In recent months, Ghana’s currency, the Ghanaian Cedi, has experienced a concerning trend of rapid depreciation against major foreign currencies, sparking fears and concerns among citizens and policymakers alike. The depreciation of the cedi not only poses immediate challenges to the economy but also raises broader questions about the country’s fiscal management, economic stability, and prospects for sustainable growth.

The cedi’s depreciation is not an isolated event but rather a symptom of underlying economic vulnerabilities and external factors. One of the primary drivers behind the currency’s decline is the imbalance between foreign exchange supply and demand. Ghana heavily relies on imports for various goods and services, including oil, machinery, and consumer products. However, the country’s export earnings, predominantly from commodities such as gold, cocoa, and oil, have not been sufficient to cover its import bill consistently. This imbalance puts pressure on the cedi, leading to its depreciation against stronger currencies.

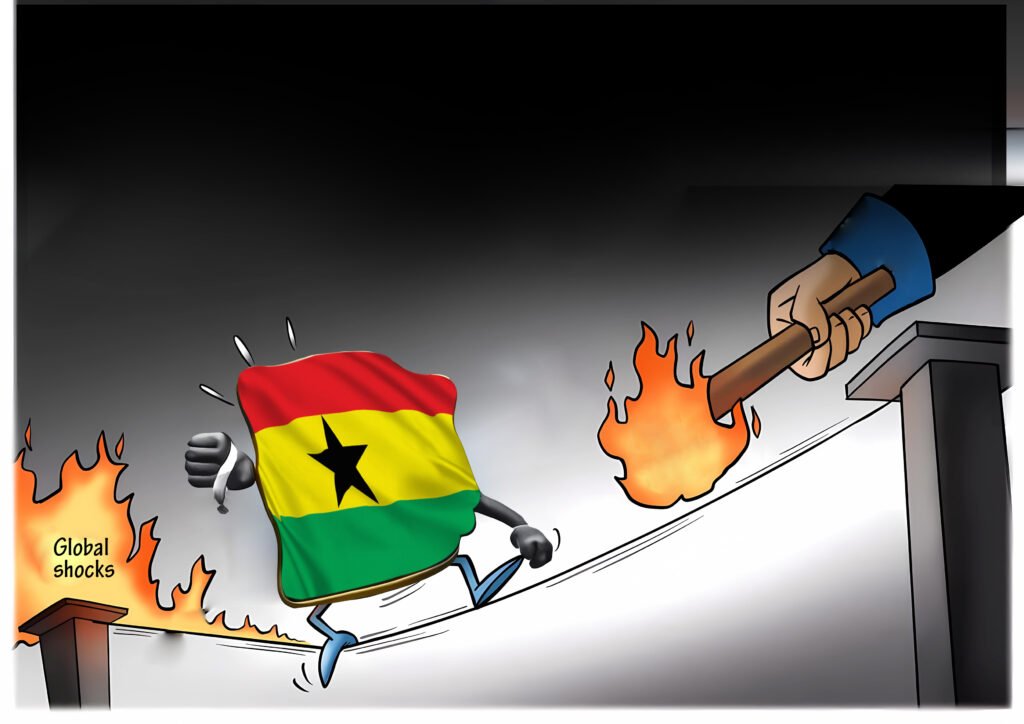

Furthermore, global economic dynamics and external shocks exacerbate the situation. Fluctuations in global commodity prices, particularly oil, gold, and cocoa, directly impact Ghana’s export earnings and, consequently, its foreign exchange reserves. Additionally, uncertainties in global financial markets, geopolitical tensions, and shifts in investor sentiment can trigger capital outflows from emerging markets like Ghana, further weakening the cedi.

The COVID-19 pandemic has also played a significant role in exacerbating Ghana’s currency woes. The pandemic disrupted global trade and supply chains, leading to reduced demand for Ghana’s exports and disruptions in foreign investment inflows. Furthermore, the pandemic-induced economic downturn strained government finances, forcing increased borrowing and leading to concerns about debt sustainability. These factors have heightened investor uncertainty and weakened confidence in the cedi, contributing to its depreciation.

Cascading Effects of the Cedi Depreciation

The consequences of the rapid depreciation of the cedi are far-reaching and multifaceted. One immediate impact is the rise in import costs, which translates into higher prices for imported goods, including fuel, food, and raw materials. This, in turn, fuels inflationary pressures, erodes purchasing power, and reduces the standard of living for ordinary Ghanaians, especially those on fixed in- comes or living below the poverty line.

Businesses also face challenges in planning and budgeting due to currency volatility, which disrupts investment decisions and hampers long-term economic growth. Small and medium enterprises (SMEs) are particularly vulnerable as they often lack the resources to hedge against currency risks or absorb sudden cost increases, leading to closures, layoffs, and economic distress.

Moreover, the depreciation of the cedi undermines investor confidence and can deter foreign direct investment (FDI) and portfolio inflows. Foreign investors may perceive Ghana as a riskier invest- ment destination due to currency instability and concerns about macroeconomic fundamentals. This could result in reduced investment inflows, stalling infrastructure projects, and hindering job creation and economic development.

In response to the currency depreciation and its adverse effects, the Ghanaian government and monetary authorities have implemented various measures to stabilize the cedi and mitigate economic challenges. These measures include interventions in the foreign exchange market, monetary policy adjustments, fiscal reforms, and efforts to diversify the economy away from over reliance on commodities.

However, addressing the root causes of currency depreciation requires comprehensive and sustained efforts to improve the country’s export competitiveness, enhance productivity, attract investment, and strengthen macroeconomic fundamentals. This necessitates structural reforms, investment in infrastructure and human capital, promotion of innovation and entrepreneurship, and prudent fiscal management to reduce reliance on external borrowing.

Cedi, Africa’s Third-Worst Performing Currency

The cedi has become Africa’s third worst performing currency this year as it faces an uphill battle as economic challenges and political uncertainty weigh heavily on the nation’s financial stability. Despite efforts such as securing a $3 billion bailout from the International Monetary Fund (IMF) following a default in 2022, the cedi has already witnessed a significant decline of over 8% against the dollar, and analysts warn that the worst is yet to come.

The IMF bailout provided a temporary reprieve for Ghana, allowing the country to secure workouts with domestic and official creditors. However, negotiations with eurobond investors remain unresolved. Although Ghana’s international reserves saw improvement, reaching a 10-month high of $5.9 billion in December, it is still deemed insufficient to effectively defend the currency against further depreciation.

Ghana’s decision to suspend foreign debt payments helped alleviate some pressure on the cedi, but the upcoming presidential elections scheduled for December present a new set of challenges. Political uncertainty often leads to increased foreign exchange demand pressure due to election-related expenditures. This could exacerbate the weakening of the cedi.

The aftermath of the Covid-19 pandemic and external shocks, such as Russia’s invasion of Ukraine, prompted Ghana to announce a moratorium on its foreign obligations in December 2022. While progress has been made in restructuring domestic bonds and reaching agreements with bilateral lenders, negotiations with eurobond holders, who are owed $13 billion, are still ongoing.

Despite potential improvements in investor sentiment following debt restructuring, political risk looms large. Foreign investors may remain cautious due to uncertainty surrounding the upcoming elections. The dependence of Ghana’s economy, the world’s second largest cocoa producer, on imports further complicates the situation. Increased imports, ranging from everyday goods to heavy machinery, are expected in the lead-up to the election, putting additional pressure on the cedi.

The central bank’s policy priority under the IMF program is to rebuild foreign reserves, indicating a cautious approach to market intervention. While some analysts, including Fitch, forecast further weakening of the cedi, crossing the GHS13 mark against the dollar in the first quarter under- scores the urgency of the situation.

Significant Depreciation in First Quarter of 2024

Meanwhile, the latest data released by the Bank of Ghana (BoG) paints a concerning picture for Ghana’s local currency, the cedi, as it has experienced a notable depreciation against major trading currencies in the first quarter of 2024. According to the BoG’s March 2024 Summary of Economic and Financial Data, the cedi has depreciated by an average of 6.2% against the US dollar, British pound, and euro.

This marks a significant decline from the 22.3% average depreciation recorded in March 2023, indicating ongoing challenges in maintaining the stability of the currency. Specifically, the cedi was pegged at GHS 12.74 to $1 in March 2024, reflecting a year-to-date depreciation rate of 6.8%. The depreciation rates for January, February, and March were 1.3%, 4.7%, and 6.8%, respectively.

Despite the concerning figures, there is a glimmer of hope when comparing year-on-year data. In March 2023, the depreciation rate against the US dollar stood at a staggering 22.1%, significantly higher than the 6.8% recorded in March 2024. Similarly, the cedi saw year-to-date depreciation rates of 6.7% against the pound and 5.2% against the euro in March 2024, compared to 24.3% and 23.6% respectively in March of the previous year.

While the reduced depreciation rates may indicate some progress in stabilizing the currency, it is clear that challenges persist. The volatility of global markets, coupled with domestic economic factors, continues to exert pressure on the cedi. Addressing these challenges will require a comprehensive approach that tackles both short-term currency fluctuations and long-term structural issues within the economy.

Moreover, the implications of currency depreciation extend beyond the financial sector, impacting various aspects of the economy, including inflation, consumer purchasing power, and external trade. As such, it is imperative for policy makers to implement measures aimed at bolstering the resilience of the cedi and fostering sustainable economic growth.

Ghana’s Economic Outlook for 2024

While projections by the International Monetary Fund (IMF) and the Bank of Ghana suggest a positive trajectory, the outlook for 2024 presents a mix of optimism and caution with various factors posing challenges that warrant close attention.

Inflation remains a key concern on the economic terrain. The IMF projects Ghana’s exit inflation for 2024 at 15.0%, in line with the government’s budget target. The Bank of Ghana’s projection, ranging from 13.0% to 17.0%, highlights the uncertainty surrounding this metric. These projections hinge on ongoing government reforms and adherence to the IMF program. However, risks loom large, particularly with the impending election cycle, historically associated with fiscal slippages.

Global fuel and food prices, influenced by geopolitical concerns, pose additional challenges to inflation management. Utility tariff hikes further exacerbate these pressures, potentially impeding the desired downward trend in inflation. Such factors necessitate a vigilant approach to economic policy and fiscal management to mitigate their adverse effects.

Despite these challenges, Ghana aims for economic growth in 2024, with a target of 2.8%, a modest improvement from the preceding year. However, uncertainties surrounding the upcoming elections and cautious monetary policy by the Bank of Ghana may temper this growth trajectory. The central bank’s reluctance to significantly lower the policy rate could result in a gradual decline in domestic interest rates, affecting investment dynamics.

Election-related policy uncertainty and ongoing discussions on external debt restructuring present additional risks to the investment climate. The potential impact on long-term capital deployment underscores the need for stability and clarity in economic policymaking. Moreover, the passage of the Emissions Levy Bill, with its potential repercussions on transport fares and consumer spending, adds another layer of complexity to the economy.