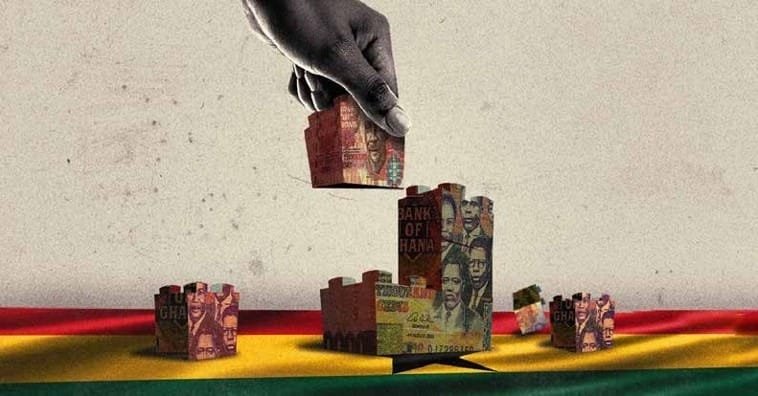

In the heart of West Africa, Ghana’s story is one of resilience and transformation. The nation is no stranger to economic challenges, but it is equally well- versed in embracing change and emerging stronger. Ghana, a nation of vibrant culture and burgeoning economic prospects, recently embarked on a transformative journey to restructure its national debt. This pursuit of fiscal equilibrium is more than just a policy change; it is a symphony of financial realignment that resonates deeply within the banking sector.

In recent years, Ghana has been navigating a complex financial landscape, grappling with the challenges posed by a mounting national debt. The government’s response to this fiscal predicament has been a strategic and carefully orchestrated debt re- structuring plan.

The Overture: Understanding Ghana’s Debt Restructuring

Debt restructuring, in essence, is a financial realignment strategy adopted by nations to reconfigure the terms and conditions of their debt. This includes adjustments to interest rates, maturities, and payment schedules. For Ghana, the pursuit of debt re- structuring is driven by multiple objectives, including the desire to ensure economic sustainability, maintain financial resilience, and ease the burden on the national treasury.

Ghana’s debt restructuring measures are not only a fiscal manoeuvre but also a risk mitigation strategy for the banking sector. High levels of government debt can expose banks to sovereign risk, potentially affecting their financial stability. Thus, debt re- structuring serves as a buffer, reducing the susceptibility of banks to government insolvency.

Banks are an integral part of the financial orchestra, and their liquidity and funding position is closely interwoven with government debt. Banks often invest in government bonds, considering them as liquid assets. The restructuring of these bonds can significantly impact their value and liquidity. Consequently, banks may need to orchestrate adjustments in their balance sheets to ensure that their financial harmony re- mains uninterrupted.

The interest rate ecosystem with- in the banking sector is intrinsically linked to debt restructuring. As government debt is often considered a benchmark, the restructuring of government bonds can have a ripple effect on other financial products, including loans and savings accounts. While this can benefit consumers by pro- viding lower interest rates, it may present banks with the challenge of balancing profitability in a low- er interest rate environment.

However, the harmonious overture of Ghana’s debt restructuring reverberates far beyond the banking sector. The successful resolution of fiscal challenges entices foreign investment, fortifies economic confidence, and sets the stage for greater financial stability. A thriving economy orchestrates increased credit demand; a melody the banking sector is well-equipped to conduct.

Understanding Ghana’s Debt Dynamics

Before delving into the specifics of Ghana’s debt restructuring, it’s essential to grasp the backdrop against which these financial manoeuvres are taking place. Ghana, like many other emerging economies, faced economic challenges exacerbated by the global eco- nomic downturn, domestic fiscal mismanagement, and external shocks. As a result, the country found itself in the grip of a mounting debt burden.

By 2022, Ghana’s debt-to-GDP ratio had soared, prompting the government to reassess its financial strategy. The debt was largely attributed to infrastructure projects, fiscal deficits, and the economic fallout from the COVID-19 pandemic. Recognizing the urgency of the situation, Ghana’s policymakers opted for a comprehensive debt restructuring plan to alleviate the strain on the nation’s finances.

The Symphony in Action – Economic Implications

As the debt restructuring plan un- folded, its impact on the broader economy became increasingly evident. One of the immediate effects was a renewed sense of confidence among investors and international financial institutions. The successful execution of the debt restructuring plan signaled Ghana’s commitment to sound fiscal management and enhanced its credibility in the eyes of the global financial com- munity.

The extended maturities and reduced interest rates resulting from the debt restructuring also had a positive effect on the government’s budget. With more favourable terms, the fiscal space opened up, allowing for increased public spending on essential ser- vices and infrastructure projects. This injection of funds into the economy had a multiplier effect, stimulating economic activity and fostering job creation.

Moreover, the debt restructuring plan played a crucial role in stabilizing the national currency, the Ghanaian cedi. By addressing concerns about the sustain- ability of the country’s debt, the government mitigated the risk of currency depreciation and inflation. This, in turn, contributed to a more stable macroeconomic environment, which is crucial for attracting foreign investment and promoting domestic business expansion.

The Banking Sector as a Key Player and the Challenges

While the economic symphony was playing out on a grand scale, its resonance was keenly felt in Ghana’s banking sector. Banks, as the primary financial interme- diaries, are intricately connected to the overall health of the economy. The debt restructuring plan had several implications for these financial institutions, producing both challenges and opportunities.

Banks in Ghana, like in many developing economies, hold a significant portion of their as- sets in government securities. As government restructured its debt, banks faced the challenge of managing their exposure to these securities. The potential reduction in interest rates on government bonds could impact banks’ interest income.

The restructuring of government debt raised concerns about cred-it risk. Banks had to carefully assess the creditworthiness of the government and adjust their risk management strategies accordingly. A default by the government could have far-reaching consequences for the banking sector.

However, the positive economic effects of the debt restructuring, such as increased public spending and infrastructure development, presented opportunities for banks to expand their lending portfolios. A growing economy typically translates into increased

Navigating Risks and Embracing Innovation

The ongoing saga of Ghana’s debt restructuring and its reverberations in the banking sector also invites a closer examination of potential risks and the role of innovation in shaping the future landscape.

While Ghana’s debt restructuring plan has provided a degree of stability, external factors can pose challenges. Global economic uncertainties, such as fluctuations in commodity prices or geopolitical tensions, could impact the nation’s economic trajectory. Banks, being inherently tied to the global financial system, are required to remain adaptable to external shocks.

The injection of funds into the economy, although stimulating growth, raises concerns about inflation. As such, banks need to carefully monitor inflationary pressures and adjust their strategies to navigate potential impacts on interest rates, asset quality, and overall financial stability.

The success of debt restructuring hinges on the government’s ability to maintain fiscal discipline and implement sound economic policies. Consequently, banks, as guardians of financial stability, are expected to actively engage with policymakers to ensure the sustainability of debt levels and mitigate the risk of future financial crises.

Thus, the banking sector can har- ness the power of digital transformation to enhance efficiency and customer experience. Embracing technologies such as online banking, mobile payments, and block- chain can streamline operations and open new avenues for financial inclusion.

In the face of evolving risks, banks can leverage advanced risk management tools and analytics to assess and mitigate po- tential threats. Machine learning algorithms and predictive analytics can provide insights into credit risk, helping banks make informed decisions in a rapidly changing economic landscape.

Curtain Call: Looking Ahead

As Ghana’s debt restructuring plan continues to unfold, the financial symphony is far from over. The success of the restructuring efforts depends on the government’s ability to implement complementary policies that foster sustainable economic growth. It also relies on continued collaboration with international partners and creditors to ensure the longevity of the financial stability achieved through the restructuring.

However, the banking sector, as a key player in this symphony, must remain vigilant and adaptive. While challenges persist, the opportunities presented by a revitalized economy are vast. Hence, banks can play a pivotal role in supporting businesses, entrepreneurs, and individuals as they navigate the post-restructuring landscape.

Ghana’s journey through debt restructuring is a testament to the intricate dance between fiscal policy, economic stability, and the resilience of the banking sector. The successful navigation of these complexities paints a promising picture for the future of Ghana’s economy.

As the financial symphony continues to unfold, the harmony created through debt restructuring may well set the stage for a new era of sustainable growth and prosperity.

Ghana’s debt restructuring journey is a transformative process that encompasses the entire eco- nomic orchestra, with the banking sector playing a vital role. As this financial symphony unfolds, it’s crucial for both the government and banks to fine-tune their strategies, adapt to changing conditions, and collaborate to maintain economic harmony. The final crescendo, orchestrated success- fully, will result in a harmonious financial landscape, securing Ghana’s position as a melodious success story in the world of finance.