the purchase of gold and that is also helping significantly.”

He also praised the proactive role of the Bank of Ghana, noting that “with the managed float exchange rate system, with some interventions on the market– Bank of Ghana intervenes with some dollar supplies on the market which ensures that the sectors that matter get access to forex to trade… In addition, I see the posture of the governor, [and] his team, as quite encouraging in the sense that lately they engage more with the public.”

One notable example of this engagement Prof. Quartey recalled was, “Recently, when we had a board member of the Bank of Ghana come out to say they are going to restrict the use of cash dollars; [that] you cannot cash over the counter, they came out swiftly, [and] debunked it. I mean, that’s what you expect of a very proactive leader or governor. So, all these are helping the economy.”

He also recognized the positive impact of the ongoing IMF program and emphasized the effect of a bipartisan approach to Ghana’s economic recovery.

Of course, the IMF program also has brought some credibility… It is my hope that we sustain what has been started, but I would not want one government to take all the credit and not acknowledge the previous government. I think together …they both have worked to ensure that we are enjoying this relative stability.”

Need for Continuity to Sustain Economic Stability

In assessing the role of Ghana’s Gold for Oil, Gold for Reserves programs and GoldBod in stabilizing the economy, Prof. Peter Quartey emphasized the importance of policy continuity and non-partisanship. “I don’t want to wade into the politics of it, but I think, for me, the message should be no party should take full credit; let’s apportion the credit,” he said. According to him, national development thrives when successive governments build on each other’s policies rather than abandon or reverse them. “We started something, you continue it, which is good… That is great.”

Prof. Quartey believes that Ghana’s decision to diversify its reserves into gold is strategic. “Gold for Reserves …is great because you can keep your reserves in the US dollar or in gold. Now, US dollar is losing ground [and] some credibility. [When] gold price is going up… your reserves go up, and your currency will be stronger and stable.” While he noted he’s yet to see full implementation details of government’s strategies, he affirmed that the conceptual framework is sound.

He disclosed the GoldBod can play a significant role in curbing illegal gold exports. However, he cautioned that transparency is essential. “We want a transparent system…” Prof. Quartey further warned against promoting illegal or unsustainable mining practices in pursuit of gold, stressing, “We should also ensure that there’s sustainable mining… I do think that is the way to go.”

[However], how long can we rely on gold for export revenue? We need to diversify to the other sectors. Production of cocoa as well as other crops are on the decline. We therefore have to increase the production of Non-traditional exports, in addition to streamlining the gold purchase programme, and together, we’ll become very sustainable, and resilient anytime there is a shock.”

Besides, Prof. Peter Quartey advised that the GoldBod should act as a regulator and license issuer without becoming a monopoly, encouraging competition much like Ghana’s COCOBOD. While supporting its role in streamlining gold exports, he warned against politicizing the licensing process, stressing the need for transparency. “If it is done in a transparent manner… using technology… I believe the GoldBod would help to streamline, especially the illegal trading or export of our gold,” he stated, cautioning that corruption and favoritism could undermine its potential impact.

Cedi Appreciation: Policy or Pure Luck?

Responding to the recent sharp appreciation of the Ghanaian cedi, Prof. Peter Quartey dismissed claims that it is merely a stroke of luck. “I don’t think luck would be the total or the main reason for what we’ve seen,” he asserted, citing the global depreciation of the US dollar, particularly against the British pound, and other major currencies as a contributing factor.

Moreover, the Director of ISSER emphasized that strong domestic policies are essential to sustain such gains. “It can happen globally, but if your domestic policies are not right, people will still not have the confidence in you and therefore hold the Cedi as a store of value”. He asserted, further explaining that the current faith in the cedi stems from policy assurances and prudent fiscal strategies.

“I therefore believe it’s a combination of both domestic and external factors,” he reemphasized. While hopeful, he remains “cautiously optimistic”, warning that past trends have shown Ghana has struggled to maintain such gains. “What remains to be done is… sustain the momentum,” he advised.

If you recall, a year or two ago, the cedi came as low as seven to nine cedis. What happened thereafter? It came from 17 cedis and dropped all the way to GHS 7 and gradually inched up to GHS 8, and GHS 9. Then it gradually started moving up and we got to GHS 13. So, we’ve been there before.”

As such, Prof. Peter Quartey emphasized that sustaining the stability of the cedi after exiting the IMF program depends on Ghana’s discipline in implementing key reforms. “If we are able to raise revenue, do the things in the IMF program, and not spend beyond reasonable limits, then when we exit, that is not going to be a problem,” he assured, further highlighting that government’s signals, including President Mahama’s commitment to a “big push,” point toward a responsible transition.

Besides, Prof. Quartey stressed the importance of efficiency: “We should also reset and run budget surplus… then you can save and invest.” He warned against wasteful spending, citing a study that found “for every 100 cedis of public investment in health, 39 cedis is wasted.” For Ghana to truly reset its economy, he averred, “we must ensure value for money.”

Nonetheless, financial think tanks, Fitch Solutions and Absa Bank, have cautioned against celebrating the cedi’s current appreciation, predicting a potential reversal by December. This, Prof. Quartey concurred that their skepticism is warranted, stating, “Any time we see gains, it doesn’t stay long… [and] we are back to where we started.” He acknowledged Ghana’s history of policy reversals and poor implementation, noting that budget statements often remain unfulfilled. But “If this time around, we are committed… then we can prove Fitch Solutions and Absa wrong,” he stressed.

Rising Public Debt In Spite of Debt-to-GDP Ratio Decline

Despite Ghana’s public debt rising to GH¢769.1 billion— a 2.1% increase— its debt-to-GDP ratio has declined to 55%. According to the ISSER Director, this apparent paradox is due to the simultaneous growth of Ghana’s GDP by 5.7%. “Your numerator grew by 2.1%, your denominator grew by 5.7%, so the ratio will come down,” he explained.

As such, Prof. Quartey stressed that both current and past governments deserve credit for investing in the economic growth, which has contributed to the rebound post the COVID-19 pandemic.

Moreover, he emphasized the need for “decisive leadership” to harness Ghana’s abundant resources, stating, “With good leadership, I tell you, we will be a high-income or high-middle-income country in no time.”

Ghana’s Unbridled Pricing Culture

Prof. Quartey also criticized Ghana’s pricing culture, where prices increase easily but rarely decline, even when the currency strengthens. “We are still convincing people to reduce prices because the thinking is that the Cedi may depreciate soon,” he remarked. To address this unbridled price culture, Prof. Quartey called for a shift in mindset: “Everybody wants to cash in… and that’s where the problem is.”

We own this economy, and we have to be citizens rather than just trying to cash in every time. I sometimes wonder why when you go to the market to buy vegetables and other things, there’s no weighing scale [to weigh them]. [However, if you] go to other African countries [and] you want to buy fruits, there’s a scale. But, ours is in a basket [and] under the basket, they’ve stuffed it with something before placing the produce in the basket. So, we always want to take advantage of each other. We do not price properly, so consumers don’t get value for money.”

Furthermore, the ISSER Director revealed that while a stronger cedi benefits importers, it is harmful to exporters because it makes Ghanaian goods more expensive abroad. In view of this, Prof. Quartey advised that to balance the benefits of a stronger cedi without disadvantaging export markets, Ghana must focus on adding value to its exports. While both importers and exporters will gradually adjust to currency movements, value-added products are less sensitive to price changes. “Even when your currency appreciates, people will still buy [value-added products],” he noted, adding that exporting raw commodities makes the country more vulnerable to sudden price reactions.

Likewise, he cautioned that the rapid appreciation of the cedi would create challenges for remittances. “If the appreciation or depreciation is gradual, people wouldn’t feel the shock,” he noted, citing cases where remittances are no longer sufficient due to unexpected exchange rate changes.

Cedi Appreciation Not Impacting Citizens Enough

Despite the Cedi’s recent appreciation, many Ghanaians aren’t feeling the impact. According to the economist, profiteering by middlemen and high import dependency are major obstacles denying the ordinary Ghanaian from feeling its impact. “Although the exchange rate is appreciating, they are not reducing prices,” he said, noting some traders still justify high prices due to previous costs.

To correct this effect, Prof. Quartey emphasized the need to revamp local production, especially in agriculture, to reduce import reliance. He noted that poor road infrastructure also contributes to high transport costs, which inflates prices of local goods. As such, “We must tackle the entire value chain—from irrigation and storage to credit and transportation,” he urged, saying holistic investment is the only way citizens will truly benefit.

We import so much from other countries; we are not self-sufficient. Look at the statistics and how much we spend on importing rice; how much we spend on imports and additionally our roads are not good to support local production and transportation to the markets. Our roads are so bad that when the goods are produced in the hinterland before they get to Accra, they are expensive because of transport cost. Recently GPRTU said they have reduced transport cost by 15% yet about 50% of the drivers are not complying with it.”

Capitalizing on Gold Proceeds to Transform Agriculture

Prof. Quartey emphasized the need for Ghana to reduce overreliance on gold exports by investing in agriculture to diversify income streams. “Agriculture is the backbone of every economy,” he noted, stressing that food sufficiency ensures stability.

He cautioned that while gold brings in vital revenue, government should use those funds to modernize farming, add value through processing, and expand irrigation. “Our agriculture is rain-fed… When the rains fail, then it becomes a problem,” he explained, advocating for both small- and large-scale irrigation projects.

We should move into irrigation. We should construct dams, be it small-scale dams or large-scale. We should support more of such initiatives to transform agriculture. I was quite excited when I saw that we’re going to tackle the Pwalugu Dam. If we can promote large scale irrigation or small-scale irrigation in the Northern sector, and be able to transform agriculture within that zone, we will be doing great exploits. Instead of importing tomato and other things from Burkina Fasso, we have arable land [to cultivate them].”

Government Cautioned Over International Capital Market Return

The current economic activities are sending a cautiously optimistic signal to investors, but Prof. Quartey warns against premature excitement and any policy or action that will affect investor confidence. “Sika mpe dede—money doesn’t like noise,” he quoted, emphasizing that investors are watching closely. While current economic gains are promising, he stressed they must be sustained over a period to truly inspire investor confidence.

Prof. Quartey, thus, cautioned the government against rushing to the international capital market, noting that Ghana’s credit ratings still remain low. “If we go now, we’ll pay higher interest rates,” he revealed, emphasizing that debt servicing already consumes over 50% of national revenue. Therefore, he urged government to build confidence gradually and wait for improved credit ratings before going externally to borrow.

Need for Institutional Independence

Prof. Quartey stressed that economic institutions like the Bank of Ghana must operate independently to function effectively. While collaboration with the Ministry of Finance is necessary, true independence—especially in monetary policy—is vital. He pointed out that although laws guarantee such autonomy, political appointments without transparent, competitive processes can compromise it.

In contrast to global best practices, Ghana’s appointment system for key roles like the Central Bank Governor lacks open competitive processes. Prof. Quartey admonished that achieving full autonomy is critical—not just for the Bank of Ghana, but also for institutions like the Chief Justice, Auditor-General’s office—to ensure economic stability and accountability.

We need to look into this and learn from best practices, especially how they are appointed, how they operate independently yet promote government’s vision. Of course, they respond to the President, but then, some level of independence is very critical for their operation, so people have confidence in the system.”

Tax Reform and Compliance, Critical

Meanwhile, to achieve the ambitious GH₵200 billion tax revenue target set by the Minister of Finance for the Ghana Revenue Authority, Prof. Quartey emphasized the need to expand the tax net through transparency, technology, and fairer tax policies. He protested that Ghana’s 21% VAT rate is punitive compared to 15–18% in many Southern African countries, thereby encouraging evasion.

He, therefore, called for reducing tax rates while broadening the base—especially by tapping into the vast informal sector and enforcing property rate collections on luxury homes in cities like Accra and Kumasi. However, he stressed that if citizens see value in taxes through improved services, it will automatically drive compliance and help stabilize the economy sustainably without IMF overreliance.

In conclusion, Prof. Quartey urged the finance minister to fully implement the IMF program and budget commitments, emphasizing their potential to lay a strong foundation for Ghana’s economic transformation. In addition, coordination of policies between the central bank and the ministry of finance is critical.