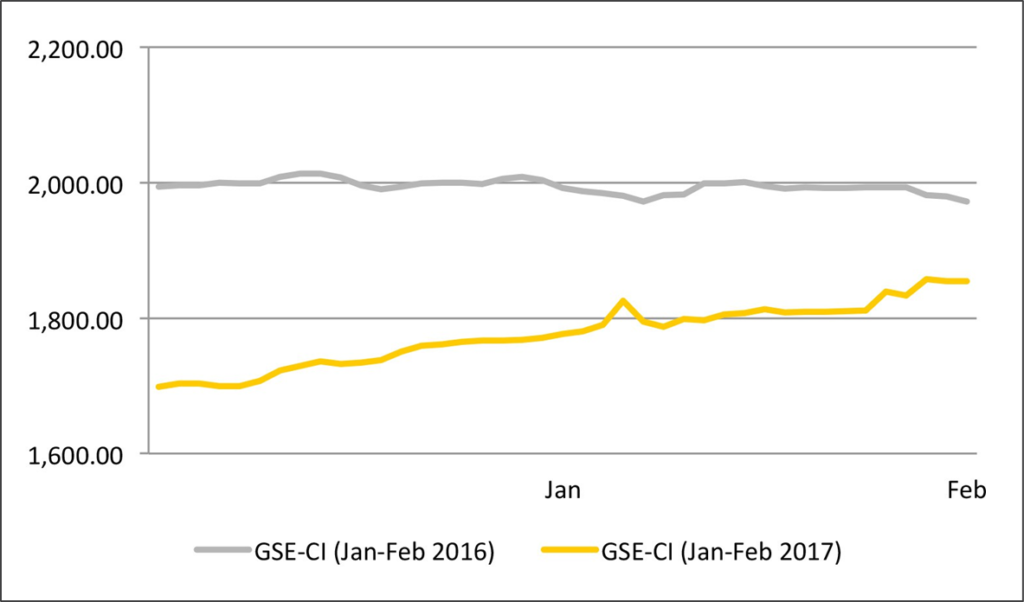

The Ghana stock market started the 2017 calendar year very bullish, with a return of 9.79% on the GSE Composite Index (GSE-CI) as at February 28. The bullish sentiment, fueled by optimism about economic recovery, resulted in a 14- day winning streak for the GSE Composite Index, the longest since February 2014. Driven by gains on financial stocks, the GSE-CI closed at 1,854.53 points on February 28, up 9.79% year- to-date, but down 6% year-on-year.

The GSE Financial Stock Index (GSE-FSI) was up 205.42 points, at 1,750.83 points with a corresponding return of 13.29%. Several banks are yet to publish their financial results for FY 2016. Banks struggles to improve asset quality in the 3rd quarter and would likely report high non-performing loan ratios at the close of the financial year. Expectations of better performance in 2017, on the back of a seemingly improving economy, may have already been priced in as increased demand for financial stocks drove the GSE- FSI up.

Efforts by the Central Bank to correct the yield curve, has led to a decline in money market instruments. Though, the return offered by risk-adjusted fixed deposit instruments, remain relatively high, declining yields on money market instruments led to a significant increase in trade volumes, as investors begin to look to the stock market for higher returns.

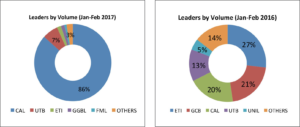

The total volume traded during the period under review was 261 million shares, more than eight times the volume recorded over the same period in 2016. The corresponding value traded was 71% in excess of the total value recorded by February 2016. The trade volume soared in February, following the acquisition of the 27.7% stake held by DPI, in CAL Bank Ltd, by Arise B.V. the transaction involved the exchange of more than 150 million CAL shares.

Following the Arise B.V.-DPI trade, CAL Bank (CAL) emerged as the most dominant equity, with 86% of the total volume traded during the period under review. Three names are repeated year-on-year, in the top five equities with the highest volumes; CAL Bank (CAL), Ecobank Transnational Incorporated (ETI) and UT Bank (UTB).

Winners and Losers

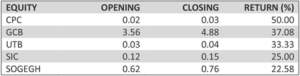

TOP GAINERS

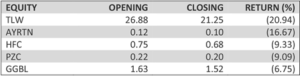

TOP LOSERS

The winners’ table was dominated by financial stocks. However, CPC was at the top of the table with a return of 50%, after gaining pesewa to close February at GHS0.03. Other gainers included GCB, UTB, SIC and SOGEGH.

Tullow Ghana Ltd (TLW) lost the most value after falling GHS5.63, to close at GHS21.25. The oil and gas company recorded a return of -20.94%. HFC Bank Ltd (HFC) was the only financial stock to record negative returns, closing at GHS0.68 with a -9.33% return. AYRTN, PZC and GGBL were also among the losers.

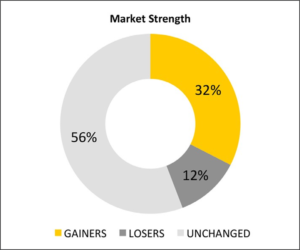

The number of gainers increased from four stocks at the end of 2016 to fourteen stocks by the February 2017. Twenty-four tickers remained unchanged while five companies saw their share prices decline.

OUTLOOK FOR THE COMING QUARTER

Efforts to correct the yield curve continue as the yields money market government securities continue their steady decline.

The inflation rate saw a significant decline from 15.4% in December 2016, to 13.3% in January 2017. The inflation rate is expected to continue trending downwards and Ministry of Finance and Economic Planning is targeting an end-year inflation rate of 11.2%.

The Bank of Ghana maintained the Monetary Policy Rate at 25.5% despite easing inflationary pressure, citing recent volatility in the foreign exchange as a threat to the outlook on inflation. Sustained decline in headline inflation could see the central bank easing its tight monetary stance in the second quarter.

It is expected that listed companies, particularly the banks, to post relatively weaker performance y/y in their 2016 annual reports, owing to poor asset quality. A continuous decline in money market yields is likely to urge investors to look to the stock market for higher yields. This would result in an improved overall performance of the GSE-CI through the first quarter.