In an era where economic stability is often held hostage by shifting political agendas, the role of an independent central bank cannot be overstated. For Ghana, the autonomy of the Bank of Ghana represents not just a bureaucratic arrangement but a strategic shield against short-term political pressures that threaten long-term financial health.

As the monetary authority entrusted with managing inflation, stabilizing the national currency, and overseeing the financial system, the Bank of Ghana’s independence has become a cornerstone of economic credibility.

Dr. Richmond Akwasi Atuahene, a seasoned banker and renowned financial consultant, offers a compelling perspective on the independence of the Bank of Ghana. With decades of experience in Ghana’s banking sector and deep insight into monetary policy, Dr. Atuahene critically underscores the central bank’s autonomy in navigating political pressures and delivering economic stability.

According to him, the idea of insulating central banks from political interference gained momentum globally in the late 20th century, and Ghana has not been left behind. Today, the Bank of Ghana operates with some degrees of autonomy that allows it to make crucial decisions—such as setting interest rates and regulating financial institutions—based on sound economic data rather than electoral timelines. This separation of monetary policy from political decision-making is essential in preventing inflationary tendencies and building investor confidence.

So, the power of the Bank of Ghana lies not in grand political speeches or sweeping reforms, but in its quiet consistency. It is the silent architect of Ghana’s monetary stability, working behind the scenes to balance competing demands in a dynamic economic environment.

Central bank independence means the central bank is responsible for maintaining price stability and managing the financial system [and] can make decisions without undue interference from politicians or other government entities. Central bank independence is crucial because it allows central banks to focus on long-term economic stability, like controlling inflation, without political interference, leading to more credible and effective monetary policy. Independent central banks are better equipped to manage inflation by setting monetary policy based on economic fundamentals rather than political expediency.”

Dr. Richmond Akwasi Atuahene emphasized that central bank independence is crucial for fostering confidence in monetary policy and ensuring long-term economic stability. He explained that an independent central bank, free from political interference, is better positioned to pursue price stability and sustainable growth, even if it requires taking unpopular short-term measures.

Independence enhances credibility by signaling a commitment to sound monetary policy and protecting the central bank from pressures to adopt politically expedient policies. He noted that true independence involves both political and operational autonomy—where the bank controls its own budget, safeguarded from legislative tampering, and led by officials with secure, renewable terms.

Historical Antecedents of Bank of Ghana’s Independence

Dr. Richmond Akwasi Atuahene highlighted the evolving trajectory of the Bank of Ghana’s independence, noting that the original Bank of Ghana Ordinance of 1957 granted the central bank both statutory and operational autonomy. However, this independence was significantly curtailed with the passage of the Bank of Ghana Act 1963 (Act 182), which subjected the bank to direct government influence for nearly four decades.

The Bank of Ghana Act 1963 Act 182 further empowered the Bank of Ghana to support direct lending to priority sectors of the Ghanaian economy and set ceilings on advance or investments by commercial banks. This policy was driven by the belief that the market imperfections and nature of the colonial financial system could support the desired pattern and level of investment without government intervention.”

A turning point came with the adoption of the 1992 Constitution, which reinstated the bank’s operational independence, and was further solidified by the landmark Bank of Ghana Act 2002 (Act 612). This legislation not only reaffirmed the Bank’s autonomy but also constitutionally anchored its role, ensuring it could carry out its monetary policy mandate free from political interference.

For nearly forty years, various governments interfered in the operations of Bank of Ghana and it was characterized by huge fiscal dominance, [which led to] economic crisis of 2000. The Parliament in 2002 passed the Bank of Ghana Act 2002 Act 612 which once again enshrined into law the operational independence of the Bank of Ghana. The independence of the Bank of Ghana under the Bank of Ghana Act also provided the Bank with the freedom to pursue policies in the interest of the financial sector without having to wait on approval from the Government or any other authority.”

Besides, Dr. Richmond Akwasi Atuahene noted that over the past two decades, many countries—especially in transition and developing economies—have reformed their central bank laws to enhance monetary policy independence. This shift was largely driven by concerns that politically dependent central banks are vulnerable to short-term electoral pressures, which often lead to inflationary policies.

According to him, two key factors accelerated this trend: the conditionality imposed by international financial institutions like the IMF and World Bank, which required greater central bank autonomy for loan access; and the structural requirements for European Union accession, which mandated that national central banks align with the independence model of the European Central Bank.

Furthermore, in the recent years there has been an accelerated movement towards granting more legal authority to the central banks; first due to successes of highly independent of the German’s Bundesbank and Swiss National Bank in maintaining price stability and second, inflationary experiences of the 1970s that were attributed to the governments’ excessive borrowing from the central banks which caused the expansionary monetary policies.”

Monopoly on National Currency Issuance Mandates Independence

One of the most fundamental responsibilities of a central bank is its exclusive authority to issue the national currency, which serves as the legal tender within a country. This monopoly is not just a technical function but a reflection of the central bank’s pivotal role in maintaining monetary stability, controlling inflation, and ensuring economic sovereignty. According to Dr. Atuahene, this power underscores the broader concept of central bank’s independence, which refers to the degree to which the institution can operate free from political interference, particularly from elected officials whose interests may lean towards short-term electoral gains rather than long-term economic stability.

Dr. Atuahene averred that the monopoly on currency issuance grants central banks control over the money supply—a critical lever in implementing effective monetary policy. This function allows central banks to respond to macroeconomic conditions by adjusting the quantity of money in circulation to target inflation and stimulate or cool economic activity. When central banks are independent, their control over currency issuance becomes a tool for maintaining credibility in monetary policy. This credibility reassures financial markets, investors, and the general public that decisions about the money supply are based on sound economic principles, rather than the shifting priorities of political leadership.

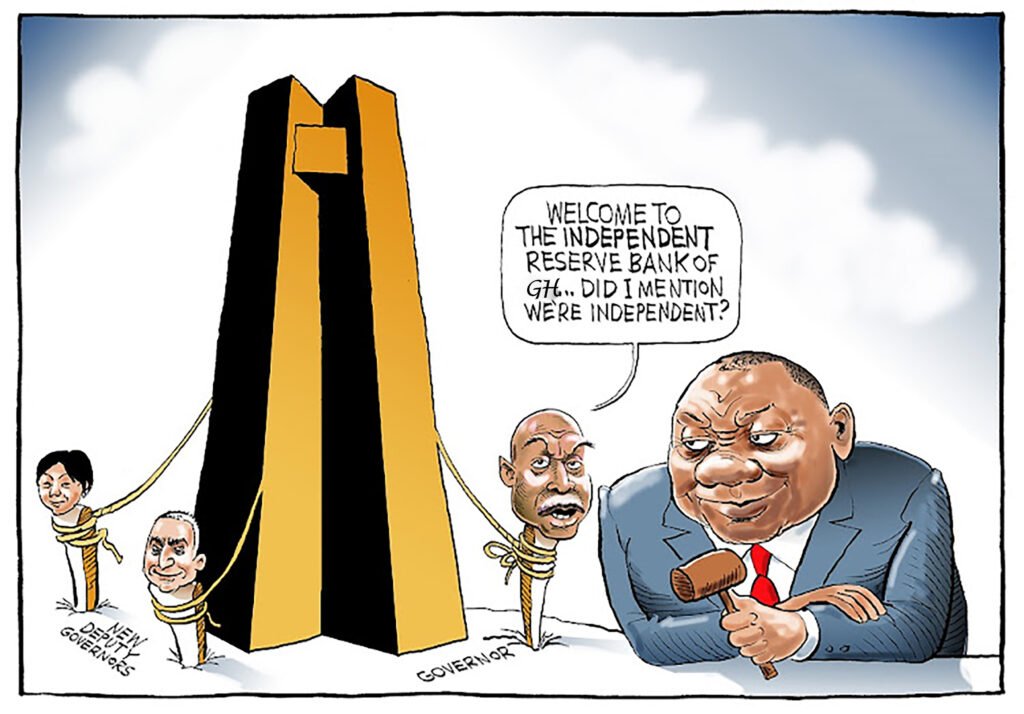

the new Governor of Bank of Ghana, Dr. Johnson Pandit Asiama

Historically, in many developing economies including Ghana, this independence was not always present. Dr. Atuahene explained that until the 1970s, the prevailing belief was that both fiscal and monetary policy should be firmly under government control. The idea of allowing unelected officials to wield such a powerful tool as monetary policy was considered undemocratic by some. However, this mindset changed significantly in the last few decades as the international community—including institutions like the International Monetary Fund (IMF) and the World Bank—began to recognize the importance of insulating central banks from political pressure. Therefore, these institutions made central bank independence a condition for financial assistance, encouraging countries to adopt reforms that granted central banks both statutory and operational autonomy.

The rationale behind such reforms lies in preventing governments from exploiting the short-run trade-off between inflation and unemployment, as predicted by the Phillips Curve. Politically dependent central banks are often tempted to finance government deficits by printing more money, which may reduce unemployment in the short term but fuels inflation in the long run. Such practices diminish the credibility of the monetary authority and result in what economists describe as an “inflationary bias.” However, according to Dr. Atuahene, independent central banks are to counter this bias by prioritizing price stability over short-term political gains, even if it requires taking unpopular economic decisions.

Economists Kenneth Rogoff and Carl Walsh proposed solutions to manage this tension. Rogoff advocated for delegating monetary policy to a conservative and independent central bank, which would be less susceptible to inflationary pressures; while Walsh suggested the use of incentive-based contracts for central bankers that align their performance with broader social welfare goals. Both approaches converge on the necessity of central bank independence as a safeguard against political misuse of monetary tools—especially the power to issue currency.

In practice, the monopoly on currency issuance gives central banks control over the instruments of monetary policy, such as open market operations, reserve requirements, and interest rates. While governments may set inflation targets or broad economic goals, it is the central bank that determines the tools and strategies to achieve them. This division of responsibility—goals defined by government, instruments controlled by central bank—is a cornerstone of effective economic management.

Absence of Strong Institutional Safeguards Hampers Independence

Dr. Atuahene’s insights on central bank’s independence highlight a troubling paradox within many developing countries including Ghana: while laws may grant central banks formal autonomy, the absence of strong institutional safeguards exposes them to the ever-present threat of political interference. Nowhere is this more evident than in the dichotomy between legal independence and actual independence, where a central bank appears independent on paper but in practice, beholden to the political class.

“Legal independence merely refers to the measure of central bank’s independence based on the interpretation of laws,” Dr. Atuahene revealed. He underscored that despite constitutions or Central Bank Acts that legally enshrine independence—such as provisions allowing central banks to appoint their own staff and control their budgets—these frameworks often fail to materialize in actual practice. This discrepancy is especially pronounced in developing economies where “Central Bank Acts do not always clearly indicate the separation of powers between the government and central bank.”

In essence, a central bank may hold legal independence but lacks institutional independence, which Dr. Atuahene describes as crucial for shielding monetary authorities from political whims. Institutional independence involves the central bank existing as an entity outside the executive and legislative arms of government. “A central bank or agency which forms part of the executive branch… typically lacks institutional independence,” he clarified.

To guard against undue influence, institutional safeguards must address three core areas: personal independence, governance structure, and transparency. Personal independence requires “clear rules for hiring and firing of senior management staff based on the agency’s competencies, skills, and probity.” More importantly, central bank governors should enjoy security of tenure, allowing them to act without fear of dismissal by politicians.

Dr. Atuahene further advocates for governance structures that outlast political cycles. “A longer tenure of the board of directors should be more than the government of the day… to strengthen the governance structure of the bank,” he suggested, citing the example of the U.S. Federal Reserve whose board members serve seven-year terms. However, he stressed the importance of staffing the boards with experts—such as retired economists and financial regulators—rather than political appointees or representatives of finance ministries, who may carry partisan biases.

Transparency, according to Dr. Atuahene, is another vital institutional safeguard. Although central banks must protect commercially sensitive information, he argued for a presumption of openness in decision-making. “Making it possible for both the public and the industry to scrutinize regulatory decisions” minimizes the risk of hidden political agendas influencing monetary policy.

Without these institutional pillars, legal independence can be dangerously hollow. The central bank, though ostensibly autonomous, may be rendered impotent in the face of inflationary pressures driven by political motives—such as election-year spending or debt monetization. Worse still, Dr. Atuahene warned that the government may “shift responsibility for inflationary outcomes to the central bank based on legal independence,” weaponizing the illusion of autonomy for political cover.

This risk is further compounded when central bank lacks goal and functional independence—the ability to set policy goals and employ tools without political meddling. Goal independence, for instance, allows institutions like the U.S. Federal Reserve to determine their own objectives, including inflation and employment, free from executive dictate. However, in countries like the UK or South Africa, government-determined inflation targets constrain goal autonomy. Similarly, functional independence, which gives the bank full control over instruments like interest rates, is undermined when governments compel central banks to finance deficits—eroding monetary control and exacerbating inflation.

Financial Autonomy, Key to Independence

Financial independence is a cornerstone of central bank autonomy. For the Bank of Ghana (BoG), this principle ensures that it can efficiently pursue its monetary policy objectives—particularly price stability—without undue influence or financial dependence on the government. As Dr. Atuahene defines it, “Financial independence is the ability of the central bank to attain its objectives efficiently without financial assistance from the government.” This autonomy is vital in safeguarding the integrity and effectiveness of the BoG’s regulatory and monetary roles.

In practice, financial independence implies that the central bank has a strong income position, granting it the necessary means to operate effectively. This includes determining its own budget, staffing, salaries, and internal operations without external manipulation.

The concept of financial independence should therefore be assessed from the perspective of whether any third party is able to exercise either direct or indirect influence not only over central bank tasks but also over its ability (understood both operationally, in terms of manpower and financially, in terms of appropriate financial resources) to fulfil its mandate.”

According to him, there are four essential aspects of financial independence: the right and ability to determine its own budget; the application of central bank-specific accounting rules; clear provisions on the distribution of profits; and clearly defined financial liability for supervisory authorities.

The Banking Consultant stated that central banks that control their financial resources can better resist political interference and respond swiftly to emerging policy needs, including inflation targeting and regulatory reforms. This autonomy also allows for competitive salaries, helping the Bank to attract skilled and experienced professionals essential to maintaining financial stability.

However, Dr. Atuahene claimed that “Central banks whose budgets are determined by the government or any other authority could lead to dependence on the industry… and possibly lead to industry capture”. This concern is particularly significant in contexts where the Ministry of Finance or other government bodies exercise financial oversight of central bank operations.

He also disclosed that “Funding through governments can be abused by the [government] to organize other types of interference such as forbearance.” In some instances, central banks funding via levies on regulated institutions may also face risks if those levies are not well-structured, as this can create an indirect form of dependency. Dr. Atuahene acknowledged the value of fund-based funding for its potential to avoid political interference but warned that “unless the levies are properly structured, it may produce a sense of budgetary dependency on the industry that could undermine the agency’s autonomy in other ways.”

Furthermore, the financial independence of the BoG is closely tied to regulatory and supervisory independence. Dr. Atuahene highlighted the importance of these dimensions, noting that regulatory autonomy allows the central bank to set rules for the financial sector without external pressure. However, he acknowledged that “prudential supervision is a matter where political interests are typically strong,” especially in contexts where public funds are used to support failing institutions.

He also pointed to concerning evidence of political interference weakening BoG’s regulatory independence. “There is empirical evidence that there is political interference in Bank of Ghana which is weakening regulatory and supervisory arrangements,” he emphasized. Furthermore, industry capture becomes particularly problematic when politically exposed persons own financial institutions, leading to “a disguised form of political capture.”

Dimensions of Bank of Ghana’s Independence

According to Dr. Atuahene, BoG’s autonomy can be examined across four critical dimensions: operational, functional, personnel, and budgetary independence. These facets are interlinked and collectively uphold the Bank’s mandate of maintaining price stability and supporting Ghana’s economic development.

First, operational independence refers to the Bank’s ability to implement monetary policy and manage its operations without undue political interference. Dr. Atuahene explained that Operational Independence allows the central bank to autonomously decide on interest rates, money supply, and exchange rate strategies—essential tools for maintaining macroeconomic stability. He noted that operational independence also encompasses goal autonomy, which is the freedom to set policy objectives such as inflation targets and exchange rate stability.

In addition, setting common goals by the central bank and the government encourages coordination between monetary and fiscal authorities like the Ministry of Finance. Under the goal independence, the Bank of Ghana has the right to set its own policy goals, whether inflation targeting, control of money supply, or maintaining a managed floating exchange rate.”

Dr. Atuahene further emphasized that the joint announcement of policy goals by BoG and the Ministry of Finance increase transparency and strengthens the credibility of monetary policy. Under the Bank of Ghana Act 2002 (Act 612), as amended in 2016 (Act 918), the BoG has the operational freedom to license and supervise banks, conduct on-site and off-site examinations, and enforce regulations based on legal evidence, ensuring that its regulatory authority remains untainted by political pressure.

Also, Dr. Atuahene identifies Functional Independence, also known as instrument independence, as a vital dimension. He noted that this has to do with BoG’s discretion in choosing and applying monetary policy instruments to achieve its stated goals.

The Bank of Ghana Act 2002 Act 612 has given Bank of Ghana functional independence to determine the best way of achieving policy goals, including the types of instruments used and the timing of their use.”

This includes tools such as treasury bills, open market operations, and adjustments to the repurchase agreement rate. While the Act grants BoG this freedom, it also permits the Minister of Finance to exert influence over monetary implementation. This duality, Dr. Atuahene believes, introduces conflict and recommended legislative reforms to ensure true instrument independence.

The third dimension he espoused is Personnel Independence, which protects BoG’s leadership from political interference. This includes the appointment, tenure, and dismissal of key personnel such as the Governor and Deputy Governors.

The Governor and two deputies are to be appointed by the President of Ghana through a transparent and competitive process and with the approval of the Council of State to hold office for a term of 4 years and eligible for another term of four years.”

These safeguards are enshrined in the 1992 Constitution and the Bank of Ghana Act. However, in practice, successive governments have occasionally undermined these provisions, often forcing resignations of governors appointed by previous regimes. Despite the constitutional clause stating that a Governor can only be removed under the same conditions as a Justice of the Superior Court, political influence remains a challenge.

Notwithstanding, BoG maintains internal autonomy in appointing staff and managing its operations, which helps insulate the institution from excessive external control.

Finally, Budgetary Independence ensures that the Bank of Ghana has the financial resources and autonomy necessary to function effectively. As outlined in the Bank of Ghana Act and the Constitution, BoG has the right to determine its own budget. “Bank of Ghana’s budget independence ensures that it has right to determine its own budget over the years without government interference,” Dr. Atuahene emphasized.

Budgetary independence is crucial for safeguarding BoG’s ability to perform its monetary policy functions without compromise. A central bank with constrained finances may find its policy decisions influenced by fiscal authorities. Adequate capital, retained earnings, and well-defined profit distribution-rules ensure that BoG remains focused on its core objective—price stability. While BoG is government-owned, its financial independence is essential in maintaining its credibility and shielding it from political manipulation.

Policies to Strengthen BoG’s Independence

Remedying the situation, Dr. Richmond Atuahene has proposed urgent constitutional reforms to protect the personnel independence of the Bank of Ghana. Chief among his recommendations is the need to lengthen the term of office for the Governor, Deputy Governors, and board members beyond the current four years.

…Their terms should be longer than that of parliamentarians, and staggered to avoid the simultaneous replacement of all officers by a new government, which would create uncertainty as to the consistency of monetary policy. Bank of Ghana could be legally more independent if the governor and two deputy governors’ term in office is longer than the political cycle of 4years; the appointment and dismissal procedures are more insulated from the government; the mandate is more focused on price stability; the formulation of monetary policy lies squarely with the central bank; and the provisions on direct central bank lending are restrictive.

“The central bank where the Governor and two Deputies are not appointed by the ruling government with the term of 5 years and non-independent directors, also not appointed by the ruling government with 5-year term, renewable for another 5 years, could enhance the independence of Bank of Ghana.”

Dr. Atuahene drew lessons from countries such as South Africa, Uganda, the UK, and the U.S., where central bank governors are appointed for minimum five-year terms and eligible for reappointment. For instance, he referenced that in the UK, the Governor of the Bank of England is appointed under the Bank of England Act 1998 for five years, with a maximum of two terms, providing up to ten years of service.

His second recommendation calls for amending Ghana’s 1992 Constitution to ensure transparency in the recruitment process. He suggested involving the Public Service Commission, as done in the UK, rather than the current internal promotions from the Bank’s research department.

Thirdly, Dr. Atuahene called for a joint decision-making process between the Presidency and Parliament on the appointment of the Governor and deputies. He proposed amending Article 183 of the Constitution and Section 11(a) of Act 918 to extend their tenures from four to five to seven years. Furthermore, the constitutional and statutory frameworks must be updated to reflect the inflation targeting regime adopted in 2007; referencing economic growth as a central objective is inconsistent with inflation targeting.

Finally, he urged strict adherence to the Bank of Ghana Act and the reinstatement of the Fiscal Responsibility Act to prevent monetization of deficits. This, he believes, is vital to ensuring the Bank’s autonomy in achieving price stability.

While the silent power of an independent Bank of Ghana holds immense potential for stabilizing the economy and safeguarding monetary policy from short-term political pressures, significant challenges remain in its realization—challenges that are not unique to Ghana but common across many emerging economies. Political interference, weak institutional capacity, and a lack of transparency continue to undermine the effectiveness of central bank’s independence.

Governments may exert pressure on central banks to adopt policies such as lowering interest rates or printing more money to meet short-term political objectives, even at the expense of long-term economic stability. Furthermore, the absence of transparent operations makes it difficult to assess the true level of independence, while limited institutional capacity hampers the implementation of robust monetary frameworks. Addressing these challenges is essential to reinforcing the Bank of Ghana’s independence and ensuring its ability to fulfill its primary mandate of maintaining price stability.