One-year Extension to Ghana’s ongoing IMF program Bodes Well for Market Sentiments

On 30th August, 2017, the IMF Executive Board concluded the fourth review of Ghana’s Extended Credit Facility (ECF) program with the approval of US$94.2 million tranche disbursement as BOP support.

Key highlight was that the government reached an agreement with the IMF for a one-year extension to the duration of the ongoing 3-year ECF program, which was initially scheduled to end in Apr-2018.

Rationale for the Program Extension:

Although Ghana recorded marked improvements in fiscal indicators during the first year of implementation of the program in 2015, significant slippages in the 2016 election year eroded most of the fiscal gains. The fiscal deficit consequently surged by 230bps to 9.3% in 2016 after a 310bps reduction to 7.0% in 2015.

While other key macroeconomic indicators such as inflation, interest rate and exchange rates have embarked on a favourable path, the erosion of fiscal gains remains a significant risk to Ghana’s macroeconomic stability and growth.

The decision to extend the ongoing IMF- supported fiscal adjustment program is broadly positive for Ghana as the extra year would offer the necessary anchor to restore fiscal sustainability and strengthen the implementation of structural reforms.

Perspectives on the Program Implementation Timeline:

Perspectives on the Program Implementation Timeline:

Ghana’s 3-year program commenced in April 2015 and was originally scheduled to end in April 2018 when the final review, potentially in Q1-2018, would be used as a closure for the program without conditions for any BOP disbursement. This meant that the binding conditions of the program would have covered the January – December 2017 budget cycle only. Against this backdrop, the one year extension to the IMF program pushes the program end date to April 2019.

This therefore indicates that the binding conditions for each review and BOP disbursements would cover the January – December 2018 budget cycle. The final review, potentially in Q1-2019, would thus be carried out without any binding conditions for BOP disbursements as the program ends in Apr-2019. However, the IMF’s technical support is expected to anchor the preparation of the 2019 budget which is expected to be presented to Ghana’s parliament in November 2018.

Overall, the 2017 and 2018 implementation years are critical for sustaining investor confidence and real GDP growth. A favourable outturn in key macroeconomic indicators during the 2017 and 2018 implementation years would firmly anchor investor confidence beyond the IMF program. The outlook for Ghana’s return to fiscal sustainability and robust economic growth is mostly bullish on account of government’s commitment to fiscal discipline and structural reforms together with increased private sector investment.

Perspectives on the IMF Forecast of Ghana’s Outlook:

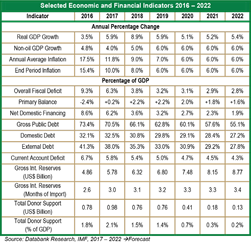

Ghana’s medium term outlook as projected by the IMF (refer to above table) appears positive on the back of stronger domestic and external balances.

Low fiscal deficit and positive primary balance to restore debt sustainability:

The IMF expects a sharp decline in fiscal deficit to 3.8% in 2018 with a sustained decline annually to 2.8% of GDP by 2022. Consequently, the primary balance is expected to swing into a surplus position, surging to +2.2% of GDP in 2018 (from +0.2% in 2017).

The anticipated improvements in fiscal balances would be favourable for Ghana’s debt position as the debt-to-GDP ratio is expected to reduce steadily to 55.1% in 2022 (from a projected 70.5% and 66.1% in 2017 and 2018 respectively).

Increased domestic financing of fiscal deficit would limit the vulnerability of the debt portfolio to exchange rate shock:

The IMF forecast for net domestic financing of future deficit is supportive of government’s financing strategy in 2017.

From the 2017 budget and based on its implementation so far, the government continue to depend on net domestic financing for the projected budget deficit. Based on the IMF forecast, the government could extend this deficit financing strategy to 2018 and 2019 as net domestic financing corresponds to overall deficit for the period. The 0.2% gap between the fiscal deficit and the net domestic financing for 2018 reflects the use of divestiture receipts from sale of selected state owned assets rather than net external financing.

The favourable impact of this financing strategy is observed on the debt portfolio as external debt ratio is expected to reduce steadily to 27.8% of GDP, broadly corresponding to half the total debt portfolio.

Continued progress in fiscal adjustment could trigger improvements in Ghana’s credit ratings by international ratings agencies:

Ghana’s unfavourable credit rating by international ratings agencies is underpinned by sizeable fiscal and current account imbalances which is currently higher than the average for other countries in the ‘B’ rating category.

Ghana’s current account deficit closed 2016 at 6.7% of GDP compared to 5.7% for the ‘B’ median in Fitch Ratings’ matrix while interest payments in 1H-2017 was 38% of total revenue for the period as against 9% for ‘B’ median.

Against the backdrop of elevated fiscal deficit at 9.3% in 2016, Ghana’s debt-to-GDP ratio closed 2016 at 73.4%, significantly above the 56% for Fitch’s ‘B’ median.

While Fitch anticipates a conservative improvements in both the domestic and external positions, the IMF forecasts appear more bullish. On the current account deficit, Fitch expects a marginal improvement of 40bps to 6.3% in 2017 while the IMF projects a sharper improvement of 90bps to a deficit of 5.8% in 2017. In the same vein, Fitch anticipates FY-2017 gross international reserves at US$5.2 billion (+6.1% YoY) while the IMF projects US$5.8 billion (+18.4% YoY).

On fiscal deficit, Fitch also anticipates a much slower pace of improvement on the deficit while the IMF’s latest forecast appears more bullish. Fitch expects the budget deficit to narrow by 180bps to 7.5% in 2017 compared to a 300bps reduction anticipated by the IMF’s latest forecast to 6.3% in 2017. Fitch’s more conservative forecast is based on anticipated revenue shortfalls partly due to the tax reliefs announced in the 2017 budget. The IMF’s bullish outlook is however based on government’s efficient use of the public financial management system to limit the risk of expenditure overruns.

Overall, it appears both the IMF and international ratings agencies anticipates a broad improvement in Ghana’s short- to-medium term outlook. The pace of improvement however differs based on perceptions of the government’s fiscal consolidation drives. The fundamental conclusion is that these improvements in both domestic and external balances are expected to favourably impact Ghana’s credit ratings by the international ratings agencies.

According to Fitch Ratings, the main factors that could positively impact Ghana’s ratings include:

- A reduction in the budget deficit and a marked decline in government debt/GDP.

- An improvement in Ghana’s external position, such as a narrowing of the current account deficit and the rebuilding of the external reserves

- A sustained improvement in macroeconomic

The improving fiscal balance together with the firming external position appears positive for Ghana’s credit rating. The declining inflation and interest rates together with a relatively stable exchange rate would also favour macroeconomic stability. Ghana could therefore be in line for a revision to its ratings outlook from “Stable” to “Positive” over the next 3 years.

Oil & gas to drive growth in the short term while non-oil sector recovers to sustain growth in the medium term:

Oil & gas to drive growth in the short term while non-oil sector recovers to sustain growth in the medium term:

On the back of a sharp recovery in hydrocarbon production, Ghana’s growth pulse is expected to pick up in 2017 and 2018.

Oil production on the Tweneboa-Enyenra- Ntomme (TEN) fields is expected to ramp up to an average of 50,000bpd in 2017 while the Sankofa-Gye-Nyame (SGN) field is also commenced production in July 2017. In addition to production from the main Jubilee field, average daily output for the 2017 is expected above 120,000bpd compared to 88,300bpd in 2016. The SGN oil field which is predominantly gas is expected to commence the export of gas in early 2018, supporting the hydrocarbon-led growth in 2017 and 2018.

The IMF however expects economic activity in the non-oil sector to propel growth from 2019 as non-oil growth is projected at 6.0% annually to 2022. This is broadly underpinned by anticipated improvement in fiscal space to support public sector expenditure and investment while macroeconomic stability support private sector investment spending.

In the medium term, government’s industrialization agenda which is also expected to create a backward linkage with Agriculture sector (through the planting for food & jobs) is expected to start yielding results. Baring unanticipated delays in policy implementation and structural bottlenecks, the non-oil growth could be driven by agriculture, manufacturing, ICT, transport as well as financial and insurance activities.

Government however requires a cautious approach to donor inflows:

Comparing the IMF’s latest forecast to the government’s medium-term fiscal framework for 2018 – 2021, deviations for anticipated donor support could hurt Ghana’s fiscal position if expectations are not managed. The IMF’s forecast of donor inflows appear more conservative than the government fiscal framework for the medium term.

Based on deviations between the IMF’s forecast and government’s expectations for donor inflows, there could be an average funding gap equivalent to ~0.4% of GDP between 2018 and 2021. While this poses a risk to fiscal position, the potential risks appear more elevated in the short term than in the medium term as improved fiscal space over time could help minimize any potential shortfalls in donor support. In short term, government firm commitment to the strict enforcement of the public financial management system would be very critical in mitigating the shortfall risks.

Oil & gas to drive growth in the short term while non-oil sector recovers to sustain growth in the medium term:

Oil & gas to drive growth in the short term while non-oil sector recovers to sustain growth in the medium term: