Growth firmed up in Sub-Saharan Africa (SSA) at the start of 2017, overshooting analysts’ expectations. According to a preliminary estimate, regional GDP grew 2.1% annually in Q1, above Q4 2016’s 1.3% expansion. If confirmed, this will mark the fastest growth since Q4 2015 and suggests that green shoots are emerging in some battered economies that are beginning to recover from a dismal 2016. Overall, however, regional growth is still meagre in a historical context as many economies are suffering from worsening economic imbalances.

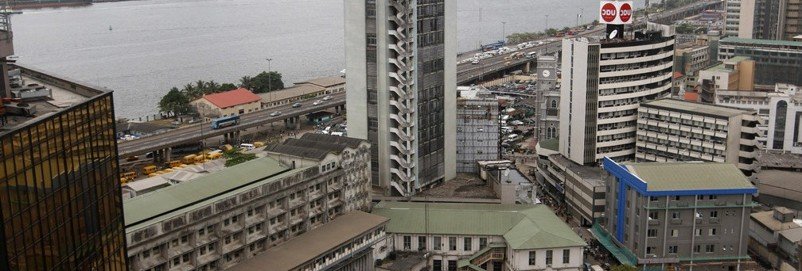

Behind Q1’s result was a fifth consecutive quarter of contraction in Nigeria’s economy, as the oil sector continued to hold back growth. Security concerns stemming from militant attacks in the key oil-producing Niger Delta region have devastated oil production and the effects have rippled through the economy. However, the GDP contraction was the softest since Q4 2015 and the non-oil sector returned to growth in Q1.

Growth in South Africa picked up marginally in Q1, but was feeble all-in-all and the economy entered into a technical recession on a quarterly basis. The external sector failed to contribute to growth despite a better global backdrop and government spending was muted due to fiscal constraints. In fact, South Africa has been in the spotlight in recent weeks, as downbeat news continues to emerge from the second-largest economy in SSA. Business confidence fell to a multi-year low in the second quarter, after an abrupt cabinet reshuffle increased political uncertainty. Moreover, the economy’s credit rating was recently downgraded by Moody’s and the important mining industry is threatening legal action over recent changes to legislation. The government recently unveiled a new mining charter, which lifts the black ownership requirement to 30% and is toughly opposed by mining companies in the country. Against this backdrop, analysts see the South African economy decelerating slightly in Q2, but expect regional GDP to pick-up to a 2.5% expansion.

Elsewhere in the region, growth accelerated in Cote d’Ivoire and in Mozambique. Activity strengthened in Mozambique thanks to a better performance by the mining sector; however, the country’s economic panorama is still bleak due to strained government finances and a high debt burden. GDP figures for Q1 are still outstanding for the remaining economies in the region.

Analysts trimmed their forecasts for Sub- Saharan Africa this month and now see regional GDP expanding 2.6% in 2017, down 0.1 percentage points from last month’s estimate. While the region is seen slowly picking up from a dreadful 2016, fiscal constraints, political uncertainty and weak investor sentiment will keep the pace of recovery subdued. In 2018, growth is seen gaining pace as GDP is expected to increase 3.5%.

The downgraded 2017 outlook is due to downward revisions for the majority of the region’s economies. Lower growth prospects were seen for seven economies including Kenya, Nigeria and South Africa. Ethiopia, Mozambique and Zambia were the only countries to see their forecasts lifted, while three economies’ projections were left unchanged.

Cote d’Ivoire and Ethiopia are expected to be the fastest-growing economies this year, both expanding 7.0%. On the flip side, the regional heavy-weights are the poorest performers with South Africa expected to grow a weak 0.9% in 2017, followed by Nigeria with a 1.2% expansion.

Focus on some African Countries TANZANIA | Solid growth trajectory but…

The economy remains in good shape but is likely slowing somewhat as clouds are gathering over the banking sector. The current account deficit narrowed considerably in annual terms for the twelve months through April and public debt rose in the same period in order to finance the government budget. The administration is loosening its purse strings in an effort to cushion the slowdown and fund infrastructure investment, which was one of the main drivers of growth last year. In a bid to contrast the sharp rise in non-performing loans, the Central Bank announced new rules in early June aimed at strengthening commercial banks’ capital buffers and reducing the ratio of bad loans.

Growth should remain solid this year, benefiting from the implementation of major infrastructure projects, a strengthening global economy and increased power supply. Nevertheless, a further deterioration in the banking system and difficulties in financing the high fiscal deficit pose downside risks. Our panel expects GDP to expand 6.6% in 2017, down 0.4 percentage points from last month, and 6.8% in 2018.

Cote d’Ivoire| Fastest paces due to resilient dynamics in the services sector

In the aftermath of some months’ short-lived mutiny, which ended in mid-May when troops began receiving their agreed-upon bonuses, the government will now face the reality of an even wider fiscal deficit. Aggravated by the collapse in cocoa prices, the yawning budget shortfall projected for this year was partially addressed in June with two Eurobond issues at a combined value of USD 1.8 billion. The debt offering was oversubscribed by nearly four times, illustrating investors’ confidence in the country’s fundamentals over the long term. To combat low cocoa prices, national regulators began collaborating with their counterparts in Ghana in early June in order to manage prices on the international market.

Although the economy has been shaken by crises this year, it is still expected to grow at one of the fastest paces in the region in 2017 due to resilient dynamics in the services sector. That said, lower cocoa prices will take their toll on growth. Our panelists expect growth to fall to 7.0% in 2017, which is down 0.6 percentage points from last month’s forecast, and to edge up to 7.2% in 2018.

ANGOLA | Low oil prices hit public purse strings

The economy is still keeled over, following a rough 2016 which saw growth plummet due to low oil prices and a weak construction sector. Although the recently announced extension to the OPEC deal is in principle good news for the all-important hydrocarbon sector, the price of the country’s Cabinda oil has actually fallen over the last few weeks. It now rests substantially below breakeven level, which spells bad news for a fiscal position which could be weakened further by expenditure overruns in the build up to August’s presidential elections. In addition, despite increasing relative to Q4, the economic climate indicator for Q1 shows that business sentiment remains in the doldrums, with many firms citing woes such as subdued demand and limited access to credit and materials. The latter is likely due in part to foreign exchange restrictions curtailing imported inputs.

Growth will be meagre this year due to low business confidence and a non-oil sector still hampered by limited access to foreign exchange and high inflation. Looking further ahead, moderately higher oil production should cause growth to tick up slightly. Analysts expect GDP to expand 1.5% in 2017, unchanged from last month’s forecast. In 2018, they see the economy picking up the pace and growing 2.5%.

KENYA | Election set to take place against a backdrop of economic decline

Last month brought sobering news to Kenyan policymakers: IMF data revealed that Ethiopia overtook Kenya as the region’s largest economy and it risks being overtaken for second place by Tanzania very soon. The finding highlighted the effect several years of sub-par economic performance has had on the country’s standing as a regional power. The news comes as the country grapples with drought-induced high inflation, which the government is seeking to allay by passing a supplementary budget foreseeing large food subsidies. It is currently being held up due to large supplementary spending items being attached to the bill. The tenuous situation comes as the country heads to the polls in early August to elect its new president and Parliament. The political battle lines have been drawn, with opposition parties uniting behind a single candidate, mirroring a similar alliance struck between the governing party and its allies in September last year.

GDP growth is expected to suffer somewhat this year due to the interest cap introduced late last year and the dire situation in the agricultural sector. In addition, political uncertainty around the August presidential election could dampen business sentiment and delay investment decisions. Panellists now expect GDP growth to slow down to 5.2% in 2017, which is down 0.1 percentage points from last month’s forecast, before picking up slightly to 5.6% growth in 2018.

INFLATION | Price pressures fall in May

Inflation fell for a third consecutive month in May, easing from April’s 13.9% to 13.3%, according to preliminary data compiled by analysts. Despite reduced price pressures, inflation is still elevated in many economies across the region and policymakers have little space to loosen monetary policy. In May, both Angola and Nigeria’s Central Bank’s held their main monetary policy rates unchanged.

Inflation will remain stubbornly high this year despite stabilization in exchange rates and tight monetary policies. The analysts surveyed this month expect regional inflation to average 12.4% in 2017, which is up 0.4 percentage points from last month’s forecast and above 2016’s 12.3%. Next year, inflationary pressures should begin to recede and inflation is projected to average 9.5% in 2018.