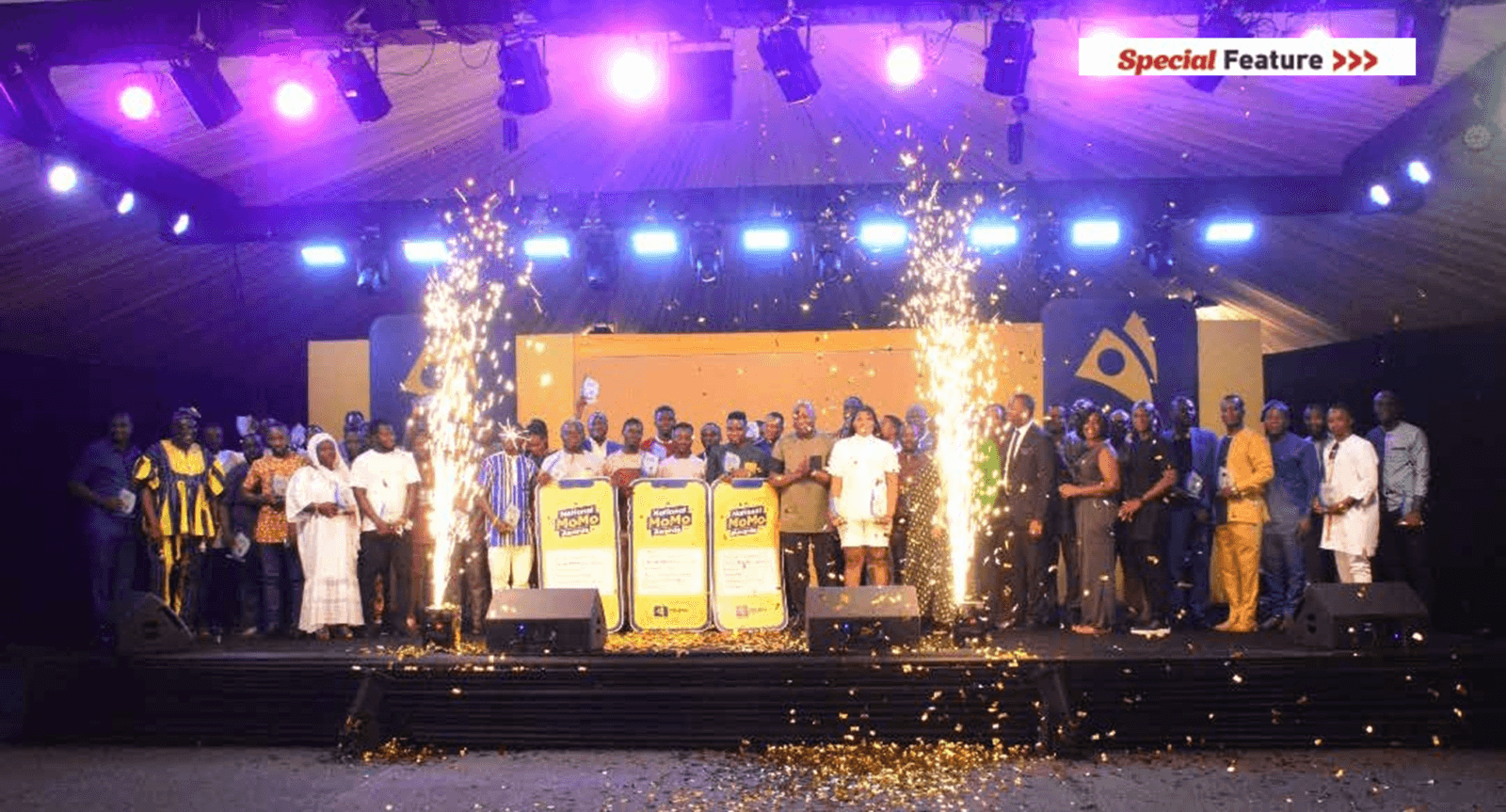

In a dazzling celebration of dedication, resilience, and in- novation, MTN Mobile Money Limited (MML), a subsidiary of MTN Ghana, in crowning its operations and rewarding efforts of outstanding performers in 2023, hosted the prestigious National Mobile Money (MoMo) Awards Night on 15th Dec. 2023. The event, held to honor the exceptional contributions of agents and merchants in advancing the digital financial landscape, proved to be a resounding success.

Stepping into the limelight was Shaibu Haruna, the CEO of Mo- bile Money Ltd. (MML), who took the stage to commend the extraordinary efforts of agents and other winners. Despite the myriad challenges faced by the industry in the past year, he lauded their commitment and resilience. Haruna acknowledged the significant strides made by the MML over the last 14 years but emphasized the need to address key challenges hindering the company’s pursuit of advancing financial inclusion.

Top Honors and Recognition

The highlight of the evening was the announcement of the Regional Best Agent and Merchant Awards. Ms. Dorcas Abena Gyaba of My Kids Pride Links, hailing from the Greater Accra Region, claimed the prestigious Regional Best Agent Award; while J. Obeng Ventures from the Ashanti Region secured the title of Regional Best Merchant. Both winners received E-cash of GHC50,000 and a plaque, symbolizing their outstanding achievements.

Ms. Gyaba expressing her gratitude to the MML for the recognition, pledged to maintain her hard work. She also encouraged fellow agents and merchants to strive for excellence and promote MTN Mobile Money as a reliable financial solution.

The awardees were drawn from all 16 regions, with 44 of them being selected from six categories: Best Agents for all regions; Best Mobile Agents in 3 sales regions; Stakeholder/Partner Awards; Overall Best Agent; and Overall Best Merchant. Each winner went home with an e-cash of GHC10,000 and a plaque.

The Awards night also recognized partner institutions for their contributions to the Fin- tech Ecosystem. They included Cellulant Ghana Limited for MoMo Fintech Financial Inclusion Champion; IT Consortium MoMo for Fintech Partner Innovator; Pay Switch Company Limited for MOMO Fintech Partner of the Year; ECG Powered by Hubtel for E-Government Digital Trans- formation Excellence Award; KOA Impact Ghana for Open API Merchant; and Afrifaman Limited (Tekhype) for Open API Fintech of the Year.

The 2023 National Mobile Money Awards Night was not just a celebration of individual achievements but a collective acknowledgment of the industry’s progress and commitment to overcoming challenges. As the Fintech landscape continues to evolve, MTN Mobile Money Limited and its partners stand poised to shape the future of digital finance in Ghana. The night served as a testament to the innovation and dedication that will drive the industry forward in the coming years.

In his address, Mr. Paapa Osei, the Head of Legal and Corporate Affairs at MTN Mobile Money Limited, added a touch of gratitude and reflection to the glittering affair. He highlighted that the awards night held a special significance— it was not just about honoring individual accomplishments but a heartfelt celebration of the MML’s valued partners and stakeholders in the vast Fintech Ecosystem across the country.

Mr. Osei took a moment to commend the awardees for their unwavering dedication throughout the challenging year. He remarked, “We are indeed proud of the strides we have been able to accomplish together. This is to everyone who played a part in our journey. Ayekoo!!!”

Industry Leaders Tackle Barriers to Digital Payment Adoption in Ghana

Mobile Money Limited (MML) marked this year’s Mobile Money Month with a significant step forward by organizing a stakeholder’s forum held in Accra on the theme “Addressing the Barriers to Digital Payment Adoption in Ghana.” The forum brought together key industry leaders and stakeholders to engage in a collective conversation aimed at spurring growth and overcoming challenges in the mobile financial services and digital payments sector.

At the forum, during the ‘2023 MoMo Season’, participants engaged in discussions surrounding the crucial barriers to digital payments in Ghana. Challenges such as digital and financial literacy, interoperability constraints, platform stability, fraud, and the cost of financial transactions were identified as hurdles impeding progress of the industry. However, Mr. Haruna assured stakeholders of the MML’s commitment to working collaboratively to address these challenges for the benefit of the entire industry.

In the spirit of shared responsibility, Mr. Haruna urged all stakeholders and customers to join the fight against MoMo fraud. Thus, he revealed that the MML has taken proactive measures by training 180 staff of the Economic and Organized Crime Organization (EOCO) across the country to investigate and prosecute digital finance-related crimes.

Also, Head of Products and Services at Mobile Money Limited, Sylvia Otuo Acheampong, addressed the participants, acknowledging the significant progress made in technological advancements and digital adoption over the years. However, she emphasized that there is still more work to be done.

Kwame Oppong, Head of FinTech and In- novation at the Bank of Ghana, reiterated the Central Bank’s crucial role in spearheading digitization in the banking sector. He expressed the commitment of the Central Bank to finding solutions for addressing barriers that hinder digital payments adoption in Ghana, aligning with the national goal of building a cash-lite economy. Furthermore, Archie Hesse, CEO of Ghana In-His words encapsulated the spirit of unity and shared success that permeated the event. By acknowledging the collective journey and expressing pride in the achievements made in unison, Mr. Osei encapsulated the ethos of a thriving Fintech community.

As the applause echoed through the venue, Mr. Osei’s words served as a reminder that success is rarely a solitary endeavor. The Fintech Eco- system, with its diverse players and contributors, came together on the night to celebrate achievements, acknowledge challenges, and reaffirm a commitment to shaping a future where digital finance seamlessly integrates with the daily lives of the Ghanaian people.

terbank Payments and Settlement System (GhIPSS), applauded MTN for organizing the initiative and called for increased collaboration and partnership among stake- holders. Recognizing the strides Ghana has made in digital innovation and adoption, Hesse emphasized the need for a unified effort to overcome challenges.

That notwithstanding, Eric Kotey, CEO of Cellulant Ghana, identified fraud and limited accessibility as barriers to digital payments adoption. He, thus, provided practical advice, urging Mobile Network Operators to implement strict security measures, enhance education, and address smart- phone penetration issues. Kotey further advised Fintech companies to focus on user-friendly interfaces, offline products, awareness campaigns, and incentives, stating that addressing these factors would drive adoption.

The CEO of Mobile Money Ltd.

Winifred Kotin, CEO of Eagle Innovations, likewise emphasized the importance of innovative and collaborative approaches to designing effective educational strategies. She highlighted tools and mediums such as mass education, community-based education, interactive workshops, demos, role-playing, storytelling, and a multisectoral approach to education as crucial for boosting digital payments adoption across the country.

The collaborative spirit witnessed at the forum set the stage for a future where barriers are dismantled, and digital payments becoming an integral part of everyday life in Ghana.

The recent series of events, including the National MoMo Awards, the launch of the 2023 MoMo Season, and a stakeholder forum, collectively highlight the MML’s commitment to advancing mobile financial solutions. These initiatives, marked by collaboration, innovation, and a focus on education, propel Ghana towards a transformative digital future, where barriers are dismantled, and the vision of a cash-lite economy becoming a tangible reality.

Launch of 2023 MoMo Season

In a grand launch event held in Accra, the MML unveiled the much-anticipated 2023 MoMo Season, echoing the theme, “Addressing the barriers to digital payments adoption in Ghana.” The season aimed to not only create awareness about the myriad opportunities Mobile Money (MoMo) offers in the digital economy, also acknowledged and celebrated the invaluable contributions of partners and customers.

The launch signified a commitment to highlighting the pivotal role that MTN Mobile Money Services play in the Ghanaian economy. With a focus on bringing MoMo services closer to the doorsteps of more Ghanaians, the season portended an ode to the over 11 million subscribers who have embraced and utilized MTN MoMo as a cornerstone of their financial transactions.

As part of the 2023 MoMo Season celebrations, a series of activities and campaigns were put in place. These included launch activities in key cities such as Accra, Kumasi, Takoradi, Nkawkaw, and Tamale. The season featured consumer and staff promos, market storms, stakeholder fora, digital campaigns, the Catch Them Young Series, and MoMo fraud education initiatives.

Mrs. Cynthia Fosu, Chief Executive Officer of Izone, affirmed that Mobile Money Limited remains com- mitted to leading the delivery of a bold new digital world. She emphasized the company’s dedication to addressing barriers to digital payments adoption through innovative solutions and initiatives. Leveraging digitization, Mobile Money Limited aims to revitalize the Ghanaian economy, contributing to a future where digital financial services are accessible to all.

MoMo’s Positive Impact on Economy

At the launch, Mr. Shaibu Haruna, the Chief Executive Officer of Mobile Money Limited, expressed the transformative impact MTN MoMo has had since its inception in 2009. He emphasized how the service has not only offered financial solutions to both the banked and un- banked but has also created significant employment opportunities for millions of Ghanaians.

“Currently, MoMo customers have access to a wide array of services, including payments, investments, insurance, remittances, pensions, among others,” Mr. Haruna stated. He further highlighted that MoMo has redefined the business landscape, revolutionizing payment methods, and providing livelihoods for numerous individuals.

Impressive Growth Despite Challenges

Despite challenges, as highlighted in the 2022 Summary of Economic and Financial Data by the Bank of Ghana, Mobile Money transactions in 2022 reached a record GH¢1.07 trillion, surpassing the GH¢902.5 billion in 2021. As such, Prince Owusu-Nyarko, Senior Manager, South West Business of MTN Ghana emphasized that this growth is a testament to the resilience and adaptability of MoMo in the face of challenges.

The theme, “Addressing the barriers to digital payments adoption in Ghana,” aligns with MTN’s Ambition 2025 strategy of leading digital solutions for Africa’s progress and spearheading digital and financial inclusion in Ghana and across Africa.

Recognizing challenges such as interoperability issues, fake identification cards, platform infra- structure, customer onboarding, and MoMo fraud, MTN Ghana and Mobile Money Limited are committed to working closely with stakeholders to build a robust, efficient, and more inclusive digital payments ecosystem.

Tackling MoMo Fraud

Mr. Owusu-Nyarko acknowl- edged the ongoing efforts to combat MoMo fraud, highlighting that although there has been a marginal decline in fraudulent activities, there is still work to be done. He, therefore, assured MTN Ghana remains commit- ted to staying ahead of fraudulent activities through robust measures, collaboration, and intensified public education.

As MTN Ghana aims to achieve its Ambition 2025 strategy of transitioning to a platform player and a full-fledged digital-first technology company, collaboration with partners and industry players will be key. The focus includes accelerating growth in the digital payments sector, boosting financial inclusion, and further investing in digital infrastructure.

With a multi-sectorial approach to policy formulation and strategic partnerships, the MML is poised to lead the way in shaping the future of digital payments in the country. The 2023 MoMo Season sets the stage for a future where barriers are broken, and digital possibilities are limitless.