The difference between great and poor customer service has always been clear, and businesses on the wrong end of this spectrum usually pay a price. This is as true for insurance as it is for any other customer-facing business. Today, the consequences of subpar service are amplified by the speed and reach of social media. One poorly handled claim, one mistake captured on a smart phone, can escalate quickly into a brand-damaging crisis. This is just one reason firms across all industries should increase their focus on providing great customer experience.

Providing a strong customer experience is not just about reducing the risk of customer service mishaps. It is increasingly a way for companies in competitive markets to distinguish their brands. The airline industry is a good point of comparison with insurance. Both are highly regulated and highly competitive, and carriers in both industries find it increasingly difficult to differentiate their products without lowering prices.

ON THE PATH TO PROFITABLE GROWTH

Delivering a superior customer experience takes more than developing a mobile app or adding call centre staff. It requires significant investments, relentless improvements, and collaboration across customer channels and business functions, from distribution and underwriting to claims handling.

Many insurers look at each customer touchpoint, from visiting the website to calling an agent, as a discrete event. But customers see those events as steps in a single journey to meet an important need, such as protecting themselves and their families or recovering from an accident.

Improving customer satisfaction can be an engine of profitable growth, but it demands a common vision and new levels of coordination across historically strong organizational silos. Establishing cross-functional, multichannel customer experiences should be a CEO and boardlevel priority.

In this context, digital tools are unlocking new opportunities for insurers. For example, since more than 80 percent of shoppers now touch a digital channel at least once throughout their shopping journey, carriers can find new ways to engage customers efficiently and effectively with personalized messages, and improve speed, service, and

consistency to raise satisfaction.

A number of commercial lines carriers are using digital tools to improve journeys. Many commercial insurance buyers value online interfaces with self-service features and the ability to track the status of interactions in real time instead of having to make inquiries by phone, email, or through their brokers.

Advances like these require coordinating multichannel interactions with an overarching view of business value. Quick, cosmetic fixes are likely to fall short, while costly changes do not always deliver strong returns. Delivering a superior customer experience depends on the full range of pricing, products, and services.

BARRIERS TO SUPERIOR CUSTOMER EXPERIENCE

The main reason so many companies fail to improve customer journeys is that understanding what customers’ value is not an easy task. Identifying what drives customer satisfaction and translating it into operational performance improvements requires deep customer insights, solid analytics, and modelling the most important customer journeys, with cross-functional ownership and multichannel, end-to-end management.

So how can insurers overcome these barriers and deliver exceptional customer experiences? The first step is to align on what type of experience they want to deliver. Experts disagree on some fundamental elements of this issue. Some believe that fewer customer touch-points are better, while others say more interactions create more opportunities to add value and build loyalty.

Both can be correct, of course, depending on particular customer segments and the specific journeys they are on. Customers with more complex insurance needs might want a higher-touch approach during sales and onboarding.

TRANSFORMING THE CUSTOMER EXPERIENCE IN INSURANCE

Understanding what customers want is paramount in building a better customer experience. But real transformations are achieved when carriers take a comprehensive approach to customer journeys and how their organization works.

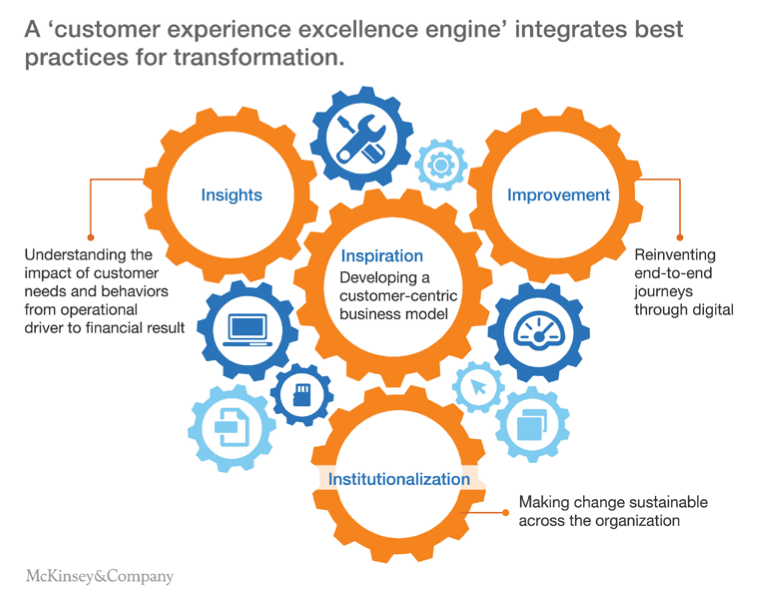

Only a holistic process can deliver tangible and sustained improvements. There are four core elements to a successful approach to excellence in customer experience: inspiration, insights, improvements, and institutionalization. Each element can yield a better experience, but the full impact is seen only when the four are pulled together.

INSPIRATION

INSPIRATION

Create a comprehensive vision for a customer-centric business and operating model with clear targets. A customer-centric transformation begins with an overarching vision exemplified by senior leaders and modelled throughout the organization. CEOs listening in to live call center phone calls or serving coffee to their customers are nice, powerful touches. But the real value of a customer-centric culture is unlocked when employees rally behind a common purpose that drives them to go beyond their regular standard of work.

Customer-centric organizations go the extra mile, demonstrating that customer satisfaction is not just a metric on a dashboard but an inspiration.

INSIGHTS

Develop customer insights and link customer satisfaction to operational key performance indicators and business impact (such as churn and cross-selling). Improvements in customer experience result from a clear understanding of customer needs and their implications from an operational standpoint. Most customer-centric processes also improve efficiency, but large investment decisions demand a clear articulation of costs and benefits, such as how much value an innovation adds from the customer’s point of view and how much of a competitive edge it provides. In other words, customer satisfaction initiatives should be grounded in facts, not gut feelings.

Many companies typically rely on two tools to assess customer satisfaction, both with shortcomings: Top-down metrics: All insurers periodically measure customer satisfaction. Many do so on a differentiated basis—by division, for example.

Those may be good starting points, but they rarely provide clear indications as to where and how to make improvements. Customer satisfaction scores need to be linked to operational metrics and economic value to highlight how to address customer needs. Likewise, recommendation scores may not reflect true customer satisfaction. In some industries, improving the customer rating may barely increase the likelihood of renewing a subscription or buying a new product, while in insurance, a similar jump can be a differentiator.

Internal surveys: Surveying internal leaders is a good way to generate ideas for improvements, but these leaders tend to focus on technical shortcomings and may not rank other nuances in interactions the way customers do.

Increasing customer satisfaction goes hand-in-hand with operationally relevant customer intelligence. Insurers can also gain valuable insights—and avoid trying to solve the wrong problems—by comparing how customers describe their experiences with actual company data. In other words, if customer complaints about long callcentre wait times do not match reality, then the problem might have more to do with communication and not necessarily be solved by adding call centre staff.

IMPROVEMENT

Radically redesign customer journeys from start to finish, using digital elements as the standard. Insights from research help insurers decide where to invest, but effectively redesigning customer journeys also requires discipline. Journeys can be optimized according to a five step structure. An effective process usually requires a crossfunctional team with members from sales, operations, IT, and other areas:

Step 1—Break down the journey using customer perspective as a central focus. Step 2—Map the journey against current internal operations.

Step 3—Call out the “wow moments” and pain points, such as unnecessary wait times or delays in communication. Step 4—Prioritize pain points based on what matters most to customers. Step 5—Radically redesign the journey to address the pain points and focus on customer needs.

Improvements must be seen as a continuous process. Carriers should plan for successive rounds of innovation, especially in digital, where expectations rise rapidly. All changes should be tested quickly with real customers, and not every lever must be in place before testing begins: they can be piloted and implemented in stages, and many incremental improvements are possible without lengthy preparations or IT infrastructure overhauls.

INSTITUTIONALIZATION

Build customer-centricity into the organization, changing culture and processes from the front line to the C-suite. Sustained improvements in customer satisfaction are possible only if the entire company—from top executives to the front line—is aligned around the effort and the rollout is rapid. Five best practices that increase the chances of success:

- strong executive ownership and a clear mandate for cross-functional journey owners to drive change across the organization

- central measurement architecture that continuously reports customer intelligence to the relevant operational KPIs, allowing feedback and improvement

- lean management practices with regular performance dialogues about customer satisfaction between top management and operational leaders

- proactive change management with compelling “change stories,” recognition from top management, regular interaction with real customers to gather feedback, and new approaches to attracting customercentric talent

- training to give employees new skills, and “navigators” and “champions” to carry the change to individual departments and make it stick

Many companies do well by starting with one or two small, rapid pilots to demonstrate impact and generate knowledge. They then use the momentum to scale up the improvements across the company, rolling out three or four customer journey categories at a time, with organizational owners for each.

A strong central team uses a standardized methodology and identifies synergies between customer journeys, such as in service and claims call centers, and identifies the skills required for success in individual areas. Every team has clear objectives in terms of customer satisfaction with regard to the best competitor. Recruiting profiles and human resources policies are aligned with the new way of working.

TAKING ACTION

Insurers need to invest human and financial resources in customer-centricity to build and maintain a competitive edge. Best-inclass players have already made some of these investments and are reaping cascading benefits.

The opportunities for insurers to differentiate themselves through stronger customer experience are huge and growing. The fundamental challenge many companies face is getting the organization moving. There is no time to wait. In the digital era, consumer power is rising. Carriers that cling to product-, function-, or channel-centric views risk falling behind as market leaders build deeper relationships with customers and capture ever-larger shares of the market. For carriers with the resolve to see their business through the eyes of the customer, each interaction becomes a way to live up to their brand promise; functions come together in new ways across customer journeys; and technology and digital become accelerators.

Transforming any large organization is difficult, of course, but the value at stake is significant. The adage is still valid: “You don’t earn loyalty in a day. You earn loyalty day by day.”

INSPIRATION

INSPIRATION