The final quarter of 2016 ended with the GSE-Composite Index closing the year at 1,689.09 points, with a resultant year-to-date return of – 15.33%, and 4.83% on quarter- on-quarter basis. The market had initially clawed back 2.76% of its value by August 31, however, continued decline on the prices of heavily weighted financial stocks led to a net decline in the index by the close of the 4th quarter.

The market capitalization at the end of the year was GHS52.69 billion (USD12.55billion), down 7.75% year-on-year, from GHS57.12billion (USD15.50billion). The downward trend in the index can largely be attributed to continued decline in the share prices of 62% of the listed companies.The GSE Financial Stock Index closed the year at 1,545.41 points, down 19.93% year-to-date. Barring the fourth quarter listings of Access Bank Ltd (ABG) and Agricultural Development Bank (ADB), which recorded price appreciation at the end of the year, all constituents of the GSE Financial Stock Index would have ended the year in the red. Very few banks saw positive year-on-year growth in the 3rd quarter, as banks struggled to improve their asset quality towards the end of the year. Uncertainty concerning non-performing loans and Ghana’s election were seemingly priced in.

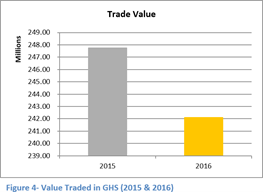

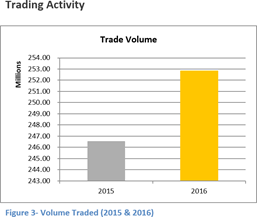

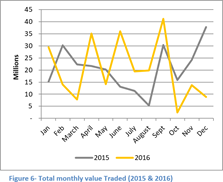

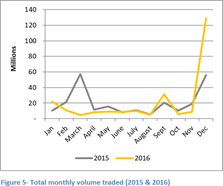

The stock market remained a buyers’ market through till the end of the year. Demand was observed in stocks such as Fanmilk Ltd (FML) and GCB Bank (GCB) in the 3rd quarter, but was quelled going into the final quarter of 2016. High yielding Government securities and even higher yielding risk-adjusted fixed deposit instruments remained the preferred assets for investors. Relative to the previous year, trade volumes remained relatively low through till November. The month of December saw a spike in the volume traded. The total volume traded in the 4th quarter was 143.43 million, 68% more than the volume recorded over the same period last year. However the total volume for the year was only 2.56% more than the previous year. The rollercoaster- like trend in monthly traded values continued through till the end of the year. 2016 recorded a total trade value of GHS242.12 million, 2.28% less than the total value traded in 2015.

The stock market remained a buyers’ market through till the end of the year. Demand was observed in stocks such as Fanmilk Ltd (FML) and GCB Bank (GCB) in the 3rd quarter, but was quelled going into the final quarter of 2016. High yielding Government securities and even higher yielding risk-adjusted fixed deposit instruments remained the preferred assets for investors. Relative to the previous year, trade volumes remained relatively low through till November. The month of December saw a spike in the volume traded. The total volume traded in the 4th quarter was 143.43 million, 68% more than the volume recorded over the same period last year. However the total volume for the year was only 2.56% more than the previous year. The rollercoaster- like trend in monthly traded values continued through till the end of the year. 2016 recorded a total trade value of GHS242.12 million, 2.28% less than the total value traded in 2015.

Ayrton Drugs Limited emerged as the most dominant equity, in terms of traded volume, for 2016. Three names are repeated year- on-year, in the top five equities with the highest volumes; CAL Bank (CAL), Ecobank Transnational Incorporated (ETI) and UT Bank (UTB).

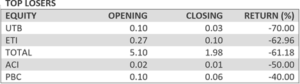

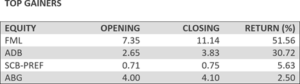

FML stayed top of the leaders through the 3rd quarter to the close of 2016, with a return of 51.56%. Other top gainers included newly- listed banks, ADB and ABG with respective returns of 30.72% and 2.50%. The Pan African banking giant, ETI, lost more value towards the end of the year with a return of -62.96%. Only UT Bank (UTB) recorded lower returns for 2016. The indigenous Ghanaian bank lost 70% of its value in 2016. Total Petroleum Ghana Ltd (TOTAL) shed 61.18% of its value to close the year at GHS1.98 from GHS5.10. PBC Limited (PBC) inched up a pesewa from GHS0.05 (Aug 31, 2016) to end the year at GHS0.06.

The number of gainers decreased from six stocks in August 2016 to four by year- end. The number of stocks that lost value remained at twenty-three from August through to December 2016. Eleven stocks had their share prices unchanged at the end of the year.

OUTLOOK FOR THE COMING QUARTER

The Ghanaian economy may yet be on the road to recovery. The yields on money market government securities have seen steady declines in the last quarter of 2016. This follows the issuance of a 10-Year Government of Ghana bond at 19%.

The inflation rate declined to 15.5% in November 2016, from 17.7% in December 2015. The inflation rate is expected to continue trending downwards and the Bank of Ghana maintains its 2017 inflation target of 8% (±2%). With inflation trending downwards, the Monetary Policy Committee of the Central Bank reduced its rate to 25.5%. It is expected that the Central Bank will ease its tight monetary stance in the next quarter, if inflation rate continues downwards.

It is also expected that listed companies, particularly the banks, will post relatively weaker performance y/y in their 2016 annual reports. This would result in an initial decline in the general market performance in the first quarter. However, with the uncertainty from the election behind us, and economic indicators pointing to a recovery, It is expected that the demand for high yielding government securities and higher yielding fixed income instruments, will quell in favor of longer dated securities (bonds and stocks).