The global economy is expected to expand to 3.4% says analysts.

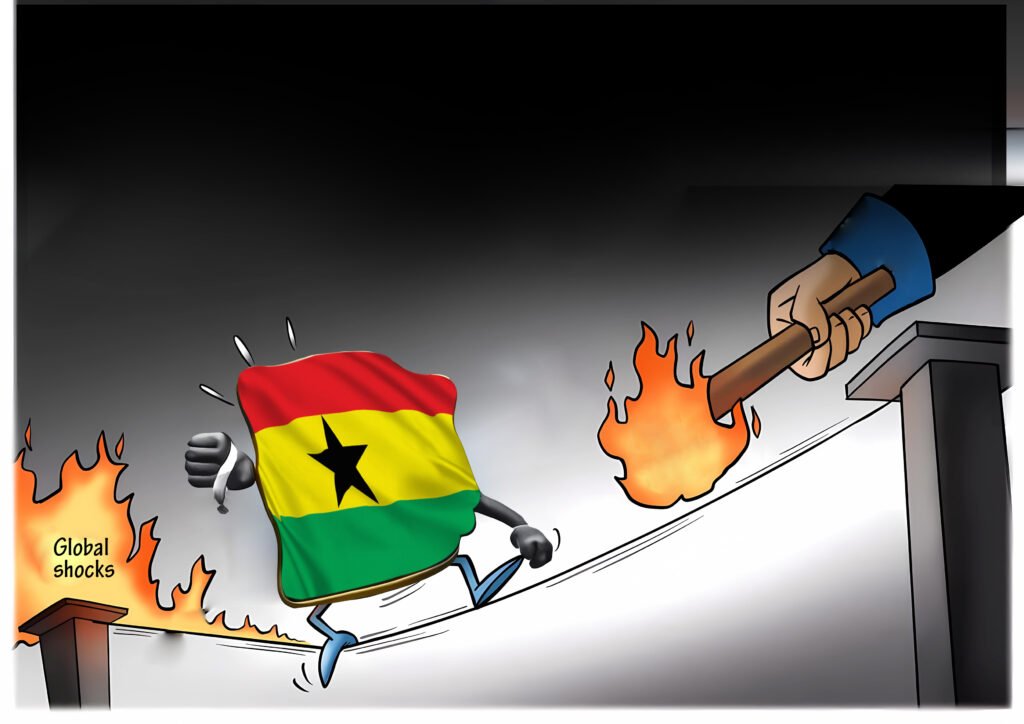

The Global economy suffered another lackluster year in 2016 for numerous reasons which differs by region. Generally, the culprits include structural adjustments in many countries, efforts to reduce overcapacity, recurring natural disasters, geopolitical events—such as Brexit, a coup d’état in Turkey and the ongoing civil war in Syria, among others—and heightened uncertainty related to the U.S. presidential election, as well as potential policy changes in the U.S. and a number of other major economies.

Against this backdrop, many central banks in the developed world have maintained exceptionally loose monetary policy in an effort to support household consumption and business investment. Eight years after the acute phase of the global financial crisis, the developed world is still using its central banks as a crutch. Throughout developed economies, interest rates are at, or close to, record lows and several are experimenting with avant-garde policies in the hope of stimulating domestic demand. Although it is reasonably clear that such policies are actually supporting economic growth— while introducing distortions in many asset markets—it is still hard to see how these economies will wean themselves off such support in the coming year

The Rising Uncertainties in 2017: highlights on China, Brexit and the EU, and Trump’s administration

Geopolitical factors, elections in various European countries and the inauguration of Donald Trump as President of the United States will all contribute to a highly uncertain global context in 2017. Following an expected lackluster growth in 2016, analysts expect that global economic growth will nevertheless experience a moderate improvement in 2017 and continue at around this rate in the following two years. The improvement projected in 2017 rests mainly on analysts’ assumptions that the global economy will continue to be bolstered by a continued recovery in developed economies—supported by still accommodative monetary policy in some economies and a renewed fiscal boost in others—and by stronger economic activity in most of the emerging world.

However, certain threats persist. Among these threats are potential stumbling blocks in the Brexit negotiations, the resurfacing of another China-meltdown episode like that seen in early 2016—with a consequent deceleration of its economy—and uncertainty related to the economic policies of the new Trump administration, which have the potential to stir things up drastically in the global economy. In terms of political risks, the wave of change seen in 2016 in a number of countries including the UK, the U.S. and Italy will continue unrelentingly in 2017 and uncertainly related to recent geopolitical events will persist.

Looking at individual countries, outlook for 2017 shows an upward progression to growth prospects for major economies such as the Euro zone, Japan and the U.S. The GDP growth forecast for the UK has also improved as concerns over negative spillovers from the Brexit vote continued to reduce.

The Global Economy in a 3600

UNITED STATES | Signs of economic strength precede new administration

In the U.S., the scenario of higher interest rates continues to gain strength. At its last monetary policy meeting of 2016, the Fed announced its decision to raise interest rates, while the accompanying projection materials included an increase in the median estimate for rate hikes for 2017.

Of the world’s richest countries, the U.S. economy is undoubtedly in the best position, even though growth has fallen to a new normal of about 1.5%. President-elect Donald Trump has signaled a large “self-financed” fiscal stimulus, while ultimately backtracking on major disruptive policies related to trade or immigration.

As the dust settles following the presidential election, economic data from the past month have been broadly positive. Steady gains in the labor market, including a post-recession drop in the unemployment rate in November, have made the headlines. Personal disposable income and household spending have remained fairly solid throughout 2016, boosted by buoyant consumer confidence, which jumped to a nine-year high in November. In terms of economic growth, after an extended soft growth patch characterized by five quarters of inventory correction, GDP growth in Q3, at 3.2%, was the fastest in two years. Meanwhile, positive prospects for oil prices and somewhat improving global conditions are supporting U.S. manufacturing activity, with the ISM index rising for a third consecutive month in November.

The signs of strength in the U.S. economy, as Donald Trump assumes office, provide a strong contrast to the difficult context inherited by his predecessor, Barack Obama, who took office at the depths of the financial crisis. Trump has vowed to further boost

U.S. growth to about 3.5% a year on average. However, analysts expect the boost that Trump can add to U.S. growth in 2017 and 2018 to be modest. They see GDP growth at 2.2% in 2017 and inching up further to 2.3% in 2018.

EURO AREA | Region shows resilience overall in Q4

In Europe, although the latest economic indicators have been resilient, confidence in the Eurozone has continued to be undermined by political risks, the rise of national opt- outs from region-wide policy and the EU’s struggle to deal with Brexit. Such are the threats that Europe faces that questions the future of Greece, the region’s immigration crisis and difficulties in its banking sector are likely to be pushed to the margins for now. In the common currency area, economic growth has been plodding at around 1.5% in 2016.

The Eurozone’s growth story continued unfazed in the third quarter, as a solid performance in the domestic economy drove a steady expansion. Households benefited from low inflation and an improving labor market, while the external sector and investment were the economy’s weak spots. Data for the final quarter 2016 point to a modest pick-up in momentum. The unemployment rate inched down in October and economic sentiment rose in November. In addition, the euro fell to the lowest level seen in years following the U.S. Federal Reserve’s decision to hike interest rates. The depreciated currency should bode well for the region’s exports, which have been hurt by subdued volumes of global trade.

The common-currency region’s growth outlook is expected to be 1.5% in 2017. A solid domestic economy should support the economy’s momentum, however, political risks are elevated in the face of a jam-packed election schedule this year. In 2018, growth is expected to remain stable at 1.5%.

JAPAN | Recovery remains in question

The fate of Japan is what European economies are keen to avoid. GDP growth in Japan remained lackluster in 2016, at around 0.5%. The economy continues to be constricted by a shrinking workforce, a rising old-age dependency ratio and tight immigration controls.

Economic activity performed relatively well in Q4 as the weakening of the yen following Donald Trump’s victory in the November U.S. presidential election and a modest pick-up in global growth supported business confidence. On the downside, poor gains in wage growth continue to constrain private consumption. Although GDP expanded for the third consecutive quarter in Q3, the reading was revised down due to a worse-than-expected performance in private investment and a sharp destocking process. Moreover, a change in accounting standards and the base year for GDP contributed to the lower figure.

An accommodative monetary policy and a weaker yen are expected to boost growth next year. That said, ambitious economic and social reforms are needed to ensure a healthier and more sustainable growth trajectory. The main downside risk to growth this year will be increased protectionism under Trump’s administration. Analysts see the economy growing 0.9% in 2017 and declining to a growth rate of 0.8% in 2018.

UNITED KINGDOM | The calm before the storm in 2017

The United Kingdom’s economy continues to hold up well. A complete set of data confirmed that GDP growth had decelerated marginally in the third quarter, but that growth remains robust compared to historical levels. The economy was supported by a rebound in exports while domestic demand disappointed. Economic activity is performing well as the smooth political transition following the resignation of former Prime Minister David Cameron and the accommodative stimulus of the Central Bank are keeping consumer and business confidence at reasonable levels. However, the depreciation of the pound, rising inflation and insufficient wage hikes risk eroding household consumption. In the next five years, the government projects higher borrowing and a slower fiscal consolidation compared to previous budget.

Political uncertainty stemming from the referendum will continue to deter investment. Growth is expected to decelerate in 2017 amid a slowdown in real household income growth. However, accommodative policy action taken by the Bank of England (BoE) will soften the impact. The economy is expected to expand to 1.1% in 2017 and in 2018, GDP growth is projected to accelerate to 1.3%.

EMERGING MARKETS | Resilient growth expected

2016 proved to be a less uncertain year for most emerging economies than had seemed likely. Expectations of a U.S. tightening cycle in 2016 dissipated as the year progressed— the first rate hike was ultimately postponed until the end of the year—and the greenback rally stalled. This prompted many emerging market central banks to cut interest rates, boosting disposable income. Moreover, investors went back on the hunt for higher- yielding assets, capital flowed back into  emerging markets and bond issuance likely reached a record high in 2016. Nonetheless, market participants’ bigger appetite for emerging-market debt was partly due to the absence of returns in developed economies, rather than a vote of confidence for riskier assets.

emerging markets and bond issuance likely reached a record high in 2016. Nonetheless, market participants’ bigger appetite for emerging-market debt was partly due to the absence of returns in developed economies, rather than a vote of confidence for riskier assets.

In emerging market and developing economies, growth will accelerate. In 2017, emerging economies are expected to grow 4.6 percent.

However, prospects differ sharply across countries and regions.

Among major emerging economies, the economic outlook for Brazil, Russia and India looks stable, while China’s GDP growth projection remains unclear.

In China, policymakers will continue to shift the economy away from its reliance on investment and industry toward consumption and services, a policy that is expected to slow growth in the short term while building the foundations for a more sustainable long- term expansion. Still, China’s government is expected to take steps to rein in credit that is “increasing at a dangerous pace’’ and cut off support to unviable state-owned enterprises, “accepting the associated slower GDP growth,” the IMF said.

China’s economy, the world’s second largest, is expected to decline 6.2 percent in 2017 from the 6.6 percent in 2016.

Growth in emerging Asia, and especially India, continues to be resilient. India’s gross domestic product is projected to expand 7.6 percent this year and next, the fastest pace among the world’s major economies.

At a regional level, only growth prospects for Latin America and Sub-Saharan Africa shows a decline.