Just two (2) years ago, Ghana’s economy was teetering on the edge of collapse. The country’s fiscal architecture had been shattered, leaving behind GH¢67 billion in arrears and over GH¢194 billion in reckless contractual commitments. Public confidence was in tatters, the private sector was gasping, and the country’s financial credibility had sunk to historic lows.

Inflation soared, jobs vanished, interest rates skyrocketed, and the Ghana Cedi was the “worst-performing currency in the world”. The cost of living spiraled out of control, and social unrest loomed large.

After years of macroeconomic turbulence, Ghana’s economy took a decisive leap forward in the first half of 2025. The country now experiences growth metrics that stuns observers and inspire cautious optimism among investors, analysts, and multilateral partners.

According to the Ghana Statistical Service (GSS), amidst a backdrop of global economic turmoil and uncertainty, Ghana’s economy defied expectations, surging ahead with its strongest first-quarter performance in five years. The nation’s Gross Domestic Product (GDP) expanded by an impressive 5.3% in the first quarter of 2025, surpassing the 4.9% growth recorded during the same period in 2024. This remarkable feat not only marks the highest Q1 growth since 2020 but also signals a decisive rebound and growing resilience in Ghana’s economic structure.

The agriculture sector emerged as the standout performer, clocking a blistering 6.6% growth, a significant jump from its modest performance last year and contributing 26.4% to the overall Q1 growth. Within the sector, the fishing sub-sector soared by 16.4%, making it the fastest-growing component across all sectors. As Ghana deepens its focus on agro-industrialization and food security, these numbers underscore the transformative potential of the Agriculture for Economic Transformation Programme currently underway.

Meanwhile, the services sector, which represents the largest segment of the economy at 46.8%, expanded by 5.9%, accounting for a whopping 47.9% of the quarter’s total growth. At the heart of this surge was the Information and Communication Technology (ICT) sub-sector, which leapt by 13.1%, reaffirming Ghana’s growing status as a digital and tech-driven economy.

The industrial sector also held its ground with a 3.4% growth rate and contributed 20.6% to overall GDP growth. Within industry, manufacturing registered a strong 6.6% growth, signaling the return of renewed interest in industrial vibrancy aimed at industrial expansion and job creation.

Even more promising was the performance of non-oil GDP, which grew by a powerful 6.8%— the highest since 2018— compared to 4.3% in Q1 2024. This figure reflects the increasing diversification of Ghana’s economy, reducing reliance on crude oil and showcasing gains from sectors with higher value addition.

This supersonic surge can be attributed to the new John Mahama Administration who oversaw a mix of smart fiscal consolidation, policy discipline, public investment, and international support— especially under the International Monetary Fund (IMF) Extended Credit Facility (ECF) programme, which Ghana entered in May 2023.

With initiatives like the 24-Hour Economy Policy, the Big Push Programme, and the Agriculture for Economic Transformation Agenda in full throttle, the country is on course to surpass its 2025 GDP growth target of 4.0%.

Inflation in Free Fall

For a nation once plagued by hyperinflation, the latest consumer price data offers a breath of fresh air. After peaking at 54.1% in December 2022, inflation fell from 23.8% in December 2024 to 13.7% by June 2025— the lowest since December 2021, driven by improved food supply, currency stability, and tighter monetary policy by the Bank of Ghana.

The results are even more dramatic in producer and food prices. Producer price inflation plummeted by 20.2 percentage points to 5.9%. Food inflation dropped from 27.8% to 16.3%, while non-food inflation fell from 20.3% to 11.4%. Inflation for locally produced goods and services declined from 26.4% in December 2024 to 14% in June 2025.

Prices of staples like rice, sugar, and cooking oil are now at four-year lows. Fuel prices have eased at the pump. This is not random fortune; it is the consequence of aggressive fiscal tightening, improved supply chains, and a sharply appreciating currency.

The current Central Bank benchmark Monetary Policy Rate of 28% is helping anchor expectations while avoiding a premature easing that could reignite inflationary pressures.

This disinflation has brought much-needed relief to households and businesses, restoring consumer purchasing power and helping firms plan more confidently.

Interest Rates Dive, Confidence Soars

Interest rates, which once choked the government of Ghana and added to the mounting debt of the country, are easing across the board. Treasury bill rates fell significantly: the 91-day dropped from 27.7% to 14.7%, the 182-day from 28.4% to 15.34%, and the 364-day from 29.95% to 15.76%, from December 2024 to June 2025 respectively.

The average lending rate fell from 30.3% to 27.0%, while the Ghana Reference Rate dropped from 29.31% to 24.0%. In just six months, Ghana saved GH¢4.9 billion in domestic interest payments.

Investor confidence is rebounding. Credit to the private sector rose 31.3%, and deposit mobilization improved significantly.

Ghana Cedi: From Shame to Superhero

If there’s one figure that sums up Ghana’s economic rebound, it’s the historic performance of the Cedi. After years of free fall which led to it being classified as “one of the worst performers on the global stage”, the currency is in full flight.

As of June 2025, the Cedi appreciated 42.6% against the US Dollar, 30.3% against the Pound, and 25.6% against the Euro. This is a staggering reversal from 2024 when it depreciated against all major currencies. In fact, Ghana has nearly undone all Cedi depreciation from 2022 to 2024.

Currently, the Cedi trades at GH¢10.4 to the Dollar, down from GH¢17.0 just a year ago— a recovery never seen in Ghana’s 60-year currency history.

This appreciation is underpinned by soaring reserves, fiscal credibility, and a strong trade performance. With such firm fundamentals, the Cedi’s rebound isn’t just sustainable— it’s emblematic of national revival.

Rebuilding the Reserves and External Sector

Ghana’s external position has strengthened remarkably. Gross International Reserves rose from US$8.98 billion in December 2024 to US$11.12 billion in June 2025, equivalent to 4.8 months of import cover.

Trade surplus exploded from US$1.37 billion in June 2024 to US$5.57 billion in June 2025— a 306.6% increase— thanks to stronger exports in cocoa and gold and tighter import controls.

The current account surplus hit US$3.44 billion by June, up from US$283 million a year earlier. Net capital and financial inflows exceeded US$937 million, reflecting renewed investor faith.

Fiscal Turnaround: From Wasteland to Surplus

Fiscal performance in the first half of 2025 was nothing short of transformative. The primary balance on a commitment basis hit a surplus of 1.1% of GDP— nearly triple the 0.4% target.

The overall fiscal deficit was 0.7% of GDP, better than the 1.8% target. On a cash basis, the primary balance flipped from a projected 0.2% deficit to a 0.7% surplus.

Revenues outperformed, especially in Corporate Income Tax and Mineral Royalties. Expenditure discipline was tight, with spending contained at GH¢109.7 billion— 14.3% below the programmed figure.

Ghana’s domestic interest payments fell short of budget by GH¢4.9 billion, while foreign interest payments also dipped thanks to the Cedi’s strength.

According to the Ministry of Finance, domestic revenue for H1 2025 reached GHS 67.9 billion, about 8.1% higher than projected, driven by strong performance in corporate income tax, VAT, and petroleum receipts.

Meanwhile, expenditure stood at GHS 91.2 billion, slightly below budgeted estimates, thanks to better control over compensation and interest payments. The result was a primary fiscal surplus of 0.9% of GDP, a major turnaround from deficits of over 3% just two years ago.

This fiscal discipline was achieved without stalling growth-critical investments in roads, health, education, and agriculture. The government’s ‘Grow 24’, an alternative policy to the flagship Planting for Food and Jobs has expanded coverage, and capital expenditure has been prioritized within fiscal space limits.

Debt Declines for the First Time in Years

Perhaps the most impressive achievement is in public debt reduction. Ghana’s public debt dropped from GH¢726.7 billion at end-2024 to GH¢613 billion by June 2025— a decline of GH¢113.7 billion in six months.

This reflects a 15.6% negative rate of debt accumulation, and a fall in the debt-to-GDP ratio from 61.8% to 43.8%. Foreign debt now forms just 49% of total public debt, down from 57.4%.

This isn’t just accounting wizardry; it’s fiscal redemption. For the first time in years, Ghana’s debt trajectory is downward and sustainable.

The World’s Watching— and Applauding

Global rating agencies have taken notice. Fitch Ratings upgraded Ghana’s Long-Term Foreign-Currency Issuer Default Rating to ‘B-‘ with a stable outlook from ‘Restricted Default’— a two-notch leap.

The IMF completed its fourth review of Ghana’s programme, triggering a fresh US$367 million disbursement. The World Bank and other partners are lining up to support Ghana’s momentum.

Fitch cited the Cedi’s appreciation, declining debt levels, strong GDP growth, and rising reserves as key drivers for the upgrade. S&P and Moody’s are expected to follow suit.

Government’s Clear Roadmap to Consolidating the Gains

This recovery hasn’t come by chance. It is the fruit of vision, commitment, and sacrifice. Prudent fiscal policies, tight monetary controls, structural reforms, debt restructuring, and a clear growth agenda have created a credible pathway for lasting stability.

The Mahama administration has outlined a clear roadmap to ensure Ghana’s economic gains in the first half of 2025 are sustained and deepened. Central to this vision is the commitment to maintain fiscal discipline and avoid the pitfalls of excessive borrowing that previously contributed to macroeconomic instability. With rising investor confidence and improved revenue performance, the government intends to consolidate gains by prioritizing value-for-money spending and strengthening public financial management systems.

A major component of the administration’s forward-looking strategy is the diversification of Ghana’s economy beyond the traditional reliance on cocoa, gold, and oil. The government plans to accelerate the Agriculture for Economic Transformation Agenda, which is designed to modernize farming systems, increase productivity, and integrate agriculture more closely with industry and exports. This will not only support food security and reduce import dependency but also create jobs, particularly for the youth. Industrialization will also be given renewed attention, with policies aimed at boosting domestic manufacturing, agro-processing, and strategic investments under the 24Hour Economy Policy.

Furthermore, the administration seeks to deepen financial inclusion and expand support for Small and Medium Enterprises (SMEs), which remain the backbone of Ghana’s economic fabric. Access to affordable credit, improved digital infrastructure, and targeted policy incentives will be prioritized to stimulate innovation and business resilience.

Ghana Rising Again

At the start of 2025, Ghana was in intensive care. Today, it is cruising at economic supersonic speed.

GDP growth is at a 5-year high. Inflation is at a 4-year low. Public debt is shrinking. Reserves are rising. The Cedi is flying high. And investor confidence is back.

The story of H1 2025 is not just about economic indicators— it’s about a nation reclaiming its future. It is proof that with decisive leadership, sound policies, and national determination, even the most broken economies can rise again.

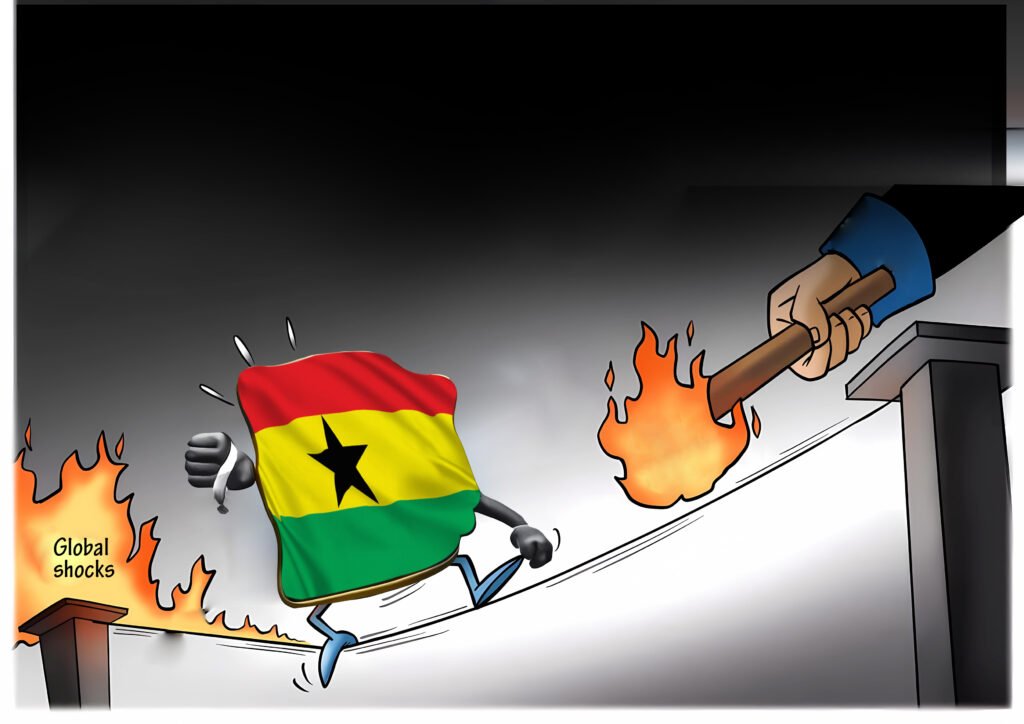

That notwithstanding, sustaining this “supersonic speed” will depend on two key factors: policy consistency and global market conditions. Any commodity price shocks, geopolitical tension, or delays in debt restructuring could undermine hard-won gains.

All in all, Ghana is no longer a cautionary tale— it is a comeback story.

And the second half of the year? Even brighter skies await! Albeit, all things being equal.