The recent modest strengthening of the global economy is a welcome distraction from the drumbeat of negative expectations for slow global growth over the next decade. This opens the door for businesses to catch up on their

reinvention and digital transformation to strengthen their growth base and allow them to weather the longer-term, structural headwinds which remain. This recent cyclical upswing and recovery in productivity will raise global growth to 3.3 percent in 2017 from 2.9 percent in 2016.

Risks to the global economic outlook appear to be broadly balanced, with a slight positive bias. The economic recovery is gradually being consolidated on the back of a general uptick in global demand and improving labour markets, particularly in the developed world. Moreover, with the exception of the United States, monetary policies among the world’s largest economies will remain accommodative throughout this year and governments are expected to shore up economic activity via fiscal spending. Higher commodity prices are providing some relief to some battered emerging-market economies.

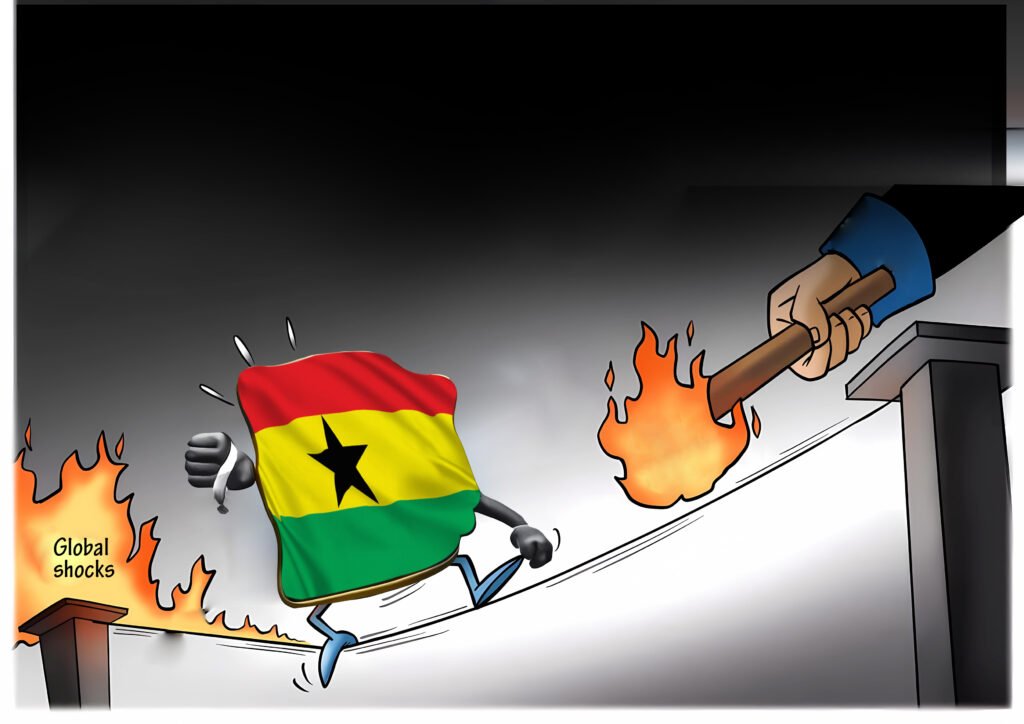

Although the global outlook remains generally positive, some developments have the potential to jeopardize the nascent economic recovery. In the U.S., the long- awaited fiscal stimulus has been scaled down and postponed, while, the uncertainty about President Donald Trump’s commercial polices remains high. Despite remaining strong, China’s April data was much weaker than expected, suggesting that the world’s major growth engine could be cooling significantly. While economic performance among emerging-market economies has improved compared to last year, the lack of impetus in commodity prices and still-large structural economic imbalances have the potential to reverse the situation.

The World at 360°

Taking a closer look at major economies, the GDP growth forecast for this year was held stable for the Euro area, the United Kingdom and the United States. Growth prospects for Canada and Japan were revised upwards.

Among the emerging economies, despite a dubious start to Q2, growth in China remains robust, supporting the outlook for Asia ex- Japan. While Latin America’s economic outlook was left unchanged, recent political developments in Brazil will certainly have a negative impact on the region’s growth prospects in the coming months. Eastern Europe continues to benefit from strong dynamics in the Eurozone and the ongoing economic recovery in Russia. Finally, despite higher commodity prices and strong dynamism in the non-oil sector, regional vulnerabilities have led growth estimates for the Middle East and North Africa to be stable.

UNITED STATES | Economy set to strengthen in Q2

The economy seems to be back on its feet after having run aground in Q1 at 1.2% annualized growth. The April job report noted stronger employment gains compared with March and a further decline in the unemployment rate, which continues to prove a boon for households who have seen inflation rising and financial conditions tightening but only moderate wage growth. In line with the brisk pace of job creation, retail sales picked up pace in April, which suggests that the stagnation in private spending observed in Q1 was indeed temporary. Industrial production also leaped at the outset of Q2, recording the largest expansion in more than three years in April on higher core manufacturing and mining output. With survey-based data still strong, GDP growth is poised to come in at a stronger clip in Q2 despite the political storm that has engulfed the Trump administration in recent weeks.

Heightened political noise is raising doubts about Washington’s ability to roll out growth-inducing policies later this year. Nonetheless, panellists see the U.S. economy with more than enough wind in its sails and thus expect it to grow 2.2% this year, which is unchanged from last month’s projection.

All told, the U.S. economy remains on a solid footing and although, we’re leaving unchanged the forecasts for U.S. growth but acknowledge the possibility that a scandal- hit Trump administration may be unable to deliver the fiscal stimulus it promised.

EURO AREA | Growth momentum remains intact

In the Eurozone, real GDP rose 2.0% annualized in the first quarter, faster than the pace seen in the U.S. Of the fourteen countries that reported quarterly growth rates (out of 19 eurozone members), thirteen showed increases in output, including powerhouses Germany (+2.4%) and France (+1.0%). So much so that the zone’s overall output is now 3% above 2008 levels. And based on flash manufacturing PMIs for May (which was at its highest in 73 months) it seems momentum extended to Q2. The European Commission’s Economic sentiment index is the highest in a decade reflecting increased confidence among both businesses and consumers in Europe.

Does that mean the European Central Bank will be withdrawing stimulus? That’s unlikely to happen soon considering ECB President Draghi continues to see risks “tilted to the downside” and remains concerned about below-target inflation which “has yet to show a convincing upward trend”. Moreover, the ECB knows the Eurozone still has a ways to go to catch up to its peers – while the zone’s real GDP is now 3% above pre-recession levels, output in the U.S. and Canada are respectively 13% and 15% above levels of 2008 Q1. Also, the European Central Bank will not be entirely satisfied with credit access. At first glance, the ECB’s policies seem to be working well with higher credit growth translating into improving Eurozone economic data. Loan growth to non-financial corporations has indeed improved since Targeted Longer- Term Refinancing Operations (TLTROs)

were first implemented in June 2014 – the ECB designed the TLTROs to reduce funding costs for banks and give them incentives to lend. The TLTROs have had mixed results, boosting loans in healthy Eurozone economies but failing to replicate the feat in the most vulnerable ones.

The failure of TLTROs in the latter case is likely due to lingering weakness of bank balance sheets. In Italy for example, the share of non-performing loans in total loans is at an all-time high. That explains in part why member countries such as Greece (which saw a decline in output in Q1 on top of a massive slump the prior quarter), Italy, Spain, Portugal, Cyprus, and Slovenia all remain in recovery mode as opposed to being in expansion, with their respective GDP still below pre-recession levels. There are also risks sovereign spreads may widen again,

e.g. if Greece and its creditors are unable to agree on another bailout before July or Italy’s 2018 elections hand over power to anti- EU politicians. And of course, the negative impacts of Brexit on the Eurozone should not be underestimated. All told, the ECB’s work is hardly complete. In other words, Euro bulls and others counting on a quick end to the ECB’s stimulative monetary policies may end up being disappointed.

JAPAN | Growth continued in Q2 BUT at a more moderate pace

Among developed economies, Japan was an unexpected outperformer in the first quarter, managing to grow 2.2% annualized, i.e. above potential for an economy which continues to be restrained by a declining workforce. Domestic demand grew at the fastest pace in a year, and trade also contributed to growth. That was the fifth consecutive quarter of positive growth for Japan, the longest such streak since 2006. Based on indices, growth seems to have continued in Q2, albeit at a more moderate pace. Part of this Japanese resurgence is due to the depreciation of the yen in real effective terms which has allowed trade and hence the current account to improve markedly after hitting an all-time low in 2014. The current account surplus is now roughly 4% of GDP, the highest since 2010. This improvement is partly due to the Bank of Japan’s monetary policy stimulus which has weighed on the currency. Recall that the BoJ’s balance sheet is set to swell to over US$4.5 trillion (more than 100% of GDP), or about four times the size of the Fed’s balance sheet as a share of the economy. However, the BoJ’s expansionary policies continue to be offset by Tokyo’s fiscal tightening as evidenced by a narrowing structural budget deficit.

United Kingdom | Blur vision on Brexit negotiations

The just concluded UK election is unlikely to have major adverse near-term effects on the euro-zone as damage to UK demand from political uncertainty may be offset by looser fiscal policy. A softer Brexit could ultimately benefit the rest of the EU, but a big shift in that direction still seems unlikely.

Law firm Clyde and Co was considerably less optimistic about the outcome and its ramifications for business. “A hung parliament could be the worst possible result for business,” said Robert Meakin, partner at law firm Clyde and Co. “With the economy already struggling with the uncertainty of Brexit, the last think we need is further confusion and delay in the government’s investment strategy.” “The Article 50 clock is also ticking and business will be eager to ensure that there is a clear and consistent voice at the negotiating table, so as to minimise further damage to the economy. The sooner a viable government is in place, however it’s composed, the better.”

However, growth is set to remain subdued going forward, with Brexit uncertainty deterring investment and consumers feeling the pinch due to stagnating living standards. However, the Bank of England’s (BoE) ultra- loose monetary policy stance will soften the slowdown.