Introduction and Colonial Beginnings

Before Ghana’s independence, the territory known as the Gold Coast operated under a colonial monetary regime managed by the West African Currency Board (WACB). Established in 1912 and headquartered in London, the WACB was responsible for issuing and regulating the West African Pound, a currency used across British West African colonies, including Nigeria, Sierra Leone, and the Gambia, excluding Liberia. The West African Pound was directly pegged to the British Pound Sterling, and its denominations, Pounds, Shillings, and Pence, mirrored the British system. Although the arrangement brought monetary uniformity and facilitated regional trade, it served colonial interests and reinforced economic dependence on Britain. By the 1950s, with momentum building toward self-governance, Ghanaian leaders began advocating for financial sovereignty. A key priority was to establish a central bank that could oversee the country’s monetary affairs. This ambition led to the formation of the Bank of Ghana in 1957, marking the first step toward an independent national currency system.

Establishing the Ghana Pound (1958–1965)

After Ghana attained self-rule in the year 1957, monetary duties that were previously performed by the West African Currency Board were transferred to the new Bank of Ghana. With a symbolic and practical necessity of a national currency, the Bank issued as the national currency the Ghana Pound, Shillings, and Pence on 14 July 1958. It was the very first sovereign currency of the country issued under the authority of Ghana and secured by the national reserves. Although the organization of the currency including: twelve pence to the shilling, twenty shillings to the pound, was quite the same as in the British example, new denominations had been renamed with Ghana identity. The banknotes with coins had a national images and culturally relevant images, and the national pride was enhanced. There were 10 shillings, 1 pound and 5 pounds, and coins of 1/2 penny, 1 penny and 2 shillings. This currency however, although it maintained certain of the colonial legacies as far as its form is concerned, was a significant step in the process of Ghana on its road to total economic self-determination in terms of its issuance.

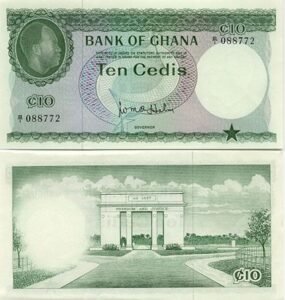

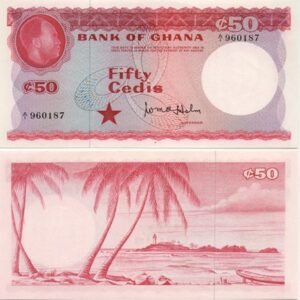

Decimalisation and the Birth of the Cedi (1965–1967)

In 1965, Ghana undertook a bold monetary reform by transitioning from the British-inherited currency system to a simplified decimal-based structure. This reform was guided by the Kessels Committee, which was tasked with recommending a suitable approach for modernising the currency. The result was the introduction of the Cedi (₵) as the new unit of currency, replacing the Ghana Pound, Shillings, and Pence. One Cedi was made equivalent to 100 Pesewas (P), with the conversion rate set at 1 Cedi to 8 Shillings 4 Pence.

Launched on 19 July 1965 by then Minister of Finance, Mr Kwasi Amoako-Atta, the new currency marked a significant shift in both function and identity. The name “Cedi” was derived from the Akan word sedie, meaning cowry shell, a historic medium of exchange in West African trade, while “Pesewa” came from pesewabo, a seed once used in barter systems. These names imbued the currency with indigenous meaning and cultural pride.

Banknotes ranged from 1 to 1,000 Cedis and bore the portrait of President Kwame Nkrumah, while coins came in 5, 10, 25, and 50 Pesewa denominations. The switch to a decimal system simplified transaction, reflected Ghanaian heritage, and reinforced national identity in the post-colonial era.

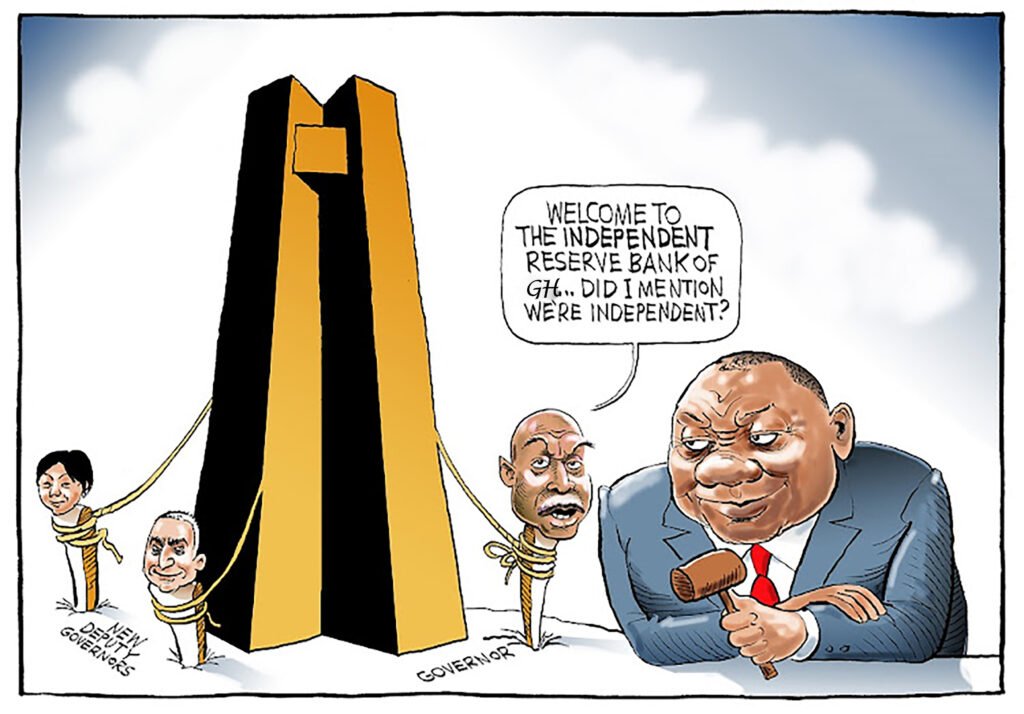

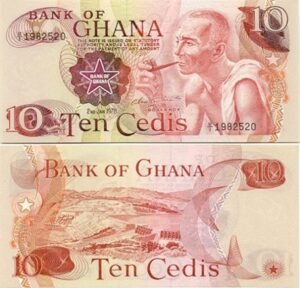

The New Cedi Era and Political Symbolism (1967–1972)

Political event greatly influenced the currency reform implemented in Ghana in 1967. After the then sitting President Kwame Nkrumah was toppled over in February, 1966, the newly instilled military regime The National Liberation Council (NLC) attempted to wipe out all things that had to do with the Kwame Nkrumah regime. This also involved the national currency which displayed the portrait of Nkrumah prominently. On 17 February 1967 the bank of Ghana issued a new issue of notes and coins denominated in ‘New Cedi’ (N₵) to replace the 1965 Advanced Cedi.

The denominations, however, were still the same: 1, 5 and 10 Cedis but there was no image of Nkrumah in the new notes and had adopted neutral symbols of the nation. Accompanying coins were; 1/2, 1, 2 1/2, 5, 10 and 20 Pesewas. The exchange rate introduced 1 New Cedi as the equivalent of 1.20 of the old Cedi. Co-circulation of the two currencies was extended in a grace of three months after which Cedi was demonetised. This reform pointed out that currency not only may benefit economically but also politically as the power of the nation changed.

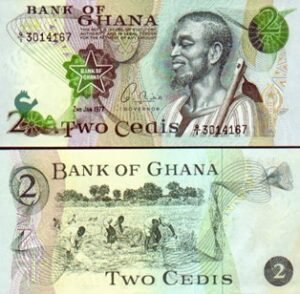

Cedi Re-issue and Further Reforms (1972–1979)

Another currency reform was effected in 1972 under the new regime which followed another military coup that removed the Second Republic government under the leadership of the President Edward Akufo-Addo and the Prime Minister Dr Kofi Abrefa Busia. Its goal was to claim a new political course and to rationalize currency system. The re-issue was to be supervised by a committee that was headed by the then Governor of the Bank of Ghana Mr J. H. Frimpong-Ansah.

This currency was renamed by a simpler name into the Cedi (₵) excluding the prefix New. Designs of banknotes were also changed and thus neutral symbols with no political connection were included. The currency consisted of 1, 2, 5 and 10 Cedis and the previous mentions to Nkrumah-era currency were abolished. This re-issue was a bid to stabilise the belief of the masses in the presence of economic insecurity and also strengthen the grip of the state on the fiscal tools. The amended notes and coins also established the grounds to yet more reforms against the presses of inflation that were to increase later in the decade.

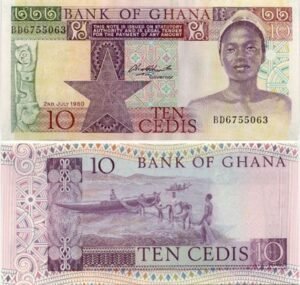

Currency Demonetisation and Discount Policy (1979–1983)

The government implemented a massive exercise of demonetisation in March 1979; the move came after an increase in inflation and issues of clandestine hoarding. Old Cedi notes were called in, and a new issue was set on a punitive exchange basis; notes of up to 10,000 cedis were exchanged at 30 per cent; those over that figure at 50 per cent. This shift was meant to fill the unaccounted funds holding and led to financial loss and mass panic. There were new banknotes of 1, 2, 5, 10, 20 and 50 Cedis as well as 50 Pesewas and 1 Cedi coins. The balances in bank accounts were however not affected.

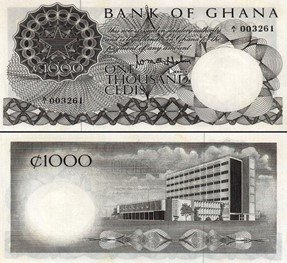

Inflation and High-Denomination Expansion (1983–2007)

Since 1983, a long-term spell of inflation was recorded in Ghana and thus the Bank of Ghana responded by making successive adjustments in the currency layout. The Cedi value kept depreciating and to buy commodities used in day to day life and running of business ventures, high denominations were introduced. In 1983, the Bank reprinted Cedi notes with new design and security features including the 50 note which was reintroduced back in circulation previously withdrawn in the year 1979.

As inflation intensified, the Central Bank introduced new denominations—¢100 and ¢200 in 1984, followed by ¢500 in 1986. To manage rising printing costs and improve efficiency, lower-value notes such as ¢1, ¢5, ¢10, and ¢20 were gradually phased out and replaced with coins. The trend continued into the 1990s, with the launch of the ¢1,000 note in 1991, and ¢2,000 and ¢5,000 notes in 1994. By 2003, ¢10,000 and ¢20,000 notes were introduced, becoming the highest denominations ever issued in Ghana.

Meanwhile, coins of ¢50, ¢100, ¢200, and ¢500 were introduced to support smaller transactions. Despite these efforts, the Cedi’s purchasing power remained weak, and everyday commerce often required bulky stacks of cash. This environment set the stage for a more comprehensive reform, redenomination, in the years ahead.

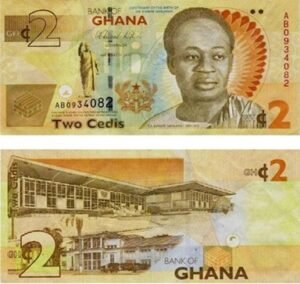

Redenomination and Currency Modernisation (2007–2019)

By the early 2000s, Ghana’s currency system had become unwieldy due to decades of inflation. Ordinary transactions required large bundles of notes, and the psychological impact of high face values undermined public confidence. To address this, the Bank of Ghana undertook a major currency reform: redenomination. On 1 July 2007, the Ghana Cedi (GH¢) was introduced, replacing the old Cedi at a rate of 1 Ghana Cedi to 10,000 old Cedis. The aim was to simplify transactions, improve accounting systems, and restore faith in the national currency.

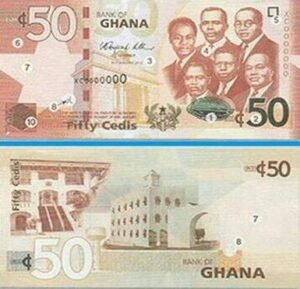

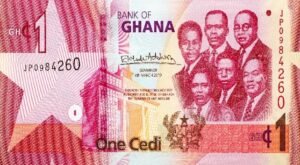

The redenomination was preceded by an extensive public education campaign to ease the transition. New banknotes were issued in denominations of GH¢1, GH¢5, GH¢10, GH¢20, and GH¢50. Coins were also introduced, ranging from 1 Pesewa to GH¢1, featuring enhanced durability and modern designs. The new currency maintained strong national imagery, while incorporating improved security features.

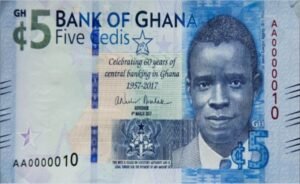

Subsequent years saw further innovation. In 2010, the Bank of Ghana released a commemorative GH¢2 note to mark the centenary of Dr Kwame Nkrumah’s birth. In 2012, the GH¢50 note was upgraded with enhanced security to address counterfeiting. A new GH¢5 note, introduced in 2017 to celebrate the Bank’s 60th anniversary, featured advanced technology and updated aesthetics.

Throughout this period, the Central Bank continued to refine the currency’s structure and usability in line with changing economic demands. The redenomination and subsequent upgrades helped Ghana move towards a more modern, efficient, and secure monetary system, laying the groundwork for further adjustments in the decade ahead.

In March 2010, the GH₵2 was also introduced by Bank of Ghana to commemorate the centenary celebration of the birth of Dr Kwame Nkrumah.

Due to high counterfeiting rate of the GH₵50 in 2010/2011, Bank of Ghana introduced an upgraded GH₵50 banknote with enhanced security features in August 2012.

In March 2017, a new GH¢5 note was introduced by the Bank of Ghana as a commemorative banknote to mark the Bank’s 60th anniversary of establishment.

Recent Innovations and Upgrades (2019–Present)

Ghana’s currency system has continued to evolve in response to modern economic needs. In May 2019, the Bank of Ghana introduced upgraded versions of all existing GH¢1, GH¢5, GH¢10, GH¢20, and GH¢50 banknotes. The new series maintained the familiar designs but incorporated advanced security features, such as upgraded watermarks, security threads, and optically variable ink, to strengthen resilience against counterfeiting.

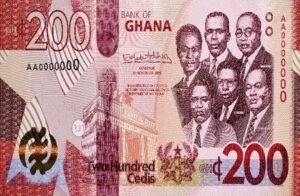

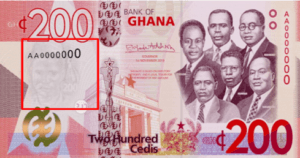

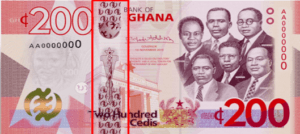

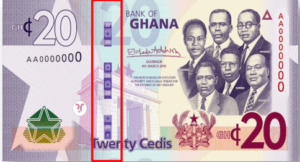

In November 2019, the currency suite further expanded with the launch of GH¢100 and GH¢200 banknotes, alongside a new GH¢2 coin. These higher denominations aimed to enhance transaction convenience, reduce printing costs, and ease cash handling in a largely cash-based economy. The GH¢2 coin reinforced the shift towards durable, cost-effective forms of currency.

In November 2019 the Bank of Ghana introduced GH¢100 and GH¢200 banknotes as well as a GH¢2 coin.

In December 2022, Bank of Ghana upgraded the existing GH¢1 coin with enhanced security features.

Most recently, in December 2022, the Bank released an upgraded GH¢1 coin, featuring improved materials and enhanced security features to extend its circulating lifespan. These recent measures underscore a commitment to currency durability, security, and efficiency, supporting Ghana’s evolving fiscal and economic landscape.

SECURING CONFIDENCE: UNDERSTANDING THE SECURITY FEATURES OF THE GHANA CEDI

Security Features of the Cedi Notes

Security features on currencies are crucial for safeguarding their value and credibility. The Bank of Ghana has done a solid job enhancing the security of the currency to stay ahead of counterfeiters. Security features aren’t just for show, they’re part of a broader strategy to protect the economy, reduce fraud, and make transactions smoother for everyone. Here’s why they matter:

Prevention of Counterfeiting

Currency is a prime target for fraud due to its widespread use. Counterfeiting devalues real money. Security features make it harder for criminals to reproduce banknotes accurately.

Maintain Public Confidence

When people trust that their money is real and accepted, it supports economic stability. Visible security elements reassure users that the note they’re holding is genuine.

Aid Quick Verification

Features such as tactile marks and UV-sensitive elements help individuals and businesses quickly check authenticity. Some security features are designed to aid visually impaired users with raised prints on them.

Adapt to Evolving Technology

As counterfeit methods get more sophisticated, central banks must keep innovating. Ghana, for instance, has updated its banknotes with enhanced features such as:

- Optically variable ink on the denomination

- Security threads woven into the note

- Enhanced watermark designs that show up under light

Levels of Security Features on the Ghana Cedi Note

There are three main levels of security features on the Ghana Cedi note. Here’s a breakdown:

Level One (1): Public Recognition Features – For the General Public

Level Two (2): Machine Readable Features – For Tellers and Cash Machine operators

Level Three (3): Central Bank Features – Reserved for the Central Bank

Public Recognition Features

- Look (1 & 2)

- Feel

- Tilt

Public Features – Watermark

It is the image of Tetteh Quashie with a cocoa pod and more noticeable in the plain star area of the banknote. It becomes visible on both sides when viewed against light.

Watermark

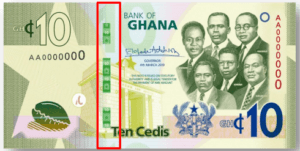

Security Thread – Motion Surface Stripe

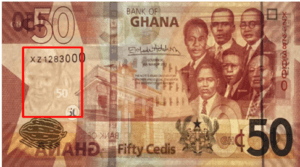

- It’s a 3D image stripe running from top to bottom in front of the GH₵200 and GH₵100 banknotes GH₵200

- Upper and lower parts of the stripe – Adinkra symbol of Except God – In a three (3) dimensional form – Moving above an apparently deep background of the symbols

- Middle part – The State Sword – With a star on top – Appearing to expand and contract when tilted

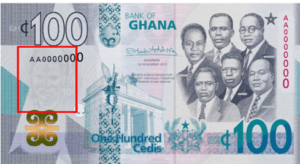

Security Thread – Motion Surface Stripe

- GH₵100 – Upper and lower sections

- Adinkra symbol of strength

- In a three (3) dimensional form

- Moving above an apparently deep background of the symbols. – Middle part – Parliament mace, depicting a bird on it appearing to flap it wings when the note is tilted.

Security Thread – Motion Surface Stripe

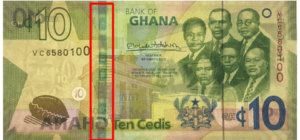

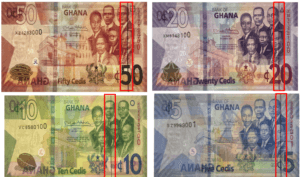

Security thread – Rapid thread

Rapid Thread – GH₵50, GH₵20, GH₵10, GH₵5 & GH₵1

It is a shiny broken line with movement that runs through the banknote from top to bottom. It is continuous when viewed against light. When the banknote is tilted, a star expands and contracts while the denominational value stays still.

Security thread – Rapid thread

Viewed Normally

Viewed against Light

Viewed Normally

Viewed against Light

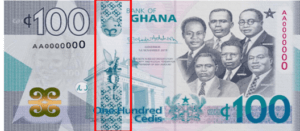

Security Thread – Embedded Magnetic Thread

This feature can be classified as both public recognition feature and machine-readable feature. It is visible when the banknote is viewed against light. It can be seen on all Ghana cedi banknotes with exception of the old series and commemorative notes.

Security Thread – Embedded Magnetic Thread

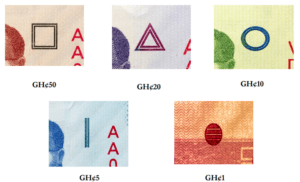

Blind Recognition Feature

It’s a mark printed on the right corner of the banknote with high tactility for the blind and visually impaired.

Blind Recognition Feature

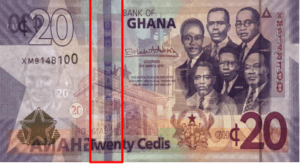

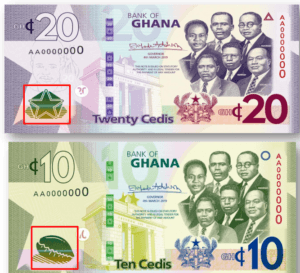

Public Features: OVMI – Spark Live

This feature can also be seen as both Public and Teller recognition feature. It is a shiny colour-changing image:

- Except God (Gye Nyame) on the GH₵200

- Symbol of Strength on the GH₵100

- Cocoa Pod on the GH₵50 ➢Star on the GH₵20

- Cowrie Shell on the GH₵10

- Tilt the note and a shiny bar moves Up & Down.

- Colour also changes from Gold to Green when tilted

Optically Variable Magnetic Image – Spark Live

Conclusion

The banknote can be seen as the Business Card of a country, this is because it represents the identity, values, and credibility of the nation in a compact, widely circulated form. Design elements such as portraits of historical figures, national landmarks, flora and fauna, or cultural motifs showcase what the country values and wants to be known for. Cognizant of the importance of the country’s currency, the Bank of Ghana has embedded stringent security features on the notes as protection against counterfeiting.

These features represent the technological and institutional efforts to safeguard the economy from fraud. The security features also symbolise vigilance and innovation in the face of evolving threats. In a nod to the transparency of the monetary system, the Bank of Ghana has made the security features visible and verifiable, allowing anyone to check the authenticity of a note, thereby promoting public participation in safeguarding the currency. Security features on a currency denote trust, authenticity, and protection and the Bank of Ghana has done exactly that with security features of the Ghana Cedi notes.