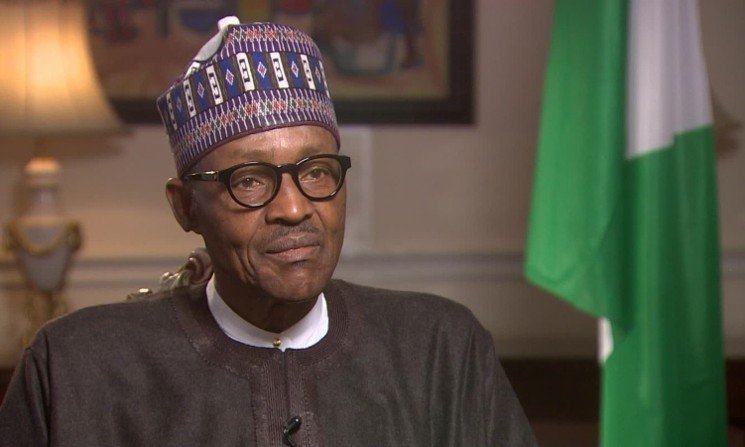

Last year, when Africa’s largest economy Nigeria sunk into its worst recession ever, an immediate economic recovery plan was expected from the government in response to the critical situation. Unfortunately the sluggishness that has characterized the President Muhammadu Buhari administration manifested itself again. A wholesome strategy for charting the way forward did not come until April this year – 4 quarters after official acknowledgement of the recessive status of the economy.

In classic Nigerian style, the 4-year Economic Recovery and Growth Plan (ERGP) was launched with much pomp and fanfare. The event was a star-studded one. The president’s cabinet and anyone you would imagine in the economics and public finance nexus was there.

The ERGP had a three-thronged approach supported by enablers and a clear delivery plan which involves restoring growth through Monetary and fiscal stability, external balance, economic growth and diversification;

Investment in the Nigerian people – Health, education, social inclusion schemes, job creation and youth employment schemes; Building a globally competitive economy by Improving the ease of doing business, investing in infrastructure and promoting digital led growth.

There’s just a little problem.

The ERGP is expected to return the growth of the nation’s economy by 2.19 percent in 2017 and 7 percent by the end of the Plan period in 2020– 2 years after the president’s current tenure. For this bogus plan to materialize, Buhari needs to return to office or his party All Progressives Congress (APC) win at the 2018 presidential elections since there’s never a continuity of programs when there is a change of government. But even under the People’s Democratic Party (PDP) rule between 1999 and 2015, there wasn’t a continuation of program. The President Olusegun Obasanjo government from 1999 had a financial bolstering plan, paying off Nigeria’s foreign debt and saving up nearly $30 billion in Excess Crude Account from oil earnings. But during President Jonathan’s government, the savings were squandered and Nigeria returned to debt. Now, 66 percent of the country’s earnings services foreign debts.

Feyi Fawehinmi, one of Nigeria’s leading economic commentators says it is impossible for the government to achieve 7 percent economic growth by 2020 as planned. On his blog he wrote: “One of my favourite American economists, Tyler Cowen, recently wrote a book where he complained about how America had become a complacent country. He illustrates this with data showing that in 1962, only 30% of the American government’s spending was spoken for before the fiscal year. By 2014, that number had reached 80% and is getting worse. In other words, all sorts of interest groups and entitlements have claimed so much of government spending in advance that it is very hard for the government to do ‘big things’. Nigeria today is not much different. 66% of current government revenues goes toward servicing debt. Typically, 80% of the government’s budget is spoken for before it is passed by salaries and other recurrent expenditure. The crucial difference is that America has all those roads, bridges, electricity and railways it had built before getting to the point of stasis.”

Nigeria is going to need to do some big and painful things as shock therapy to achieve high growth trajectory again. The alternative is stasis.

The most disturbing risk of the ERGP 4-year plan are the very managers of the economic move. Many know the antecedents of Governor of the Central Bank of Nigeria, Godwin Emefiele. He was Nigeria’s largest loaner Zenith Bank’s MD who was whisked in by the previous government when the then CBN governor Sanusi Lamido blew the whistle of $20 billion theft in government coffers. No one can vouch, except those who recommended him as elections moved close for the Dasuki scandal job, that Godwin was ready for the increasingly complex world of Central Banking. It is a well-known secret, that Godwin Emefiele held an internal meeting with Zenith Bank staff the weekend after his appointment, weeping for joy. He had never expected he would assume such elevated position and responsibility. Upon election, many expected that Buhari would have had a tea meeting, early on, telling him confidence was lost and he should honourably resign. Instead, he kept him. When Buhari was going to bring in a fiscal manager, he found Kemi Adeosun, a local state Commissioner of Finance, at a time Nigeria was roaring into a slump. One would not have expected anything less than a proper Goldman Sachs or hedge fund star, a brilliant academic, ready to put calls across the world. While it was good for Minister of State for Finance to worry on cost of pencils and erasers in government, this is Nigeria for heaven’s sake. For a country the calibre of Nigeria, her Finance Minister’s profile can’t be beneath Okonjo-Iweala, the country’s former Minister of Finance and World Bank MD, or Olusegun Aganga, Oby Ezekwesili, etc. A lot of people even anticipated that Okey Enelamah (who led Nigeria’s arguable biggest private equity, the African Finance Corporation) would be Finance Minister, but Buhari surprised everyone, sadly.

Immediately oil price started tanking low, the eggheads at IMF saw it; they saw the weaknesses in the economy. There were no savings buffers, poor Niger Delta engagement to firm oil production and the dependence on oil was evident to all. When Christine Lagarde landed, it was clear that she came for serious business. But Nigerians would prefer to be emotional than face the facts. The economy was quietly sinking but the idea of accepting IMF’s help carried a stigma (you can’t blame the correctional days of Structural Adjustment Program (SAP)). Nigeria’s economic team brought out Powerpoints and thick plans to affirm that all was right.

Christine’s words: “Frankly, given the determination and resilience displayed by the presidency and his team, I don’t see why an IMF programme is going to be needed..” However, Kenya that is not vulnerable to oil shocks put up a standby $1.5bn facility in case of currency shocks. Rather than being honest and accepting the real situation, some people started selling Indian $15bn cash advance to Nigeria and Chinese Yuan support. The monies that would have changed hands in consultancy would be unbelievable.

Seun Onigbinde, CEO of Bill and Melinda Gates Foundation-backed BudgIT and a vocal economic transparency expert suggested that he “would have gone for a $10bn IMF facility—$5bn for currency stability & $5bn for import substitution plan heavily invested in machinery that completes Nigeria’s value chains and industrial parks.

“This government is not honest on the hole we have sunk in or they weren’t smart to see it,” he concludes.

Understandably, the government has finally rolled out a recovery plan because investors have affirmed that they won’t borrow Nigeria $30bn if she can’t produce an economic plan. That $30bn has a pile of Chinese money that won’t come in cash but in infrastructure. If the Chinese build all the railways and roads, plunging the country in deeper debt, will those infrastructure projects generate sufficient revenue to offset them? If Nigeria borrows $30 billion when her current exposure is $24 billion, is the government not heightening the economy’s vulnerability to currency crisis?

The challenge here is that current government is in its final lap of governance. The cacophony for next year is for the elections and placement for politicians. Where is the long term and institutional approach to see this entire plan through? Nigeria won’t be great if government approach is like someone dieting and checking the scale every hour. There has to be a long term shot to this. Who will do the work? The risk exists – it is that of getting that World Bank cash, Chinese Roads, doubling our foreign debts but the government undoes everything with clueless leadership in another four years. If the government doesn’t institutionalize this, it falters again.