The government in its budget statement and economic policy for 2017 financial year dubbed “Sowing the seeds for growth and jobs” announced several cuts and the removal of some taxes in order to enhance and expand the operation of businesses in Ghana. The gesture was to provide a friendly environment for businesses in the country.

Considering that taxation is generally for government to raise revenue, it is not clear how this gesture affects revenue generation. John Kay, a fellow at the Institute of Fiscal Studies, London said “taxation is partly for government to raise revenue”. For him, the traditional role of government is to provide public goods such as infrastructure, defence and police, and to obtain funds for the purposes with minimum fuss or cost. Therefore, financial transactions of government generally involve either taxing some activities to subsidize others, or taxing some individuals to subsidize others.

Tax serves as a major source of revenue for the discharge of public services. Taxes in all forms are levied to achieve national goals, such as economic stability, equity, economic growth and currency protection. It is also employed by government to mobilize revenue into the nation’s coffers as reserves.

The above assertions are evidential that for the past decade, taxes of various forms played significant roles in pursuant of government’s economic development and performance strategies. Government reviewed or introduced various taxes and tax policies as instrument to achieve its economic development objectives.

In 2010, the focal economic objective of the government was fiscal consolidation to ensure macroeconomic stability. The key strategy was to “improve expenditure rationalization and management, while enhancing revenue mobilization”. Government fiscal policy through tax instruments was to strengthen the attractive framework for taxing self- employed professionals and the income from commercial activities of hitherto exempted organizations. As a result, the five years tax exemption granted the real estate industry was waived except for those companies willing to partner the government to provide affordable houses. Value Added Tax (VAT) threshold registration was increased to GH¢90, 000.00. The deferred payment scheme for VAT was also abolished and efforts were made FOR VAT refund timely. A Communication Service Tax (CST) was also introduced and it was applied to all companies in the communication industry.

All these initiatives contributed to an estimated amount of GH¢8.83 billion in total revenue and grants for the fiscal year 2010. The estimated revenue and grants for the first three quarters was GH¢6.00 billion representing about 23.1 percent of GDP. This exceeded the budgeted target of GH¢5.89 billion representing 22.7 percent of budget. The reason behind the strong performance was the improvement in tax revenue administration for the period. This led to a positive performance in total tax revenue for the year and estimated to be around GH¢4,413.4 million representing about 17 percent of GDP and higher than the budget target of GH¢4,090.5 million representing 7.9 percent.

In 2015, the government failed to meets its initial fiscal deficit projection of 6.5 percent of GDP. It was later revised to 7.3 percent of GDP during the mid-year budget review. This was as a result of decline in crude oil prices. Therefore, in order to achieve the fiscal objectives, government introduced a number of revenue and expenditure measures to complement the fiscal measures introduced in 2013 and 2014. Some of these fiscal measures included; imposition of the 17.5 percent Special Petroleum Tax, the VAT on fee-based financial services, extension of the National Fiscal Stabilization Levy of 5 percent and special import levy of 1-2 percent to 2017, increase in the withholding tax on Directors’ remuneration from 10 percent to 20 percent, and change in the VAT on Real Estate from 17.5 percent to a flat rate of 5 percent. These measures helped the government to recover significantly from the fiscal slippage. “Preliminary data for the first nine months of the year indicate higher than projected revenues and contained expenditures for the period. Due to the strong performance of revenues, a fiscal deficit of 5.1 percent of GDP (cash basis), against a target of 5.7 percent was recorded during the period”.

From the above, we see that government over the years has significantly achieved its fiscal objectives through taxation. The available data for the past decade suggests that the private sector contributed significantly to government revenue inflows based on the various tax and taxation policies implemented by the government over the years. Critics have argued that the plethora of taxes overburdened the private sector; that is, taxes affect business operating costs significantly. It is argued that the taxes eroded business profit margins, and led to higher products and service prices (as most businesses tried pushing significant amounts of the cost burden through prices to the consumer), inability of businesses to comply with tax obligations, businesses evasion of tax and ineffective tax revenue outturns etc. This dampened government’s efforts to making the private sectors the engine of growth of the economy.

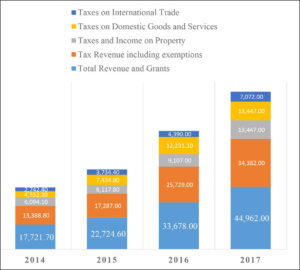

Government’s over reliance on taxes is a result of escalating debts– foreign and domestic, and accumulated interest payment that has eroded the fiscal space of government. In so doing, government’s appetite for tax as instrument to achieve its fiscal objectives has increased over the years. In order to allow the private sector to assume its much expected role as the engine of growth of the economy, the 2017 budget and economic policy stated government’s intentions to abolish and review some of the existing taxes which were referred to as “nuisance taxes”. The removal and review of the taxes was intended to lessen the burden of businesses in order for them to be able to expand, grow, and encourage the citizens to take advantage of the new tax policy initiatives and become entrepreneurial. Government’s goal is to grow the economy, while at the same time providing jobs. This, in the long run, would increase tax revenues resulting in greater stability of the economy. Figure 1 below presents a trend analysis of government’s revenue and grants for the period 2014 to 2017. 2017 revenue and grants figures are projections based on 2016 actual outturns. Figure 2 on the other hand presents a trend analysis of contribution in percentage of tax revenues and grants to Gross Domestic Product (GDP) from 2014 to 2017. Again the 2017 figures are projections of the government based on 2016 figures.

Implications of Tax Cuts or Removal on Businesses

Government’s decision to cut or abolish some taxes that affect businesses is seen as a bold step in the fiscal space of government raising revenue keep narrowing as a result of accumulated debt and interest payments over the years. And this has caused government to become over reliant on taxes to achieve its fiscal objectives. That is why tax instruments have featured prominently as dominant policy initiatives for the past decade. Even though government did achieve some of its fiscal objectives through the use of tax and debt instruments, it was to the detriment of business operations and growth as tax is a key factor that impacts business operations and expansion. Critics have argued that government debts instruments such as treasury bills and notes, and public bonds have crowded out the private sector. This is partly the reason for the high capital cost businesses face when procuring investment capital from financial institutions. Likewise, taxes borne by businesses have increased the cost of doing business. Intuitively, it is believed that government decision to cut and abolish some taxes is informed by the dilemma of how to allow the private sector to flourish in order to provide employment to citizen.

It can be argued that the government decided to cut and abolish some taxes in order to reenergize the private sector. These taxes were seen as a nuisance– low revenue yielding potential and at the same time impose a significant burden on the private sector and on the average Ghanaian. Government, although, is aware that the implementation of the removal and review of the taxes will pose some fiscal challenges to government business. Government is confident that the loss would be more than compensated for as a result of various policy measures it will introduce, including the initiatives proposed to stop the leakages of tax revenues through the implementation of the current tax regimes announced in the budget statement.

The removal of the duties on spare parts imports has the tendency to water down the cash flow pressures on businesses operating within the spare parts industry. This business sector will appreciate the following benefits of the tax abolished if and only if the cedi maintains stability. In this regard, prices of spare parts are expected to remain stable in the market. Failure of the Cedi to maintain stability would mean the tax removal would not realize its objectives. The effective management of the currency is the key determinant for government to achieve its policy objective. Government must therefore find a way to institute effective fiscal management control and restore market confidence via effective monetary policies that would press down inflation and interest rates as quickly as possible. The inability of the government to maintain currency stability would hurt many businesses. Most businesses in Ghana are import dependent for raw materials and even finished products.

The abolishing of the 17.5 percent VAT/ NHIL on financial services and exemption from taxation the gains from realization of securities listed on the Ghana Stock Exchange or publicly held securities approved by the Securities and Exchange Commission (SEC) is a positive initiative. First, its removal will help reduce bank transaction costs on investment products. It is also beneficial to both SME and large companies which use the services of the financial institutions to transfer funds locally and abroad. The SWIFT charges would be lessened and this would boost the confidence of the transnational corporations effectively using local bank services. There is also the tendency that banks’ deposits may increase if there is a corresponding improvement in bank operations and customer service across the financial sector.

The policy initiative of the government to demand from the financial institutions, especially, commercial banks to raise their minimum capital requirement; the Central Bank’s strong enforcement of license and regulatory framework; the encouragement for the banks to improve their governance and risk management systems and practices, are all appropriate measures. First, it will help the banks to minimize their risk exposure. Secondly, the banks would become competitive and be able to finance big investment projects as the petroleum sector grows larger; majority of the companies operating in the industry would need big credit facilities to finance their expansion plans. Thirdly, a stronger banking industry that is eager to assume and manage risk within tolerable levels would be a good partner to “enablers in the financial services sector”.

The recent challenges of the energy sector have exposed the economy to so many risks. These risks translated into lowering of investor confidence in the economy. Government ability to put into action medium to long term plans to curb the situation not to happen in the future would provide the banking sector with the liquidity that it needs to support infrastructure development as well as the operational requirements of the real sector.

The government’s call for all companies working in the energy (i.e. power sector), oil and gas, mining, banking, and telecommunications sectors to list a portion of their shares on the Ghana Stock Exchange (“GSE”) within five years of their commencement of operations is healthy for the economy in many ways. First, the listing of these companies on GSE will serve as a cheap source of capital mobilization rather than raising the capital abroad which involves complex financial processes that attract high charges. Secondly, the citizens will be able to own portions of these companies leading to improvement in the income levels of the larger population. Thirdly, it will help the demand for foreign currency for profit repatriation purposes. Consistent high demand for foreign currency creates pressure on the Cedi. This ultimately leads to the depreciation of the Cedi. Therefore, government’s economic stability and growth objectives are thrown out of gear.

Income levels have risen and the reforms seen in the pensions sector recently which led to the establishment of a number of Tier 2 and Tier 3 pension schemes have increased liquidity to invest in businesses with good prospects. This has a long term effect on the average Ghanaian who will be able to live a decent life in retirement. This is because the returns from the investments made by these pension funds would help assure improved pension pay-outs.

Policy Strengthening Measures

It is important to note that the recent tax cuts and removal for businesses should lead to business expansion and job creation that will invariably lead to the growth of the economy. But, tax cuts alone are not a panacea to efficient and effective operation and expansion of businesses in Ghana. Government must consider other factors, including stable supply of energy, cost of energy usage, and review of the companies’ code to correct some anomalies. Government should therefore not look at the “ad-hoc solutions, but effective implementation of medium to long term plan measures.

Government decision to cut and abolish some taxes shows how far it is willing to go in order to create a business friendly environment for businesses to thrive. Tax is one of the factors that negatively affect business operations and expansion. However, government must find other means to bridge the fiscal gap. There are two options available to government. First, government should stop all capital projects in order to contain public expenditure in order to pursue the tax cuts and the abolishing of some taxes. Secondly, government should borrow heavily on commercial terms domestically to close the fiscal gap. Should government decide to stop all capital projects, public expenditure would reduce but the real sector of the economy would decline. Should government borrow heavily in commercial terms domestically, the private sector would be crowded-out and the cost of capital would rise. Therefore, the third scenario is for government to improve the efficiency of the tax system and widen the tax net in order to lessen tax burden and at the same time borrow moderately in commercial terms from the domestic market.

It is important to observe that tax cuts and tax removal would only minimally affect the growth of the manufacturing sector as other factors that contribute to boosting manufacturing are at play. These include access to modern technology, machinery and equipment, quality of human capital, market availability, nature and type of competition at the market place, customer tastes and preferences etc. This is to say that the tax cuts and tax removal is a good initiative, but needs to be implemented in combination with other policy measures aimed at addressing short, medium and long term fiscal challenges.