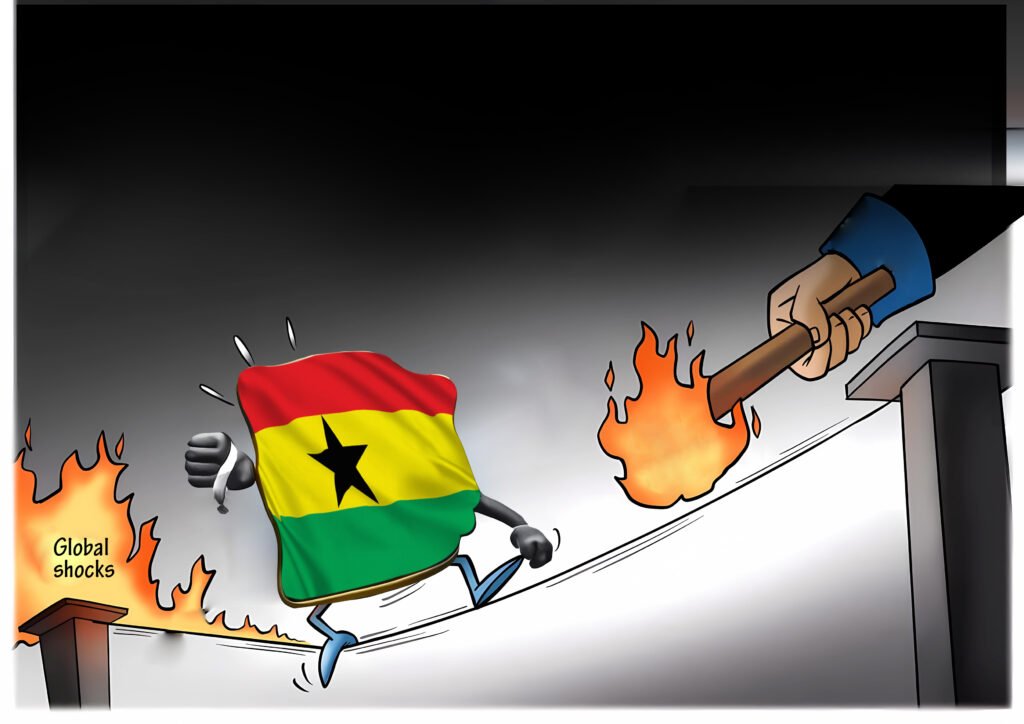

Growth is projected to improve from this year’s timid expansion on the back of a gradual pickup in the world economy and a recovery in commodity prices, however growth will remain weak. Economic progress will also depend on how fast governments implement reforms aimed at promoting growth and reestablishing macroeconomic stability. Moreover, prudent fiscal policies coupled with tighter monetary policy should tackle sharp increases in inflation and keep public fiscal balances in check.

Sub-Saharan Africa’s (SSA) GDP forecast for 2017 is expected to experience economic growth of 2.9% in 2017 while in 2018, panelists expect the economy to expand 3.9%. The downgrade to the region’s 2017 economic outlook reflects downward revisions for seven economies including Nigeria. On the other hand, growth is expected to be up for Ghana, Kenya and Tanzania. Cote d’Ivoire will be 2017 fastest- growing economy, followed by Ethiopia and Tanzania. In contrast, South Africa is forecast to be the worst performer with an expansion rate of 1.2%.

NIGERIA | Economy falls into recession in Q3 2016

Nigeria is currently facing its worst economic crisis in more than 20 years as the economic contraction worsened by more than expected in Q3, driven by a contraction in the oil sector, which is the country’s largest source of revenue. Despite Q3’s abysmal reading, the latest data and developments support the view that the economy has bottomed out, though economic activity remains weak and structural imbalances persist. The non-oil sector posted flat growth in Q3 after contracting for two consecutive periods. Forward-looking indicators from Q4 show that business confidence surged to a ten- month high while the Manufacturing PMI improved but remains in contraction. The output cut agreement reached first by OPEC members in late November and on 10 December by OPEC and non-OPEC members should give Nigeria’s beleaguered economy some breathing room since the deal exempts the country from cutting production.

The economy is expected to rebound in 2017 after contracting for the first time in over two decades in 2016. The recovery, however, will be fragile. Tight liquidity conditions, capital controls and further militant attacks could dampen growth prospects. The economy will grow 1.4% in 2017 says analysts and they foresee a 3.0% expansion in 2018.

SOUTH AFRICA | Growth remains subdued in Q3 2016

South Africa recorded another weak expansion in the third quarter of 2016 as growth continues to be dragged down by high political uncertainty, still weak global demand and a lack of much-needed structural reforms. In Q3, GDP barely expanded on a sequential basis. The dismal growth was fueled by an improvement across the board in domestic demand, while the external sector disappointed, with a double-digit contraction in exports leading to the largest deduction from growth in over a year. South Africa avoided a credit rating downgrade earlier in the month of December, 2016, but the country remains under high scrutiny and risks a rating review if economic conditions do not improve. The numerous corruption scandals involving President Jacob Zuma have widely divided the ruling ANC party and calls for his resignation have heightened lately. The political infighting is undermining the investment environment, negatively affecting the rand and thereby constraining GDP growth.

A gradual improvement in the world economy and a recovery in commodity prices will support the economy next year, though ongoing political scandals and the dire state of the labor market will weigh on growth. On balance, analysts expect the economy to expand 1.2% in 2017, while in 2018, growth is expected to accelerate to 1.8%.

ANGOLA | Growth prospects remain grim

Amid skyrocketing inflation and a plunging currency, the Angolan economy has likely grown at the slowest rate in over a decade in 2016. Its fiscal and external positions have deteriorated due to the drop in oil prices, which has also negatively impacted investment. The kwanza has lost over 20% of its value year-to-date, reducing consumer purchasing power. The recent OPEC agreement is pushing up oil prices and should eventually have positive effects for strapped government finances, but it will take time for these to appear. The country also faces political uncertainty, as President José Eduardo Dos Santos recently announced his retirement before the next general election scheduled for August 2017.

As oil prices recover, government revenues should improve as oil revenues constitute the bulk of Angola’s fiscal revenues, but the country’s growth prospects remain grim overall and will not be helped by political uncertainty. Analysts expect GDP to grow 1.5% in 2017, while in 2018, they see the economy growing 2.9%.

KENYA | Policy on interest rate cap threatens the economy

Kenya has shown resilient growth so far this year and its economy remains one of the fastest-growing in the region. Improvements in both domestic and external demand supported the manufacturing sector in November, 2016, when the manufacturing PMI index recovered from the previous month’s four- month low on the back of an increase in new orders. Higher demand from key trading partner Uganda contributed in particular to the rebound. That said, downside risks remain. A slowdown in private sector credit growth, which is a direct consequence of the government’s decision to limit commercial banks’ interest rates, and the relatively weaker currency could hold back activity growth in the private sector. In the month of December, 2016, the shilling was under pressure due to increased demand for the U.S dollar from importers.

Public investment, loose monetary policy and closer integration in the East African Community will support Kenya’s economy in 2017. However, rising political uncertainty regarding presidential elections in August 2017 will put pressure on growth. On balance, panelists see the economy growing 5.8% in 2017, while in 2018, the panel sees GDP growth also at 5.8%.

IVORY COAST | Steady growth path

The Ivory Coast has largely escaped unscathed from the commodity price slump which badly affected many of its regional peers. The country is set to become the fastest growing economy in Africa in 2017 owing in part to growing political stability and efforts by the government to lure investment. A crucial measure implemented by the government has been a series of tax breaks for cashew producers to increase domestic processing in the country. On the political front, the country geared up for parliamentary elections on 18 December, when the 255 seats of the National Assembly was keenly contested. The elections were set to see the return of the former ruling party after it had boycotted elections since losing power in 2010.

The economy is expected to remain on a steady growth path thanks to extensive international financial support and solid domestic demand. Panelists see the economy growing 7.9% in 2017, and 7.6% in 2018.

ETHIOPIA | Favorable weather conditions to rebound economic activities

The Ethiopian economy likely recorded its most sluggish period of growth in more than a decade in FY 2016. The country is expected to have failed to match the double- digit growth sought by the government in that fiscal year due to both the devastating drought that affected the harvest in most parts of the country and the ongoing social unrest. Lately, protesters have attacked foreign- and government-owned businesses, causing millions of dollars of damage. Moreover, on 30 November 2016, the main opposition figure and representative of the Oromo ethnic group was arrested in Addis Ababa, after giving a speech at the EU parliament where he criticized the government crackdown.

Going forward, more favorable weather conditions will reboot the damaged agricultural sector and the new Addis Ababa-Djibouti railway line will significantly improve trade and ease logistical constraints. However, if the ethnic minority government continues to oppress the opposition and the Oromo protests, it could also have grave consequences for the economy. Analysts expect GDP to grow 7.2% in FY 2017.

TANZANIA | Currency shortage could jeopardize the economy’s robust performance

Tanzania’s economy has been gathering pace ever since John Magufuli was elected president two years ago. Under his reformist and infrastructure-oriented agenda, the country has embarked on several multi-billion projects, including converting the Central Railway Line to standard gauge, developing natural gas plants and improving several strategic ports. GDP growth has benefited from his ambitious goals, with the Tanzanian economy accelerating markedly in the second quarter of 2016. Nonetheless, concerns over a potential liquidity crunch are hampering credit growth in the economy. Infrastructure spending and reforms aimed at reducing the share of government deposits in commercial banks have triggered a plunge in private lending. With the manufacturing sector taking the biggest hit, a currency shortage could jeopardize the economy’s robust performance as well as the pace of infrastructure implementation.

Tanzania’s tailwinds remain largely in place, with multiple infrastructure projects and robust household consumption buttressing growth for year 2017. Our panel expects GDP to expand 7.1% in 2017 and 7.0% in 2018.

INFLATION | Inflationary pressures remain elevated in November 2016

Revised data for October 2016 show that inflation was stable at September’s 13.5%. A preliminary estimate for November shows that inflation in the SSA region was 13.6%. Inflationary pressures remain elevated due to weakness in currencies across the region as well as energy and water shortages. Panelists expect regional inflation to average 11.1% in 2017. The upward revision reflects an increased inflation forecast for six countries including Angola and Nigeria. Panelists see regional inflation receding to an average of 9.1% in 2018.